India waited with baited breath while the much awaited “Startup India Stand Up India” scheme was being shown the light today. This is the pet project of Narendra Modi led NDA Govt and was covered by the media in no less fervor than the Union Budget. This scheme has been specifically designed to boost entrepreneurship in the country. The startup scenario in India has seen aggressive growth in the past year. India has seen an approximate fund infusion of $9 billion in 2015 alone. PM Modi’s love for startups is no hidden thing. And indeed…we were not at all disappointed. Starting up becomes hassle free with startup policy. Here are some of the key features that were unveiled today:

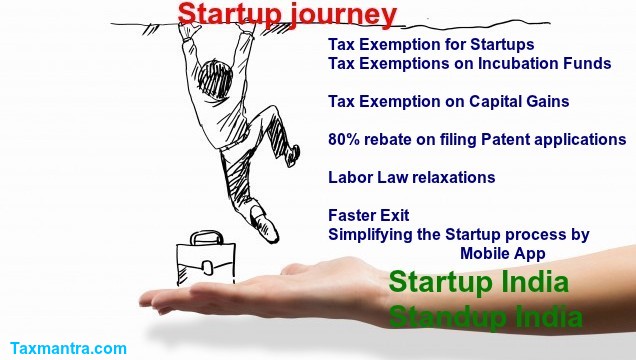

- Tax Exemption for Startups

Startups which are already in India are literally sick of the grandfathered tax regimes. Additionally, startups who intend to enter in India are equally hassled by this. In fact, probably this is one of the major factors that startups are choosing countries like Singapore and US over India, be it for starting up or shifting their operations. Now we finally have a scheme which addresses this issue on real time basis. No rebates, no reduced rates…this scheme EXEMPTS startups from taxation. Startups commencing their business after 01st April, 2016, shall be exempted from taxation for the first 3 years of its operations. This is subject to non-distribution of dividend in these initial years. The first few years of a startup are always shaky. This is the period wherein they incur sunk costs and compliance costs are too high which are less often backed by revenue inflow. Hence, this exemption would be strategically very important for the startups.

- Tax Exemptions on Incubation Funds

Another very problematic area for startups was related to investments. As per the Income Tax Act, 1961, any business receiving money in the form of share capital which is over and above the Fair Market Value (FMV) of the company, has to pay taxes under the head income from other sources, on the excess amount. At times, this gets a but illogical. This is due to the fact, FMV figuratively is determinable on the basis of operations of the company. Hence, for a startup that has just been hatched, there is practically no FMV. While investors value a startup on the basis of their prototype and team, these valuation norms seem to be an anomaly.

Hence, to encourage seed capital availability and address this problem, the Govt has planned to exempt the investment by incubators from the scope of the above section. Previously, only Venture Capitalists were entitled to this exemption. Considering the growing influx of funds in Indian startups from various sources apart from VC funds, this is a very welcome move.

Having said that, there is further scope of expansion in this avenue. As of now, this exemption has been advanced to VCs and incubators mainly due to control perspectives. However, we hope that the retail investors would also be brought under this ambit soon.

- 80% rebate on filing Patent applications by startups and setting up of Panel of facilitators

Compliance costs have been pain points for startups for eternity now in India. Many of the legal compliances come at a high cost which startups are unable to afford. The Govt has been trying to address this issue quiet frequently this year. Earlier this year, private limited companies were granted with various exemptions, aiming at reducing the compliance cost for startups. The very flavor of this intention was evident in this scheme as well. Under this scheme, startups will be granted 80% rebate in Govt costs in filing of patents.

Apart from the compliance costs, what ails Indian IP Rights scenario is the lengthy timeframe. The average time frame for a trademark application or patent to get processed is around 24-36 months. Apart from this, the processes and steps involved comparatively pre dated and less transparent.

This scheme addresses these issues and seeks to set up a redressal mechanism in place. Some of these proposed measures are summarized below:

- Fast Tracking of Patent applications to be made hereafter

- A panel of facilitators shall be empaneled by the Comptroller General of Patents, Designs and Trademarks, who shall also regulate their conduct and functions. Facilitators shall also be responsible for providing advisory on different IPRs, their protection and promotion globally, assist in filing of Trademark applications under relevant acts. The facilitators would also be appearing on hearings on behalf of the startups.

- Central Govt shall bear the entire cost of the facilitators and startups shall bear only the statutory fees

- Startups shall be provided 80%rebate on the Govt fees for filing of Patents vis-à-vis other companies

IPRs are slowly emerging as strategic business tools and rockets the valuation of a business to sky high level. Hence, in all, this indeed is going to be a very important facet of this scheme. As of now, this particular facility shall be available for 1 year, subject to further action on the basis of the outcome.

- Labor Law relaxations to startups

Compliances with the various Govt departments like Trade License, Professional Tax, PF consume a big chunk of the productive hours of a startup. We would not additionally harp about the compliance costs which seems to be a recurring factor in the startup scenario. Under this scheme, startups shall be allowed to self-certify their compliances (through Mobile App) with 9 Labor Laws and Environmental Laws. Further, with regards to the labor law compliances, the concept of inspection has been done away with for three years. However, startups may be inspected on the basis of a written complaint filed for violation subject to approval of atleast 1 level senior to the Inspecting officer.

