News & FAQs

Sexual Harassment in Startups and SMEs

Corporate Law & Intellectual Property Rights | By Soumik Kumar Sen | Oct 26, 2018

A year back one of my clients called me early in the morning and with a tensed voice said, “I might be screwed big time!” I pacified him ...

You can now claim your refund online on excess GST

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 26, 2018

Back in July, a FICCI survey revealed that 59% of the enterprises surveyed were not satisfied with the capability of the Goods and Servic...

GST anti profiteering clause puts FMCG firms in a fix

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 26, 2018

With input costs remaining high, manufacturers of consumer packaged goods have had little choice so far but to increase prices and protec...

Tata Sons may get a Rs 1,600-crore GST bill

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 26, 2018

Tata Sons, the holding company of the Tata Group, may get a goods and services tax (GST) bill of around Rs 1,600 crore over its $1.2 bill...

CA, two associates arrested for GST fraud of Rs 50 crore in Noida

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 24, 2018

A Chartered Accountant (CA) and two of his associates on Monday night were arrested for allegedly evading Rs 50 crore of Goods and Servic...

Composition scheme biz need not file purchase details while filing GST quarterly returns

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 23, 2018

Businesses opting for composition scheme under GST need not file details of purchases made from their vendors at the time of filing quart...

Food expenses recovered from employees for canteen services will attract GST

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 23, 2018

Recovery of food expenses from employees for the canteen service provided by the company will attract Goods and Services Tax (GST), accor...

CAIT asks FM to further extend due date of GST returns to December 31st

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 23, 2018

Traders’ body CAIT on October 21 wrote to Finance Minister Arun Jaitley seeking further extension of the deadline for filing summar...

GST refunds worth Rs 22,000 cr pending with govt

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 12, 2018

As much as Rs 22,000 crore GST refund is pending with the government, creating liquidity problem for exporters and impacting over...

Maggi dealer holding back GST cut

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 10, 2018

A Maggi Noodles dealer has come under watch for not passing on the benefits of a cut in goods and servicesNSE 1.13 % tax (GST) to consume...

Administrative jurisdiction no bar for launching GST enforcement action

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 10, 2018

To expedite action against erring taxpayers under GST, the Central Board of Indirect Taxes and Customs (CBIC) has written to field format...

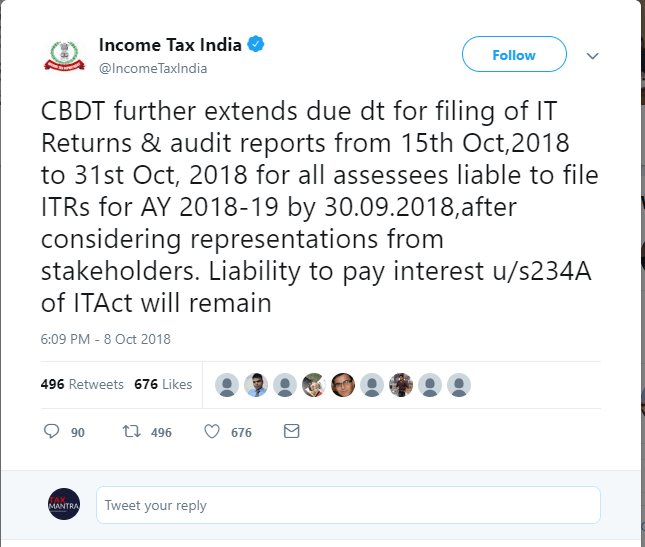

Income Tax Return filing due date extended to October 31st 2018

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 8, 2018

The Central Government today extended the due date for Tax Audit and return filing under the provisions of Income Tax Act to October 31st...

Toll Free:

Toll Free:  Contact Us

Contact Us