10 things every exporter should know about GST

GST & Other Indirect Taxes | By Dipanjali Chakraborty | Jul 27, 2017

GST implementation has no doubt given a boost to the export sector in India. Various statutory and procedural changes have been brought a...

Small grocers signing up with wholesale majors abandoning unorganized trade

News & FAQs | By Editor | Jul 27, 2017

While last November’s demonetisation choked the cash-based unorganised retail trade in the country, the game-changing Goods and Services ...

Confusion for sweet makers – GST Impact

GST & Other Indirect Taxes | By Editor | Jul 27, 2017

Sweet makers are finding it difficult to decipher the taxation rates under GST. For example: Plain sandesh, which is a ‘sweet’...

Invoice uploading for businesses started in GST Portal

News & FAQs | By Editor | Jul 26, 2017

The GSTN portal has started accepting uploading of sale and purchase invoices of businesses generated post Goods and Services Tax rollout...

Refund of CGST on goods made in excise-free zones proposed

News & FAQs | By Editor | Jul 26, 2017

A proposal to refund central goods and services tax (GST) on items made in formerly excise-free zones in Himachal Pradesh, Uttarakhand an...

जीएसटी के अंतर्गत संक्रमणिक प्रावधान

GST & Other Indirect Taxes | By ALOK PATNIA | Jul 22, 2017

मिग आर ए टीआई ओ एन एक्सटीस्टिंग टी एएक्स पी ए वाई आर आर एस इन जी एसटी एक अनंतिम आधार पर पंजीकरण का प्रमाण पत्र पहले से पहले कानून के तहत ...

जीएसटी के तहत आयात और निर्यात

General | By ALOK PATNIA | Jul 22, 2017

भारत में वर्तमान अप्रत्यक्ष कर शासन जटिल है क्योंकि करों की बहुलता, विस्तृत अनुपालन दायित्वों और टैक्स कैस्केडिंग हैं। सूचना प्रौद्योगिकी...

Due date to file intimation in case of composition Scheme has been extended to 16th August

GST & Other Indirect Taxes | By ALOK PATNIA | Jul 21, 2017

The Due date to file intimation in case of composition Scheme has been extended under Form GST CMP -01 to 16th August 2017. Earlier, sma...

Can Arbitration help to resolve disputes?

Corporate Law & Intellectual Property Rights | By Soumik Kumar Sen | Jul 21, 2017

The Arbitration clause is perhaps the most common clause of any type of agreement. But in most cases, one fails to understand it or its i...

TDS not to be deducted on GST element

GST & Other Indirect Taxes | By Editor | Jul 21, 2017

F. No. 275/59/2012-IT (B) Government of India Ministry of FinanceDepartment of RevenueCentral Board of Direct TaxesNorth Block, New Delh...

Payment of GST on Export of Services – Letter of undertaking or Bond

GST & Other Indirect Taxes | By ALOK PATNIA | Jul 20, 2017

Payment of GST on Export of Services from India – Export of services under GST regime with filing of LTU/Bond for export under GST Format...

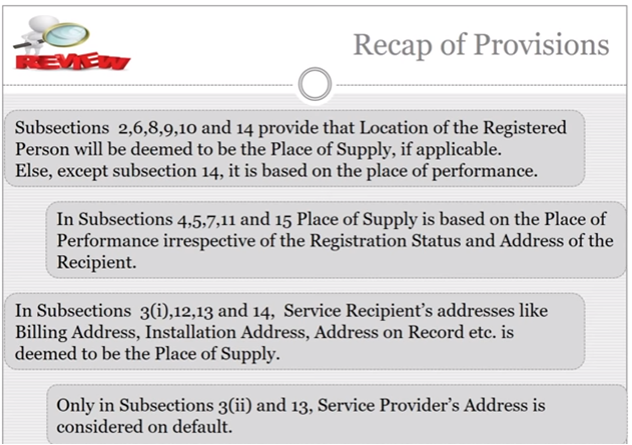

जीएसटी के अंतर्गत माल और सेवाओं की आपूर्ति का स्थान

GST & Other Indirect Taxes | By ALOK PATNIA | Jul 18, 2017

यह सामग्री मूलतः निम्नलिखित विषयों को कवर करती है: आपूर्ति के स्थान की प्रासंगिकता माल की आपूर्ति के स्थान का निर्धारण करने के लिए नियम स...

Toll Free:

Toll Free:  Contact Us

Contact Us