Invoicing under the GST regime is itself a decisive part when it comes to any transaction’s execution. At the same time, it is the most important part too as on basis of it, the input credits shall be available to the assessee’s. The absence or wrong filing of required information could trigger denial or delay in claiming input tax credit.

Invoicing under the GST regime is itself a decisive part when it comes to any transaction’s execution. At the same time, it is the most important part too as on basis of it, the input credits shall be available to the assessee’s. The absence or wrong filing of required information could trigger denial or delay in claiming input tax credit.

In GST Act, all the details to be reflected in the Invoices along with the types of invoices has been specified. Government has provided two types invoices, to be issued under GST for the recording of the transactions. Below are the ones :-

- Tax Invoice

- Bill Of Supply

- TAX INVOICE :

Where any taxable goods or services is been provided by any taxable person, a tax invoice has to be raised as per the specified format of the GST Act. The format includes sixteen different particulars to be mentioned in the invoice, as below :

- Name, address and GSTIN of the supplier;

- Date of issue of the invoice;

- HSN (Harmonised System of Nomenclature) code;

- Tax invoice number (each invoice has an unique number generated consecutively);

- Description of the goods/services for which the invoice is being raised;

- Total value of supply of goods/services transacted;

- Applicable rate of GST;

- Taxable value of supply after adjusting any discount;

- Amount of tax;

- Quantity of goods (number) and unit (metre, kg etc.);

- Place of supply and name of destination state for inter-state sales;

- Signature or digital signature of the supplier or his authorized representative;

- Delivery address if it is different from the place of supply;

- Whether GST is payable on reverse charge basis;

- If the recipient is not registered AND the value is more than Rs. 50,000 then the invoice should carry name and address of the recipient along with the address of delivery with state name and state code;

- If the buyer (recipient) is registered then the name, address and GSTIN of the recipient.

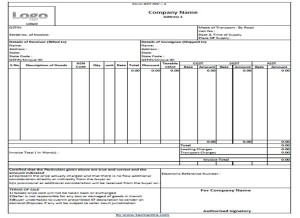

Here is the sample of a Tax Invoice for reference :

Time Limit for Issuing Tax Invoice :

In case of taxable supply of services, it shall be issued within a period of thirty days from the date of supply of service.

Provided that where the supplier of services is an insurer or a banking company or a financial institution, including a non-banking financial company, the period within which the invoice or any document in lieu thereof is to be issued shall be forty five days from the date of supply of service.

Provided further that where the supplier of services is an insurer or a banking company or a financial institution, including a non-banking financial company, or a telecom operator, or any other class of supplier of services as may be notified by the Government on the recommendations of the Council, making taxable supplies of services between distinct persons as specified in section 25 as referred to in Entry 2 of Schedule I, may issue the invoice before or at the time such supplier records the same in his books of account or before the expiry of the quarter during which the supply was made.

Manner of issuing invoice :

The invoice shall be prepared in triplicate, in case of supply of goods, in the following manner :–

- the original copy being marked as ORIGINAL FOR RECIPIENT;

- the duplicate copy being marked as DUPLICATE FOR TRANSPORTER; and

- the triplicate copy being marked as TRIPLICATE FOR SUPPLIER.

The invoice shall be prepared in duplicate, in case of supply of services, in the following manner:-

- the original copy being marked as ORIGINAL FOR RECIPIENT; and

- the duplicate copy being marked as DUPLICATE FOR SUPPLIER.

The serial number of invoices issued during a tax period shall be furnished electronically through the Common Portal in FORM GSTR-1.

What does a tax invoice for export contain ?

An export invoice must, in addition to the details required in a tax invoice, contain the following details:

- Must have the words “Supply meant for export on payment of IGST” or “Supply meant for export under bond without payment of IGST”;

- Name and address of the recipient;

- Delivery address;

- Number and date of ARE-1 (application for removal of goods for export);

PS – Bill of Supply is to be issued by a registered supplier in case of Supply of exempted goods or services and Supplier is paying tax under composition scheme.

2. BILL OF SUPPLY :

A bill of supply referred to in GST Act, has to be issued by the supplier containing the below details and information :

- name, address and GSTIN of the supplier;

- date of its issue;

- HSN Code of goods or Accounting Code for services;

- description of goods or services or both;

- a consecutive serial number, in one or multiple series, containing alphabets or numerals or special characters -hyphen or dash and slash symbolised as “-” and “/”respectively, and any combination thereof, unique for a financial year;

- name, address and GSTIN or UIN, if registered, of the recipient;

- value of supply of goods or services or both taking into account discount or abatement, if any; and

- signature or digital signature of the supplier or his authorized representative.

PS – Provided that the provisos to rule 1 shall, mutatis mutandis, apply to the bill of supply issued under this rule.

Therefore, invoicing has to be done as per the above norms specified under the GST Act.

For queries, please contact Taxmantra.com.

__________________________________________________________________________________________________________________________________________

Toll Free:

Toll Free:  Contact Us

Contact Us