No Depreciation on Goodwill from F.Y. 2020-21

Direct Taxes (including International Taxation) | By CA Ritika Lath | Aug 4, 2021

Alert- Adjustment required in F.Y. 2020-21 if depreciation on goodwill claimed in F.Y. 2019-20 Income Tax Act, 1961 (Act) provides deprec...

Business Services by ‘Airbus group India’ carried out in India to be classified as ‘Intermediary ...

GST & Other Indirect Taxes | By CA Kaushal Agarwal | Aug 2, 2021

Airbus liable for 18% GST on services abroad Airbus India’s technical advisory and procurement services for its France-based holding comp...

Five important clauses to have in ESOP Policy

CFO Advisory Services | By Soumik Kumar Sen | Jul 30, 2021

Employee Stock Option Plan (ESOP) is an employee benefit scheme under which the company encourages its employees to acquire ownership in ...

E-Commerce – What to Know about Consumer Protection Rules 2020

Corporate Law & Intellectual Property Rights | By CS Niladree Chakraborty | Jul 21, 2021

Ecommerce are commercial transactions conducted electronically on the internet. In other words, it is the activity of electronically buyi...

FAQs on Penalties under the Income Tax Act 1961

Direct Taxes (including International Taxation) | By CA Ritika Lath | Jul 15, 2021

FAQs on Penalties under the Income Tax Act 1961 There are penalties defined for maximum kind of defaults in laws of Income Tax Act...

GST on intermediary services – Considered Export or not?

GST & Other Indirect Taxes | By CA Kaushal Agarwal | Jun 29, 2021

GST on intermediary services – Considered Export or not? Matter: Pursuant to this Petition under Article 226 of the Constitution of...

TDS on purchase of goods-Section 194Q of the Income Tax Act, 1961

Direct Taxes (including International Taxation) | By CA Ritika Lath | Jun 28, 2021

TDS on purchase of goods-Section 194Q of the Income Tax Act, 1961 From -01-07-2021, if any person whether from India or outside India i...

GST Advance Ruling Mechanism- A tool for New-Age Startups

GST & Other Indirect Taxes | By CA Kaushal Agarwal | Jun 28, 2021

Why Advance Ruling GST Advance Ruling Mechanism – An advance ruling helps the applicant in planning his activities, which are liabl...

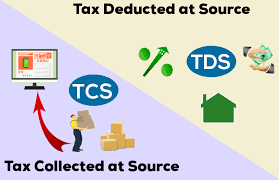

Important update- TDS/TCS Return under the IT Act, 1961

Direct Taxes (including International Taxation) | By CA Ritika Lath | Jun 17, 2021

In terms of Rule 31A of the Income Tax Rules, 1962 any person responsible for deducting TDS has to furnish quarterly TDS Return within th...

Doing Business in Singapore – Quick Guide on Company Registration and Tax Compliances

Global Expansion (Singapore/US/UAE) | By Editor | Jun 16, 2021

1. Why should you choose Singapore as the country to set up your business in? Singapore has been consistently ranked among the top best c...

GST Council Recommendations – Benefits to Common Man

COVID-19 Resources | By CA Kaushal Agarwal | May 29, 2021

The 43rd GST Council met under the Chairmanship of FM Smt. Nirmala Sitharaman along with ministers of the States & UTs through VC hel...

Fair Market Value for slump sale u/s 50 B of IT Act, 1961- Notified on 24-05-2021

Direct Taxes (including International Taxation) | By CA Ritika Lath | May 26, 2021

Before the amendment made vide Finance Act, 2021 under section 50B of the income Tax Act, 2021 (Act), capital gain on slump sale i.e. tra...

Toll Free:

Toll Free:  Contact Us

Contact Us