Khadi gets separate unique HS code, export to get a boost

GST & Other Indirect Taxes | By Editor | Nov 15, 2019

Khadi has once again come out of its customary veil, marking its presence in the exclusive HS code bracket, issued by the central gover...

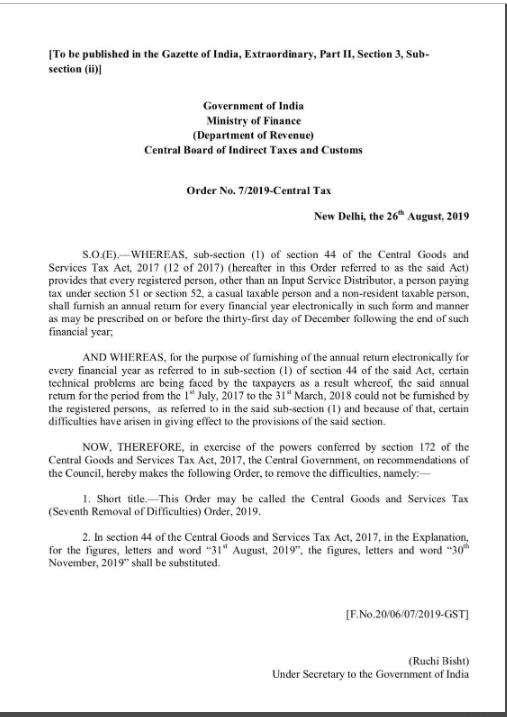

GSTR-9, GSTR-9C submission due dates extended again

GST & Other Indirect Taxes | By Editor | Nov 14, 2019

Government has decided today to extend the due dates of filing of Form GSTR-9 (Annual Return) and Form GSTR-9C (Reconciliation Stat...

Decoding Form 15 CA CB – mandatory for foreign payments

Direct Taxes (including International Taxation) | By Dipanjali Chakraborty | Nov 14, 2019

The world is becoming smaller every day. More and more cross border transactions are happening on a daily basis. Some examples of these...

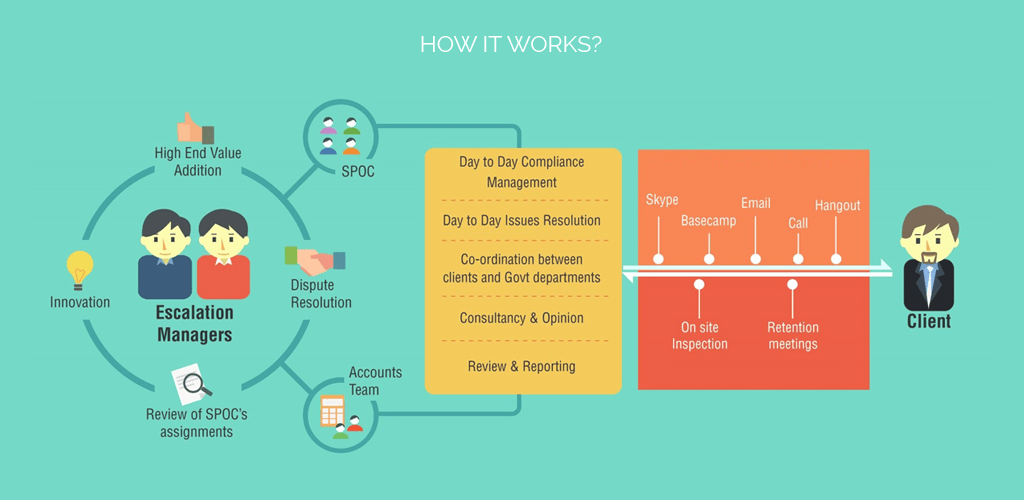

Why should you outsource the tax and legal compliance of your business to Taxmantra?

Corporate Law & Intellectual Property Rights | By Editor | Nov 4, 2019

Do you feel you have done your bit for the first few years of your business and now is the time when the platform is laid and you just ...

Optional GST Annual returns, simplification of GST refunds and rate cuts – Highlights of th...

GST & Other Indirect Taxes | By Editor | Sep 21, 2019

The GST Council, in its 37th meeting held today at Goa, recommended the following: LAW RELATED CHANGES: 1. Relaxation in filing o...

Corporate tax rate cut to 22%, new manufacturing companies to enjoy a 15% tax rate: Govt announce...

GST & Other Indirect Taxes | By ALOK PATNIA | Sep 20, 2019

Finance Minister Nirmala Sitharaman Friday proposed to slash corporate tax rate for domestic firms and new domestic manufacturing c...

How to repatriate funds in India from your overseas entity

Corporate Law & Intellectual Property Rights | By Soumik Kumar Sen | Sep 12, 2019

In this era of globalization, a company tends to form foreign entities in order to gain better access to foreign market or raise funds fr...

Why Cross Border Tax and Regulatory Planning is important for Entrepreneurs

Corporate Law & Intellectual Property Rights | By Soumik Kumar Sen | Sep 9, 2019

In order to have global reach and attain widespread customer base, investments by Indians all over the world have gained momentum over th...

Signing Contract: What You Must Know

Corporate Law & Intellectual Property Rights | By CS Niladree Chakraborty | Sep 6, 2019

Contract as an agreement is more executed and signed than said. Contracts are executed by almost every company irrespective of the indust...

More Power to MSMEs

Corporate Law & Intellectual Property Rights | By CS Niladree Chakraborty | Sep 3, 2019

The Micro, Small, and Medium Enterprises (MSMEs) which is considered as the backbone of the Indian economy has got more power with the re...

Startup Funding – How India fairs to Singapore

Corporate Law & Intellectual Property Rights | By Soumik Kumar Sen | Aug 31, 2019

Singapore and India are open economies where the environment for business investments is gathering attention. Both Singapore and India ha...

Goodbye Angel Tax

Corporate Law & Intellectual Property Rights | By CS Niladree Chakraborty | Aug 24, 2019

While the global economy including India is facing a slowdown, Finance Minister of India, Smt. Nirmala Sitharaman announced some measures...

Toll Free:

Toll Free:  Contact Us

Contact Us