The last date for filing of income tax returns (ITRs) for the financial year 2016-17 has been extended to August 5. The original deadline was July 31. The Income Tax Department has already received over two crore returns filed electronically. The department had earlier issued advertisements in leading national dailies in the last few days stating that taxpayers should disclose their income “correctly” and file their ITRs on or before July 31.

Giving the reason for the extension, a government official said the tax department’s e-filing website – incometaxindiaefiling.gov.in – has been experiencing overload due to last minute filing of returns.

Every person whose gross total income exceeds the taxable limit must file an income tax return, the Income Tax Department has said.

The Income Tax Department also mentioned certain taxpayers who are required to e-file their ITRs. These included individuals and HUFs (Hindu Undivided Families) having total income exceeding Rs. 5 lakh or claiming any refund in the return (excluding individuals of the age of 80 years or more who are furnishing return in Form ITR-I or Form ITR-2) and individuals/HUFs being a resident other than not ordinarily resident having any foreign asset/income or claiming any foreign tax relief.

The notification on the website is still awaited.

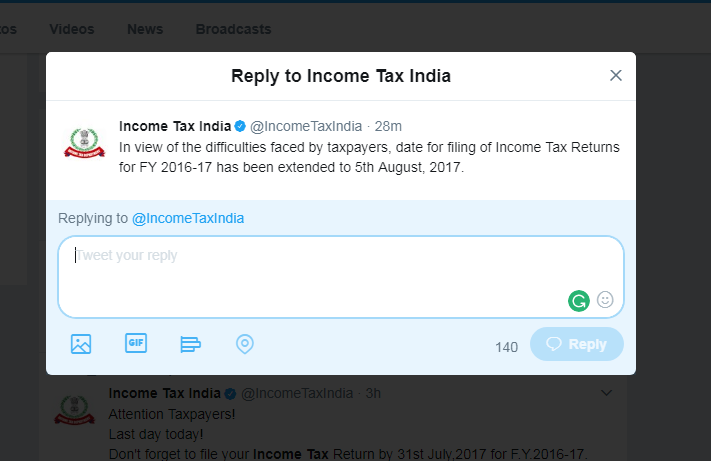

Check out the Ministry’s Twitter handle here.

Toll Free:

Toll Free:  Contact Us

Contact Us