Direct Taxes (including International Taxation)

Delhi HC allows additional depreciation to FM Radio Station

Direct Taxes (including International Taxation) | By Editor | Feb 5, 2016

In a judgment in the case of CIT v. Radio Today Broadcasting Ltd. [2015], Delhi High Court allowed additional depreciation to FM Radio St...

Women equalises with men SHE can now be a Karta

Corporate Law & Intellectual Property Rights | By Editor | Feb 1, 2016

When it comes to equality, even the Court is bound to give a landmark judgment. A suit was filed by the eldest daughter of a business fam...

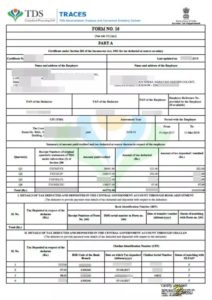

All about Form 16 – FAQs

Direct Taxes (including International Taxation) | By Editor | Jan 8, 2016

What is Form 16? Form 16 is the final certificate issued by your employer giving details of the salary you have earned and the tax...

Optimum Salary Structure for maximum Tax Benefits

Direct Taxes (including International Taxation) | By Editor | Jan 8, 2016

An optimum salary structure can be defined as the salary structure from which an employee derives the maximum Tax Benefits. We all face t...

E- file your Tax Appeal before Commissioners

Direct Taxes (including International Taxation) | By Editor | Dec 31, 2015

E- file your Tax Appeal before Commissioners In order to reduce the compliance burden, Revenue department on 30th December,2015 made c...

CBDT to opt better way of selection of scrutiny cases

Direct Taxes (including International Taxation) | By Editor | Dec 9, 2015

CBDT to opt better way of selection of scrutiny cases One more step Income Tax Department has taken to be more tech savvy. After t...

Early IT Refund for non CASS and less than Rs. 50000 cases

Direct Taxes (including International Taxation) | By Editor | Dec 7, 2015

Early IT Refund for non CASS and less than Rs. 50000 cases With every month as tax season and the average income tax refund increa...

E-mail may now pop-up with notices from Income Tax Department

Corporate Law & Intellectual Property Rights | By Editor | Dec 5, 2015

E-mail may now pop-up with notices from Income Tax Department Income Tax department is becoming more tech savvy. CBDT vide notification ...

Restrictions of Tax Authorities to attach Cash Credit Account to recover tax dues

Direct Taxes (including International Taxation) | By Editor | Nov 18, 2015

Restrictions of Tax Authorities to attach Cash Credit Account to recover tax dues Fiscally challenged, the government is frantically expl...

Seek easy exemption from TDS on interest: File Form 15G/H electronically

Direct Taxes (including International Taxation) | By ALOK PATNIA | Oct 6, 2015

Seek easy exemption from TDS on interest: File Form 15G/H electronically The CBDT has simplified the procedure for filing of self decla...

Better sense prevailed- Due Date extended till 31st October for all

Direct Taxes (including International Taxation) | By ALOK PATNIA | Oct 1, 2015

Better sense prevailed- Due Date extended till 31st October for all After a one month continuing persuasion by whole of taxation f...

CBDT extends due date for filing of return till 31st October for P&H and Gujarat

Direct Taxes (including International Taxation) | By ALOK PATNIA | Oct 1, 2015

CBDT extends due date for filing of return till 31st October for P&H and Gujarat Against all hopes, today CBDT extended due da...

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us