GST on Export Services

-

-

- Export of Services under GST

- Letter of Undertaking (LUT)

- Deemed Exports

- GST on Intermediary Services

- Inverted Duty Structure

- Q&A

-

How are exports treated under the GST Law?

Under the GST Law, export of goods or services has been treated as:

-

-

- inter-State supply and covered under the IGST Act.

- ‘zero rated supply’ i.e. the goods or services exported shall be relieved of GST levied upon them either at the input stage or at the final product stage.

-

The supplies to a SEZ unit or SEZ developer are treated as zero rated supplies in the GST Law.

Then why there is no specific mention in the GST Law about not charging of tax in respect of supplies from DTA unit to a SEZ unit or SEZ developer?

Yes, supplies made to an SEZ unit or a SEZ developer are zero rated. The supplies made to an SEZ unit or a SEZ developer can be made in the same manner as supplies made for export:

-

-

- either on payment of IGST under claim of refund;

- or under bond or LUT without payment of any IGST.

-

What is deemed export under GST Law? Whether any supply has been categorized as deemed export by the Government?

Deemed export has been defined under Section 2(39) of CGST Act, 2017 as supplies of goods as may be notified under section 147 of the said Act.

Under section 147, the Government may, on the recommendations of the Council, notify certain supplies of goods manufactured in India as deemed exports, where goods supplied do not leave India, and payment for such supplies is received either in Indian rupees or in convertible foreign exchange.

However, till date, the government has not notified any supply as deemed export.

Place of Supply relating to Immovable Property (Section 13(4) IGST)

According to this section location of the place of supply shall be the location where the immovable property is located or intended to be located.

Example 1 – An immovable property was rented out in Delhi to foreign national of USA. Payment is also received in foreign currency.

Answer – Place of supply shall be where immovable property is situated. Therefore, this transaction shall not be export of service because location of the immovable property is in India.

Example 2 – An Architect raises a bill to USA company for providing services towards property to be constructed in Delhi. A bill is raised in foreign currency and payment is also received in foreign currency.

Answer – Place of supply for such service shall be where immovable property is intended to be located. Such transaction shall not be export of service because place of supply is not outside India.

Whether software is regarded as goods or services in GST?

In terms of Schedule II of the CGST Act 2017, development, design, programming, customization, adaptation, upgradation, enhancement, implementation of information technology software and temporary transfer or permitting the use or enjoyment of any intellectual property right are treated as services.

But, if a pre-developed or pre-designed software is supplied in any medium/storage (commonly bought off-the-shelf) or made available through the use of encryption keys, the same is treated as a supply of goods classifiable under heading 8523.

How to determine whether IT services provided constitute export of service?

The supply of any service is considered an export of service, where the following conditions are met:

1. the supplier of service is located in India;

2. the recipient of service is located outside India;

3. the place of supply of service is outside India;

4. the payment for such service has been received by the supplier of service in convertible foreign exchange *[or in Indian rupees wherever permitted by the Reserve Bank of India]; and

5. the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with explanation 1 of section 8 of the IGST Act, 2017.

How is condition 5 viz the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8 of the IGST Act, 2017 impacts the taxability?

Explanation I in section 8(2) of the IGST Act, 2017 states that where a person has an establishment in India and any other establishment outside India then such establishments shall be treated as establishment of distinct persons. Where the Indian arm is set up as a liaison office or a branch they would be treated as establishments of the same entity and hence the supply inter se shall not qualify as export of services.

However, if the Indian arm is set up as a wholly owned subsidiary company incorporated under the Indian laws, the foreign company and the Indian subsidiary would not be governed by the provisions of distinct person or related person as both are separate legal entities.

Supply of Export of Services between two Distinct persons is Exempt from GST

According to clause 10F of notification 9/2017 IGST (Rate) service made to distinct person shall be exempt from tax provided the place of supply of the service is outside India in accordance with section 13 of Integrated Goods and Services Tax Act, 2017. Therefore, no tax should be charged if other conditions are fulfilled. Para 10F of the Notification 9/2017 is reproduced as under

|

Description of Services |

Rate |

Condition |

|

Services supplied by an establishment of a person in India to any establishment of that person outside India, which are treated as establishments of distinct persons in accordance with Explanation 1 in section 8 of the Integrated Goods and Services Tax Act, 2017. |

NIL |

Provided the place of supply of the service is outside India in accordance with section 13 of Integrated Goods and Services Tax Act, 2017 |

Section 13(8) IGST Act relating to services whose Place of Supply shall be location of the Supplier of Services.

a) services supplied by a banking company, or a financial institution, or a non-banking financial company, to account holders;

(b) intermediary services;

(c) services consisting of hiring of means of transport, including yachts but excluding aircrafts and vessels, up to a period of one month.

Intermediary Services defined in section 2(13) of the IGST Act i.e.

“intermediary” means a broker, an agent or any other person, by whatever name called, who arranges or facilitates the supply of goods or services or both, or securities, between two or more persons, but does not include a person who supplies such goods or services or both or securities on his own account;

CBIC issues clarification on issues related to supply of Information Technology enabled Service (ITeS services) such as call center, business process outsourcing service, etc. and ‘Intermediaries’ to overseas entities under GST law and whether they qualify to be ‘export of services’ or otherwise vide Circular No. 107/26/2019-GST Dated 18th July, 2019.

