Hike in GST-Cess on Mid, Large Cars Notified

GST & Other Indirect Taxes | By Nikita Agarwal | Sep 4, 2017

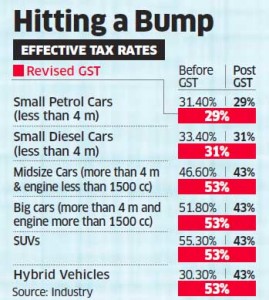

The hike of GST – cess on cars (mid-size, hybrid, luxurious) upto a maximum of 25% from 15% is being notified by the government. Followi...

All Traders should fall under GST – by PM

GST & Other Indirect Taxes | By Nikita Agarwal | Sep 2, 2017

As per the GST law, small traders not covered under the ambit of R.20 Lakhs turnover, are not required to register themselves under GST r...

Govt waives off Late Fee for GSTR 3B_July

GST & Other Indirect Taxes | By Nikita Agarwal | Sep 2, 2017

The late fee levied on the filing of GSTR 3B for july, the first month of implementation for the new tax regime, beyond the deadline has ...

E-way Bill notified – to be implemented from October

GST & Other Indirect Taxes | By Nikita Agarwal | Sep 2, 2017

E-way Bill, wherein all the goods worth more than Rs.50,000 are required to be pre-registered online before they are moved for sale beyon...

No provisional refund of ITC to categorized zero-rated suppliers

GST & Other Indirect Taxes | By Nikita Agarwal | Sep 2, 2017

As per the GST law, the taxpayers were granted a provisional refund of 90% of the total refund claim in case the goods supplied by the su...

Maharashtra records the highest GST collection

GST & Other Indirect Taxes | By Nikita Agarwal | Sep 1, 2017

It has been the first month since the roll out of GST and Maharashtra has topped in GST collections, mopping up more than Rs. 13,400 cror...

GST slabs may collapse – Arun Jaitley

GST & Other Indirect Taxes | By Nikita Agarwal | Sep 1, 2017

Speaking at the India summit organized by The Economist in the capital, the Finance Minister Arun Jaitley said that the GST slab might be...

ITR filing date extended from September 30th to October 31st

News & FAQs | By ALOK PATNIA | Aug 31, 2017

Tax payers who were supposed to file their income tax returns by September 30 now have some more time on their hands. The government has ...

E-way bill Notified for transporting goods under GST – Few Items Exempted

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 31, 2017

Government has notified e-way bill exempting certain items of mass consumption such as meat, food grains, vegetables, books, jewellery, e...

Are Handicraft Artisians Unacknowledged Under GST?

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 31, 2017

Multiple issues have been reported in the framework of GST, one of which comprises of the un-acknowledgement of handicrafts sector under ...

Cess on Luxury Cars will be hiked – Ordinance Cleared by Cabinet

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 31, 2017

Finally the cabinet has cleared the ordinance for the rise in cess for luxury cars, sports utility vehicles (SUVs) and big cars. The ordi...

जीएसटी 5 ए के लिए नियत दिनांक विस्तारित

GST & Other Indirect Taxes | By Editor | Aug 30, 2017

केंद्र सरकार द्वारा अधिसूचना के अनुसार , 15 सितंबर, 2017 तक गैर-कर योग्य ऑनलाइन इकाई के लिए भारत से बाहर की जाने वाल...

Toll Free:

Toll Free:  Contact Us

Contact Us