GST & Other Indirect Taxes

Impact Of GST On Freelancers

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 16, 2017

In the era of GST, Freelancers providing taxable services are required to get registered under GST (if exceeding the exemption limit) and...

Impact Of GST On Khadi Sector

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 16, 2017

The entire Khadi & Village Industries (KVI) sector has been enjoying the benefit of tax exemption even under the pre-independence era...

All About Reverse Charge Mechanism Under GST

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 16, 2017

“Reverse Charge” means the liability to pay tax by the recipient of the supply of goods or services or both instead of the supplier of su...

The last date to Opt-In for Composition Levy for migrated taxpayers from previous regime is 16th ...

General | By Editor | Aug 14, 2017

The micro, small and medium entrepreneurs (MSMEs) can opt for relaxed Goods and Services Tax (GST) till August 16, the Finance ministry s...

From non-AC area at AC Restaurant 18% GST on takeaway food

GST & Other Indirect Taxes | By Editor | Aug 14, 2017

The new Goods and Services Tax (GST) regime, which was rolled out from July 1, provides for levy of 12 per cent on food bill in no...

Revoke requirement of LUT/Bond for small service providers – An appeal to the Govt

GST & Other Indirect Taxes | By Dipanjali Chakraborty | Aug 11, 2017

GST has been a game changer till now. It has brought under a common umbrella all the scattered localized taxes. Most of the indirect ta...

‘Get ready for first GST filing deadline’

GST & Other Indirect Taxes | By Editor | Aug 10, 2017

Millions of companies in India are still not ready to file their first returns under the new Goods and Services Tax (GST) ahead of an Au...

Revising Invoices under GST – Debit or Credit Note

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 10, 2017

Whenever there is a revision in the tax invoice already uploaded on GSTN, the taxpayer cannot modify the said tax invoice. To give effect...

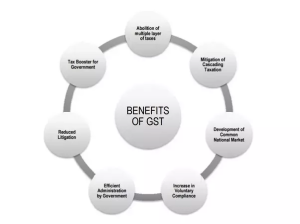

PROS OF GST

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 10, 2017

GST is an indirect Tax which is termed as “One Tax For the Whole Nation”. Introduction of GST is leading to India as one unified common m...

How to raise Invoices under the GST regime?

General | By Nikita Agarwal | Aug 9, 2017

Invoicing under the GST regime is itself a decisive part when it comes to any transaction’s execution. At the same time, it is the most i...

Furnishing of bonds/letter of undertaking on export of services – Why Govt needs to re-visit?

GST & Other Indirect Taxes | By Dipanjali Chakraborty | Aug 5, 2017

There has been a strong public outcry with respect to the requirement of furnishing bonds/letter of undertaking (LUT) for export of servi...

10 things every exporter should know about GST

GST & Other Indirect Taxes | By Dipanjali Chakraborty | Jul 27, 2017

GST implementation has no doubt given a boost to the export sector in India. Various statutory and procedural changes have been brought a...

Toll Free:

Toll Free:  Contact Us

Contact Us