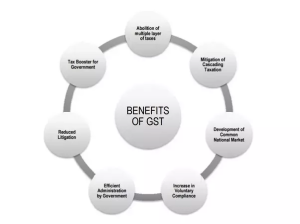

PROS OF GST

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 10, 2017

GST is an indirect Tax which is termed as “One Tax For the Whole Nation”. Introduction of GST is leading to India as one unified common m...

CBEC says online travel agents are liable to deduct TCS under GST

News & FAQs | By Editor | Aug 9, 2017

Travel agents providing online ticketing and other services will be liable to deduct 1 per cent tax at source under the GST regime as the...

How to raise Invoices under the GST regime?

General | By Nikita Agarwal | Aug 9, 2017

Invoicing under the GST regime is itself a decisive part when it comes to any transaction’s execution. At the same time, it is the most i...

GST cess raised to 25 per cent – SUVs, luxury cars to cost more

News & FAQs | By Editor | Aug 9, 2017

Under the new tax regime, cars attract the top tax rate of 28 per cent, besides attracting a cess of 1-15 per cent in order to create ...

Timeline for filing of GST returns notified by the Government

News & FAQs | By Editor | Aug 9, 2017

The government has notified the timeline for furnishing final tax returns for July and August under the Goods and Services Tax (GST) regi...

50 probable questions that Investors ask Start-ups

Corporate Law & Intellectual Property Rights | By CS Niladree Chakraborty | Aug 7, 2017

Overview Almost every startup today intends to get investment from Angel Investors, Venture Capitalists, etc., however, less than ...

E-way rules may be finalized tomorrow by the GST Council

News & FAQs | By Editor | Aug 5, 2017

The GST Council is likely to lower tax rate tomorrow on job works making fabric to garments to 5 per cent and put in place a mechanism fo...

Furnishing of bonds/letter of undertaking on export of services – Why Govt needs to re-visit?

GST & Other Indirect Taxes | By Dipanjali Chakraborty | Aug 5, 2017

There has been a strong public outcry with respect to the requirement of furnishing bonds/letter of undertaking (LUT) for export of servi...

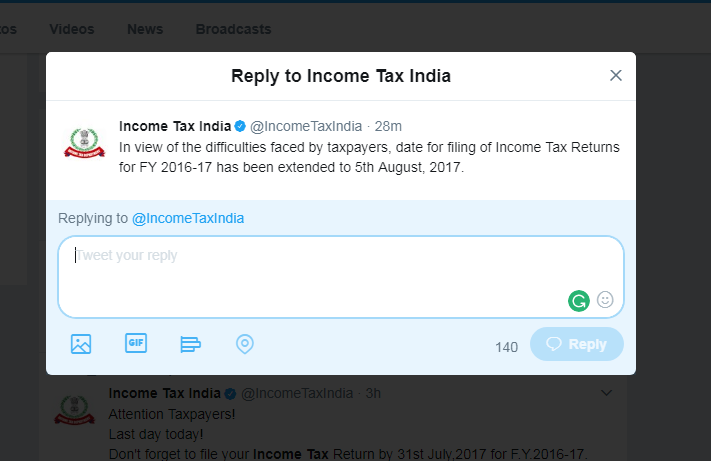

Income Tax Return filing due date extended to 5th August, 2017

News & FAQs | By Editor | Jul 31, 2017

The last date for filing of income tax returns (ITRs) for the financial year 2016-17 has been extended to August 5. The original deadline...

E-way bill floor may be raised from Rs. 50000 to prevent harassment to business

News & FAQs | By Editor | Jul 31, 2017

The Rs 50,000 threshold for e-way bills under the goods and services tax (GST) regime may be raised in order to reduce the scope for hara...

Billing cycle of telecom delayed due to GST

News & FAQs | By Editor | Jul 31, 2017

A section of postpaid users and corporate customers are getting their monthly mobile bills late as big phone companies are struggling to ...

Subdued demand may force relook at GST composition scheme

News & FAQs | By Editor | Jul 31, 2017

With just about one lakh of 70 lakh businesses opting for GST Composition Scheme, tax authorities are reviewing why the scheme that allow...

Toll Free:

Toll Free:  Contact Us

Contact Us