GST & Other Indirect Taxes

GST slabs may collapse – Arun Jaitley

GST & Other Indirect Taxes | By Nikita Agarwal | Sep 1, 2017

Speaking at the India summit organized by The Economist in the capital, the Finance Minister Arun Jaitley said that the GST slab might be...

E-way bill Notified for transporting goods under GST – Few Items Exempted

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 31, 2017

Government has notified e-way bill exempting certain items of mass consumption such as meat, food grains, vegetables, books, jewellery, e...

Are Handicraft Artisians Unacknowledged Under GST?

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 31, 2017

Multiple issues have been reported in the framework of GST, one of which comprises of the un-acknowledgement of handicrafts sector under ...

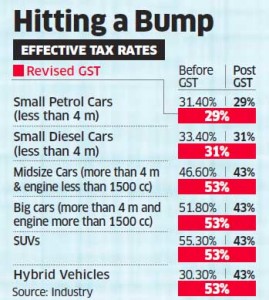

Cess on Luxury Cars will be hiked – Ordinance Cleared by Cabinet

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 31, 2017

Finally the cabinet has cleared the ordinance for the rise in cess for luxury cars, sports utility vehicles (SUVs) and big cars. The ordi...

जीएसटी 5 ए के लिए नियत दिनांक विस्तारित

GST & Other Indirect Taxes | By Editor | Aug 30, 2017

केंद्र सरकार द्वारा अधिसूचना के अनुसार , 15 सितंबर, 2017 तक गैर-कर योग्य ऑनलाइन इकाई के लिए भारत से बाहर की जाने वाल...

जीएसटी के तहत आयात की अवधारणा

GST & Other Indirect Taxes | By Editor | Aug 30, 2017

माल के आयात को आईजीएसटी अधिनियम, 2017 में परिभाषित किया गया है क्योंकि भारत के बाहर एक स्थान से सामान लाने के लिए सभ...

जीएसटी के तहत एलटीयूटी या बॉन्ड फाईल करने के लिए चरण गाइड द्वारा कदम

GST & Other Indirect Taxes | By Editor | Aug 30, 2017

जीएसटी के तहत निर्यात और आयात मुख्य रूप से आईजीएसटी अधिनियम द्वारा नियंत्रित होते हैं क्योंकि उन्हें अंतरराज्यीय आपूर्ति माना...

Air India Shifts GST Invoicing Work To Agents

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 30, 2017

Air India, to reduce the workload of the airline, has dubbed Travel Agent – its principal customers to shoulder the task of the goods and...

Government might allow revised returns for input credit for pre-GST stocks

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 30, 2017

Government is likely to allow rectification of returns filed by the companies for claiming the input tax credit for pre-goods and service...

Women Farmers’ Concerns over GST with PMO

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 30, 2017

The National Commission for Women (NCW) shall urge PMO for the concerns of Women Farmers’ in relation to increase in taxes post GST imple...

Mercedes Benz warn of prices going back to pre-GST level

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 30, 2017

The Managing Director of the Mercedes Benz India, Roland Folger, said that the prices of the luxury car might go back to pre – gst level ...

July GST Collections of Rs.92000 Crore exceeded the Target – Finance Minister

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 30, 2017

“We seem to be comfortable… The Redline has been crossed in the first month itself. “Not many had thought that the redline would be...

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us