Finally the cabinet has cleared the ordinance for the rise in cess for luxury cars, sports utility vehicles (SUVs) and big cars. The ordinance shall allow the cess to be increased from 15% to 25% as reported.

The exact quantum of the increase and its timing will be decided by the GST Council. “An enabling ordinance to that effect has been recommended to the honourable president by the GST Council,” Finance Minister Arun Jaitley said post the meeting, chaired by Prime Minister Narendra Modi. Whle explaining the move, FM said that it is to eliminate the anomaly that led to the price drop of such vehicle post GST, while those of smaller autos didn’t change.

On other hand, automakers experienced a rise in demand in the automobiles industry due to fall in prices and hence earnestly hoped that the government and the GST Council will give due consideration to the fact and desist from raising the cess and putting a dampener on the positive momentum in demand that the industry had started to witness since July 1.

“It is an unfortunate decision… It will have a negative impact on sales,” Society of Indian Automobile Manufacturers said. It will even request the government and GST Council to reconsider the hike. Also reported on August 8 that the government was planning to seek a higher cess and said on August 9 that it would do so through an ordinance.

“The GST Council, whenever, with regard to either of these two categories or both of these two categories is now entitled to take a decision, whether it wishes to increase the quantum of cess within that permissible cap,” Jaitley said. “This is not across the board… There are 12 different categories of automobiles, of which two are impacted. Its impact will be on luxury vehicles whose prices had come down a bit. This gives a room to restore that a bit. Now how much is that will depend on the GST Council.” Revenue secretary Hasmukh Adhia underscored that point: “There is no intention of increasing the rate on any car other than those which were put in luxury category on which there was a very high excise duty as well as high VAT.”

The matter shall lie on agenda of the GST council on September 9 in Hyderabad. “Whether it will on 9th or when it will happen, that the council will decide.” commented by Jaitely.

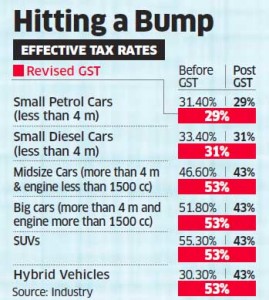

The current law provides for a maximum cess of 15%. Under GST, the maximum tax is 28%, taking total levies to 43%, lower than the more than 50% effective tax on these cars in the pre-GST regime. The higher cess will apply to motor vehicles for transport of not more than 13 persons, including the driver.

Sources –The Economic Times

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance

__________________________________________________________________________________________________________________________________________

Toll Free:

Toll Free:  Contact Us

Contact Us