Direct Taxes (including International Taxation)

The Top 10 funded startups in Singapore to look out for

Corporate Law & Intellectual Property Rights | By Dipanjali Chakraborty | Feb 15, 2020

Singapore has become the hub for technology and startups. Singapore is favored since it has a robust financial market, advanced infrastru...

Union Budget 2020 highlights – Reduced tax rates and others

Corporate Law & Intellectual Property Rights | By Dipanjali Chakraborty | Feb 1, 2020

Union Budget 2020 was presented today by the Finance Minister, Nirmala Sitharaman. The Budget 2020 is focussed on 3 major themes &...

Major policy changes in Singapore that you must be aware of from Jan 1

Direct Taxes (including International Taxation) | By Editor | Dec 10, 2019

1.Bill passed to tax overseas services like Netflix from 2020 The regime requires overseas vendors to pay GST if they have an annual glob...

DPIIT invites applications for First Ever National Startup Awards 2020

Direct Taxes (including International Taxation) | By Editor | Dec 4, 2019

The Department for Promotion of Industry and Internal Trade (DPIIT) has announced institution of the first ever National Startup Awards. ...

Incentives to Promote Industrial Development in J&K and Ladakh

Direct Taxes (including International Taxation) | By Editor | Dec 4, 2019

The Government is working on schemes that will offer significant incentives to promote industrial development in the Union Territories (U...

Cabinet approves Protocol between India & Chile for double tax avoidance

Direct Taxes (including International Taxation) | By Editor | Dec 2, 2019

The Union Cabinet chaired by Prime Minister Shri Narendra Modi today approved the signing of the Double Taxation Avoidance Agreement (DTA...

Dividend Tax may be shifted from companies to investors

Direct Taxes (including International Taxation) | By Editor | Nov 16, 2019

India is considering changes to its dividend distribution tax, according to people with knowledge of the matter, in a bid to goad compani...

Decoding Form 15 CA CB – mandatory for foreign payments

Direct Taxes (including International Taxation) | By Dipanjali Chakraborty | Nov 14, 2019

The world is becoming smaller every day. More and more cross border transactions are happening on a daily basis. Some examples of these...

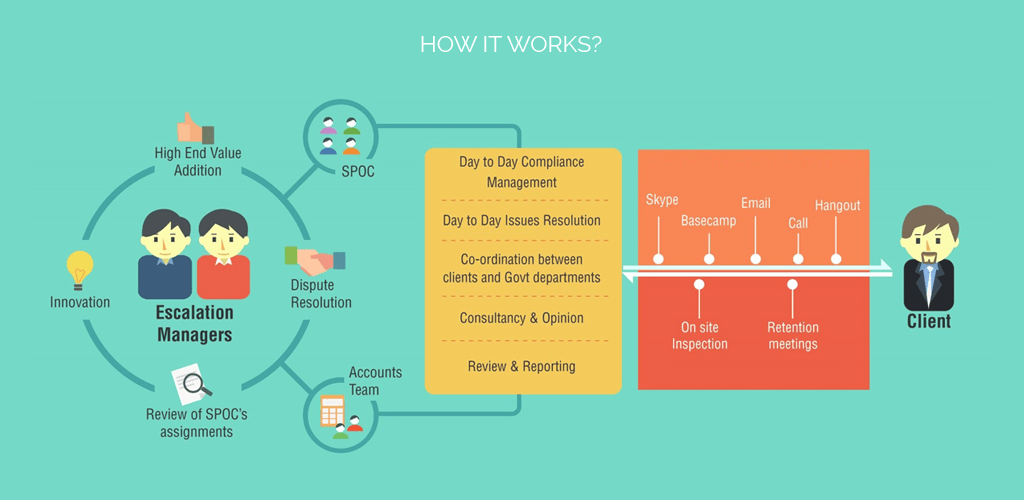

Why should you outsource the tax and legal compliance of your business to Taxmantra?

Corporate Law & Intellectual Property Rights | By Editor | Nov 4, 2019

Do you feel you have done your bit for the first few years of your business and now is the time when the platform is laid and you just ...

How to repatriate funds in India from your overseas entity

Corporate Law & Intellectual Property Rights | By Soumik Kumar Sen | Sep 12, 2019

In this era of globalization, a company tends to form foreign entities in order to gain better access to foreign market or raise funds fr...

Startup Funding – How India fairs to Singapore

Corporate Law & Intellectual Property Rights | By Soumik Kumar Sen | Aug 31, 2019

Singapore and India are open economies where the environment for business investments is gathering attention. Both Singapore and India ha...

Goodbye Angel Tax

Corporate Law & Intellectual Property Rights | By CS Niladree Chakraborty | Aug 24, 2019

While the global economy including India is facing a slowdown, Finance Minister of India, Smt. Nirmala Sitharaman announced some measures...

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us