News & FAQs

GST credits taken by tech companies under taxman’s lens

GST & Other Indirect Taxes | By ALOK PATNIA | Jul 5, 2018

The indirect tax department is scrutinizing capital expenditure incurred by information technology (IT) and information technology enable...

One year of GST and its impact on the MSME sector

GST & Other Indirect Taxes | By ALOK PATNIA | Jul 5, 2018

This July 1st being the first anniversary of the Goods and Service Tax (GST) has been declared as annual ‘GST Day’ by the government. Aft...

#TAD2018throwback – What should founders take care of w.r.t taxation and compliance of the...

Corporate Law & Intellectual Property Rights | By ALOK PATNIA | Jul 3, 2018

Alok , accompanied by Rahul Agarwalla, Taxmantra South took over this session to explain the aspects that the founders should take care w...

#TAD2018throwback – What does it take to build global products from India?

Corporate Law & Intellectual Property Rights | By ALOK PATNIA | Jul 3, 2018

A panel of India’s fiery product start-ups took it on their shoulders to explain how India is going global and how building a product nee...

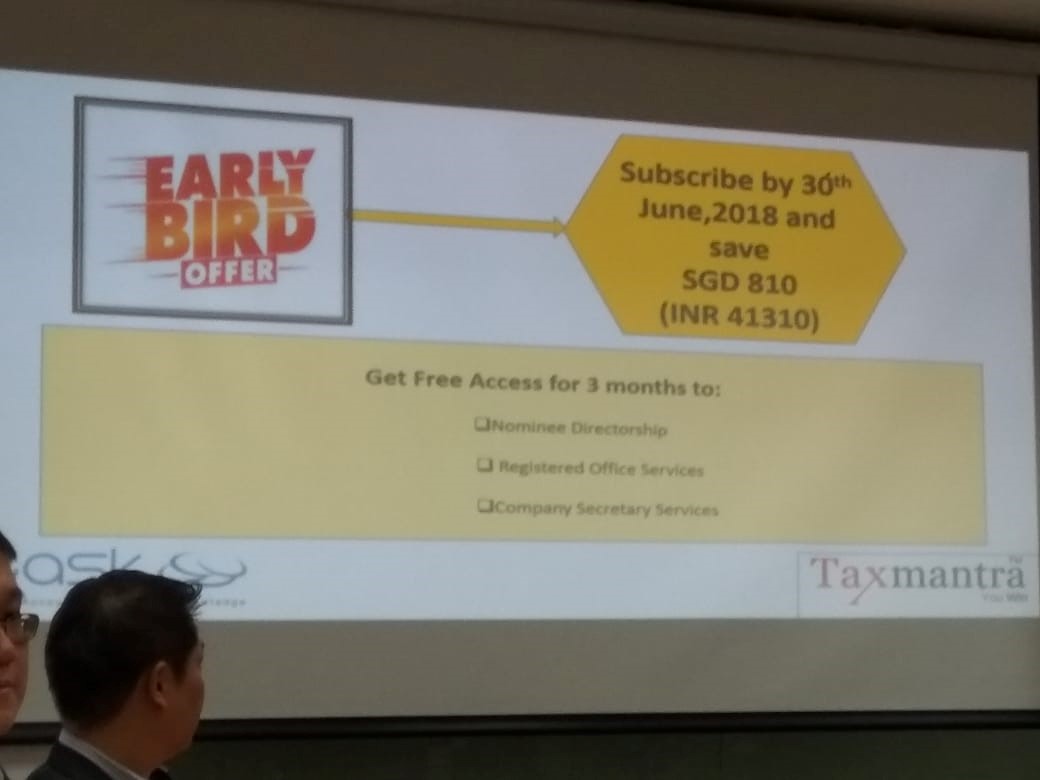

#TAD2018throwback – Session on India -Singapore compliances

Corporate Law & Intellectual Property Rights | By ALOK PATNIA | Jul 3, 2018

This dialogue was spearheaded by Alok and our Singapore partner, Kenneth Ho. Alok and Kenneth explained the nuances of starting and runni...

#TAD2018throwback – Opening Keynote by Alok Patnia

Corporate Law & Intellectual Property Rights | By ALOK PATNIA | Jul 3, 2018

The opening keynote was presented by Alok Patnia, Managing Partner at Taxmantra Globals, who graciously moderated the sessions in coordin...

GST data unearths tax leakage, fraud

News & FAQs | By ALOK PATNIA | Jul 2, 2018

The government’s indirect tax department has identified “thousands of crore rupees” in tax leakage as it strengthens its data analytics c...

Simplifying GST structure is the focus

News & FAQs | By ALOK PATNIA | Jul 2, 2018

It has been a year since the landmark goods and services tax (GST), which converted India into a single market, was implemented. Although...

After 1 year of GST, these are the sectors that still await benefits

News & FAQs | By ALOK PATNIA | Jul 2, 2018

The one year of the GST regime, India’s biggest tax reform since Independence may have seen rapid transformation in many areas of trade a...

Centre defers reverse charge mechanism till September 30

News & FAQs | By ALOK PATNIA | Jun 30, 2018

The government has further deferred the reverse charge mechanism under goods and services tax to September 30. Under this mechanism, GST ...

IT industry hopeful of GST-related issues resolution

News & FAQs | By ALOK PATNIA | Jun 29, 2018

The Indian information technology industry, even with its limited exposure to the India market, had some impact from the goods and se...

Govt may further lower GST rates, review high-tax items

News & FAQs | By ALOK PATNIA | Jun 29, 2018

The government is looking to further lower goods and services tax (GST) in the coming months, starting with construction material such as...

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us