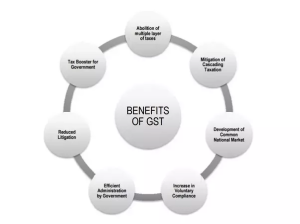

GST is an indirect Tax which is termed as “One Tax For the Whole Nation”. Introduction of GST is leading to India as one unified common market. It has subsumed most of the indirect taxes and is a single tax on the supply of goods and services, right from the manufacturer to the consumer. Credits of input taxes paid at each stage will be available in the subsequent stage of value addition, which makes GST essentially a tax only on value addition at each stage. The final consumer will thus bear only the GST charged by the last dealer in the supply chain, with set-off benefits at all the previous stages. Along with the said benefit, there are many pros of GST as summarized below:

Benefits to Consumers :

- Single and Transparent Tax – Earlier, multiple taxes were levied in the form of indirect taxes by the Central and State Government. The taxes paid by the consumers at different stages of production were not available for input credits at progressive stages of production. As a result, the cost of goods and services so produced were laden with many hidden taxes. Under GST, there is only one tax from the manufacturer to the consumer, leading to transparency of taxes paid to the final consumer.

- Reduction in overall Tax Burden – As the cascading effect of the taxes has been eliminated by the roll out of GST, efficiency gains and prevention of leakages is attained. Hence, the overall tax burden on most commodities has come down, thereby benefiting the consumers.

Benefits to Business and Industry :

- Removal of cascading – A system of seamless tax-credits throughout the value-chain, and across boundaries of States, has ensured that there is minimal cascading of taxes. This has reduced the hidden costs of doing business.

- Gain to manufacturers and exporters – The cost of locally manufactured goods and services has been reduced as the major of Central and State Taxes have been subsumed under GST. This has increased the competitiveness of Indian goods and services in the international market and has given a boost to Indian exports. The uniformity in tax rates and procedures across the country may also go a long way in reducing the compliance cost.

- Improved competitiveness – Reduction in transaction costs of doing business has eventually led to an improved competitiveness for the trade and industry.

- Easy compliance – A strong and comprehensive Information Technology system is the foundation of GST regime in India. Therefore, all tax payer services such as registrations, returns, payments, etc. is available to the taxpayers online, which has made compliance easy and transparent.

- Uniformity of tax rates and structures – Across the country, all the indirect tax rates and structure are common under GST, thereby increasing certainty and ease of doing business. To be simplified, GST has made doing business in the country tax neutral, irrespective of the choice of place of doing business.

Benefits to Central and State Governments :

- Higher revenue efficiency – GST shall result in decrease of the cost of collection of tax revenues of the Government, and shall therefore, lead to higher revenue efficiency.

- Simple and easy to administer – As multiple indirect taxes has been subsumed by GST, GST has backed with a strong end – to –end IT system. Thus, GST is simpler and easier to administer than all other indirect taxes of the Centre and State levied so far.

Thus, GST is one of the biggest fiscal reforms in India since Independence. All businesses, small or large, will be impacted by this new indirect tax regime. Further, Indian businesses will be able to better compete with foreign countries such as China, Philippines, and Bangladesh.

For more queries, please visit Taxmantra.com.

__________________________________________________________________________________________________________________________________________

Toll Free:

Toll Free:  Contact Us

Contact Us