Indian venture capitalists and private equity firms that pumped $15 billion into companies in 2016 are wary that come July, when the goods and services tax (GST) rolls out, their representatives/directors could be vulnerable to tax dues of investee companies even retrospectively, as reported on ET.

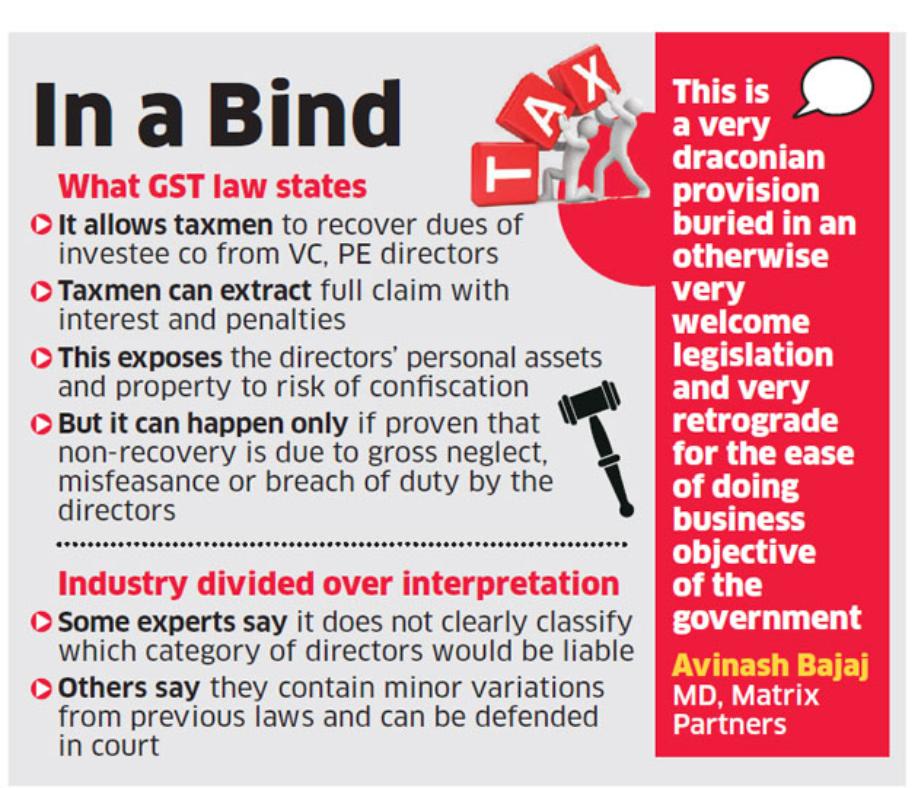

The new law gives tax authorities the right to extract the full claim with interest and penalties from these directors exposing their personal assets and property to the risk of confiscation. This can happen only if it is proven that the non-recovery is attributed to gross neglect, misfeasance or breach of duty by the directors. Thus, Nominee Directors can also be penalized for non-compliance under GST.

For instance, if company A, in which a fund Y invested in March 2016 and appointed a nominee on its board, were to receive a notice from the tax authorities in August this year for an unpaid claim pertaining to the financial year 2015, the nominee directors of fund Y are liable to satisfy the claim amounts if the company is unable. Otherwise, the directors have to prove that they were not guilty of negligence, misfeasance or breach of duty.

These provisions incorporated in Section 89 of the Central Goods and Services Tax Act have the industry divided over its interpretation with some experts saying it does not clearly classify which category of directors would be liable.

Others say that they contain only minor variations from previous laws and can be defended in court if punitive actions were to be imposed.

“This is a very draconian provision buried in an otherwise very welcome legislation and very retrograde for the ease of doing business objective of the government,” Avinash Bajaj, managing director of Matrix Partners, which manages $600 million in a combination of venture capital investments, said. Matrix Partners funded companies such as cab-hailing app Ola, online classifieds platform Quikr and Treebo Hotels among a dozen other investments in India.

“Most nominee directors of financial investors are typically denoted as non-executive directors. However, in this matter, there is no carve-out for non-executive directors, in other words, all directors are liable,” ChrysCapital’s partner Ashley Menezes said.”While the directors may not be personally liable until there is a default by the company, this is an onerous rule and cause of concern for financial investors.”

Though certain central excise, service tax, and customs laws provide for penalties to be imposed on directors for noncompliance by a company, the claims are limited to the extent of penalties imposed on the company and not to the full extent of the tax claim. In certain laws such as for non-compliance to service tax, the claims on directors have capped at Rs 1 lakh.

“Under GST, all directors are personally liable if the company fails to pay tax and the tax amount as well as penalties and interest can be recovered from the director,” said Sandeep Chilana, a partner at law firm Shardul Amarchand Mangaldas & Co. “This is a variation from previous central laws where the liabilities of directors were capped to the extent of penalties.”

Industry watchers said the new law places the onus of proving tax non-compliance did not occur due to negligence, misfeasance or breach of duty on the directors of these companies.

This provides room for tax authorities to place claims that can result in lengthy litigations and increase the cost of doing business for financial investors, especially in cases where the claim is made for a period that precede the investment date when the investor had no oversight on the company’s affairs.

“Investors will be more cautious when conducting due diligence now. They will ensure that contingent liabilities arising out of any tax-related issues are thoroughly protected in various indemnity clauses,” Abhishek Rastogi, partner at law firm Khaitan and Co, said.

Financial investors are likely to fix clear responsibilities for tax liabilities in order to protect themselves before they make an investment, tax practitioners and lawyers said. These resulting challenges could also means investors purchase D&O (Directors and Officers Insurance) covers to protect their nominees on the boards of companies. Overall, the risk and cost of compliance are likely to increase, according to various stakeholders.

Toll Free:

Toll Free:  Contact Us

Contact Us