Intermediary has been defined in the sub-section (13) of section 2 of the Integrated Goods and Service Tax Act, 2017 (hereinafter referred to as “IGST” Act) as under –

“Intermediary means a broker, an agent or any other person, by whatever name called, who arranges or facilitates the supply of goods or services or both, or securities, between two or more persons, but does not include a person who supplies such goods or services or both or securities on his own account.”

The definition of intermediary inter alia provides specific exclusion of a person i.e. that of a person who supplies such goods or services or both or securities on his own account. Therefore, the supplier of services would not be treated as `intermediary even where the supplier of service qualifies to be ‘an agent/ broker or any other person if he is involved in the supply of services on his own account.

Information Technology enabled Services (ITeS services), though not defined under the GST law, have been defined under the sub-rule (e) of rule 10 TA of the Income-tax Rules, 1962 which pertains to Safe Harbor Rules for international transactions. It defines ITeS service as‑

“information technology enabled services” means the following business process outsourcing services provided mainly with the assistance or use of information technology, namely:

but does not include any research and development services whether or not in the nature of contract research and development services”.

i. back office operations;

ii. call centers or contact center services;

iii. data processing and data mining;

iv. insurance claim processing;

v. legal databases;

vi. creation and maintenance of medical transcription excluding medical advice;

vii. translation services

viii. payroll;

ix. remote maintenance;

x. revenue accounting;

xi. support centers;

xii. website services;

xiii. data search integration and analysis;

xiv. remote education excluding education content development; or

xv. clinical database management services excluding clinical trials,

In case an exporter of services outsources a portion of the services contract to another person located outside India, what would be the tax treatment of the said portion of the contract at the hands of the exporter?

There may be instances where the full consideration for the outsourced services is not received by the exporter in India.

1.Where an exporter of services located in India is supplying certain services to a recipient located outside India, either wholly or partly through any other supplier of services located outside India, the following two supplies are taking place: –

i. Supply of services from the exporter of services located in India to the recipient of services located outside India for the full contract value;

ii. Import of services by the exporter of services located in India from the supplier of services located outside India with respect to the outsourced portion of the contract.

Thus, the total value of services as agreed to in the contract between the exporter of services located in India and the recipient of services located outside India will be considered as export of services if all the conditions laid down in section 2(6) of the IGST Act read with section 13(2) of the IGST Act are satisfied.

- It is clarified that the supplier of services located in India would be liable to pay integrated tax on reverse charge basis on the import of services on that portion of services which has been provided by the supplier located outside India to the recipient of services located outside India. Furthermore, the said supplier of services located in India would be eligible for taking input tax credit of the integrated tax so paid.

- Thus, even if the full consideration for the services as per the contract value is not received in convertible foreign exchange in India due to the fact that the recipient of services located outside India has directly paid to the supplier of services located outside India (for the outsourced part of the services), that portion of the consideration shall also be treated as receipt of consideration for export of services in terms of section 2(6)(iv) of the IGST Act, provided the:

i. integrated tax has been paid by the supplier located in India for import of services on that portion of the services which has been directly provided by the supplier located outside India to the recipient of services located outside India; and

ii. RBI by general instruction or by specific approval has allowed that a part of the consideration for such exports can be retained outside India.

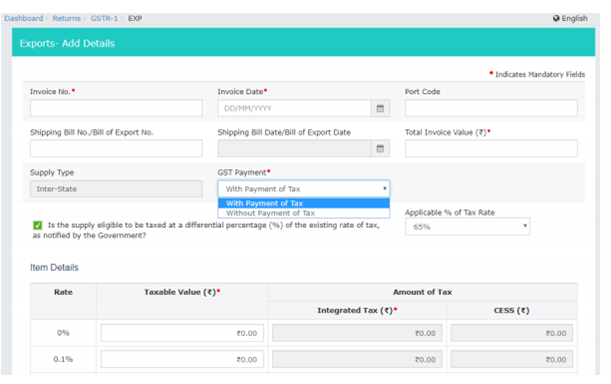

With or Without Payment of Tax

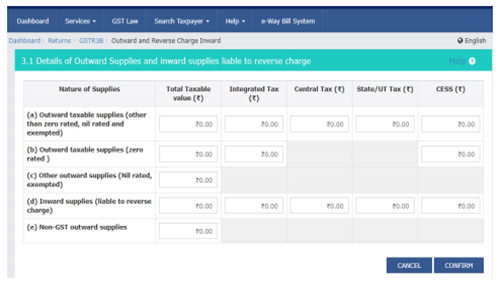

However, in GSTR 3B the export details are furnished in Table 3.1(b) as the same is classified as the zero-rated supplies. It is important to note that the GSTR 3B is a summarized return, hence, only the consolidated figure is furnished. IGST amount is reported in Table 3.1(b) of GSTR-3B [and not table 3.1(a) or 3.1(c)].

Further, the supplies to SEZ unit/developer is also treated as zero rated supplies, so the same has to be reported in this Table itself.

____________________________________________________________________________________________________________________________________

We’re listening:

For any query, support or feedback, reach us at India Tax and Legal Compliances or WA us at +91-9230033070 or Call us at 1800-102-7550

Connect on LinkedIn:

https://www.linkedin.com/company/taxmantra

Connect on Facebook:

https://www.facebook.com/taxmantra

Follow us on Twitter:

https://twitter.com/taxmantra?lang=en

Subscribe to our YouTube:

https://www.youtube.com/user/Taxmantra

____________________________________________________________________________________________________

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us