In case of environmental laws, startups which fall under the “white category” would be entitled to certify and only random checks would be conducted once in a while.

This significant exemption shall be available with respect to the following labor laws:

- The Building and Other Constructive Workers (Regulation of Employment & Conditions of Service) Act, 1996

- The Inter-State Migrant Workmen (Regulation of Employment & Conditions of Service) Act, 1979

- The Payment of Gratuity Act, 1972

- The Contract Labour (Regulation and Abolition Act), 1970

- The Employee’s Provident Funds and Miscellaneous Provisions Act, 1952

- The Employees’ State Insurance Act, 1948

- Faster Exit of Startups

At present, the process of closure of a business is tedious, time consuming and cost intensive. Often it takes years to close down the business resulting in oodles of money and unproductive compliance costs. Hence, in order to facilitate this exit route for businesses, fast track closure norms have been included in “The Insolvency and Bankruptcy Bill 2015”. This is expected to fast track the entire exit process so much so that companies with low debt gearing can be wound up within record timing of 90 days from their date of application for such winding up. An Insolvency Professional will be appointed in these cases, wherein he shall be in charge of the company for liquidating its assets and paying off the creditors of the company within 6 months of such appointment.

This seems to be a very balanced move from the Govt. On one hand, the entry routes have been greased and simultaneously the exit procedures are also being relaxed. This undoubtedly would drive away the inhibitions from the mind of budding startups who are hesitant to take the next foot forward succumbing to the fear of getting stuck up in the compliance web.

- Tax Exemption on Capital Gains

Startups have been further exempted from paying capital gains tax during the year, if such gains are invested in the Fund of Funds recognized by the Govt, namely VCFs and AIFs. Additionally, CG Tax for newly investments made in newly formed manufacturing MSMEs by individuals shall be extended to all startups. Currently, such an entity needs to purchase “new assets” with the CG received to avail such exemption. This asset purchase requisition did not seem so feasible for the service sector, which are no so asset intrinsic. Hence, the definition of new asset has been extended to include “purchase of computer of computer software”.

- Credit Guarantee Fund for Startups

At one hand, the path of investments by VCs, incubators and AIFs are being made hassle free. Simultaneously, provisions are being made to facilitate the availability of funds for startups which do not wish to go the Investment Route.

To catalyze entrepreneurship through credit innovators, a credit guarantee mechanism through National Credit Guarantee Trust Company/SIDBI shall be rolled out with a corpus of Rs, 500 crores per year for the next four years.

- Simplifying the Startup process by rolling out of Mobile App and Portal

Startups in India have been ever complaining about the lengthy and tedious process of registering their business. Under this scheme, however, startups would be able to register by just filling up a simple concise form through a mobile app and online portal that is proposed to be launched in April. The Mobile App is intended to provide “on-the-go accessibility” for:

- Registering startups with relevant agencies of the Govt. This app shall be integrated with the Ministry of Corporate Affairs (MCA) and Registrar of Firms.

- Tracking of status of application and downloading of the various approval certificates

- Filing for various compliances

- Applying for various schemes of the Startup India Action Plan

- Collaborating with various startup Ecosystem Partners. This App shall provide a collaborative platform with a network of stakeholders including VCs, incubators, mentors to facilitate discussions towards enhancing the startup ecosystem as a whole.

This App shall be available from April 01, 2016 onwards on all leading mobile/smart devices platform.

Apart from the above, there are various other plans which were rolled out:

- Setting up of a Single Point of Contact and hand holding facilitator in the form of Startup Hub

- Relaxed Norms of public procurement of startups

- Setting up of Funds of Funds with an initial corpus of Rs. 2500 crores and a total corpus of Rs. 10000 crore over a period of 4 years

- Organizing of Startup Fests and Grand Innovation Challenge

- Launching of Atal Innovation Mission for promotion of entrepreneurship and innovation

- Setting up of 35 new incubators, wherein upto 10 crores of funding support shall be provided by the CG

- Setting up of 7 new research parks in the IITs modelled on the research park at IIT Madras.

- Promotion of entrepreneurship in biotechnology be setting up of 50 new bio incubators, 150 technology transfer offices, 5 new bio clusters.

- Targeted Innovation focused programs for students

The term “startup” has also been defined for the purpose of the Government schemes. Startup means an entity, incorporated or registered in India not prior to five years with annual turnover not exceeding Rs. 25 crores in any preceding financial year, working towards innovation, development or deployment or commercialization of new products, processes or services driven by technology or IP. Provided such entity is not formed by splitting up or reconstruction of a business already in existence. Also, for availing the “startup” status, the entity has to obtain certification from the Inter-Ministerial Board, setup for such purposes.

These were some pretty bold announcements made and if executed properly can change the face of Indian startup scenario. Never have we seen such pro-active measures from the Indian Govt to boost the startup fervor in the country. This scheme remains true to its roots and upholds the promises made to the youth of the country. This scheme has already been approved by the Union Cabinet. Now, it remains to be seen that given the existing Govt infrastructure and execution machinery, how fast and how smooth these plans can be put into action.

Startups get started with Taxmantra

______________________________________________________

Toll Free:

Toll Free:  Contact Us

Contact Us