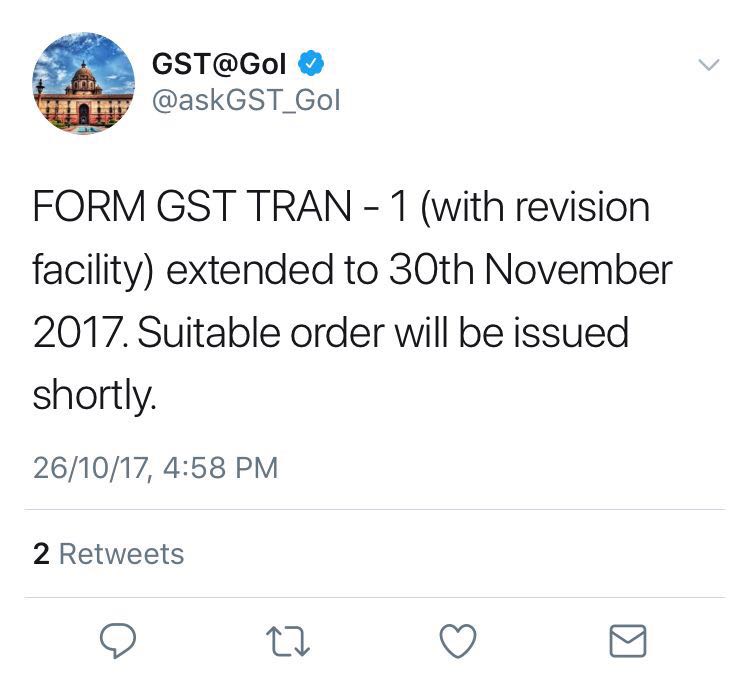

Suitable order to be issued shortly.

TRAN-1 is a return that incorporates details of all opening balances of taxes paid on stock lying at a factory, warehouse, or on capital goods and input services. All of this then needs to be captured and uploaded onto the GST Network (GSTN) portal.

Credit that is not captured appropriately in this return would be a loss to any business. A delay in filing TRAN-1 could negatively impact the working capital of a business, as till the time TRAN-1 is filed, credits from the earlier tax regime may not be available under GST.

Toll Free:

Toll Free:  Contact Us

Contact Us