- What is Form 16?

Form 16 is the final certificate issued by your employer giving details of the salary you have earned and the tax deducted on your behalf and paid to the government. For example, if a TDS of Rs 2,332 and health and education cess of Rs 68 are deducted from your April salary, Form 16 details the same. Your employer should hand it over to you by 15th June each year.

Talk to us for any query on Income Tax: India Tax and Legal Compliance

- What is Form 16A and how is it different from Form 16?

If you are not a salaried employee and work as a professional for an organization and earn contractual/ professional/ other fees based on services rendered and invoices raised, then you get Form 16 A that shows TDS details deducted from the payments made to you.

The difference between Form 16 and Form 16 A is that Form 16 shows TDS details for a salaried-employee whereas Form 16 A shows the TDS details other than for a salaried-employee.These FAQ’s on Form 16 resolves the doubts of individuals.

- How are these forms generated?

These forms shall be generated by TDS CPC on processing the quarterly TDS / TCS statements filed by deductor. Deductor will have to raise a request for the same on TRACES. Deductor shall have the option to digitally sign the certificates.

- What is the due date for the issue of these certificates?

|

Sr. No. |

Form |

Periodicity |

Due Date |

|

1 |

16 |

Annual |

By 15th day of June of the financial year immediately following the financial year in which the income was paid and tax deducted |

|

2 |

16A |

Quarterly |

Within fifteen days from the due date for furnishing the statement of tax deducted at source under rule 31A |

- What should I do if I am not getting Form 16 from TRACES?

Ensure that you have filed Form 24Q for Quarter 4 with Annexure II. It is mandatory to file Annexure II giving actual particulars for the entire financial year, as Form 16 is generated on the basis of information provided in Annexure – II.

- How are the particulars of those employees who are employed with more than one employer in a financial year to be shown in Form 16?

The employee should declare previous salary and TDS details, if any, with the current employer and the same should be considered by the current employer while deducting TDS on salary and issuing Form 16.

- What are the details available in TDS certificate (Form 16 / 16A)?

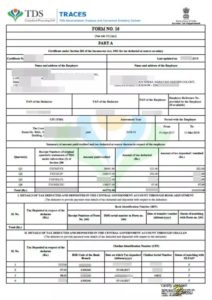

Form 16 is a user-friendly document. It has two sections, ‘PART A’ & ‘PART B’.

Part ‘A’ has the details like:

- Employee’s name & address

- Employer’s name & address

- PAN no and TAN no (Tax deduction account number)of your employer (the Deductor)

- PAN details of employee

- Assessment Year (the year in which your tax liability is calculated for the income earned in the previous year. )

- Part A provides the summary of TDS deductions. (This summary can be quarterly / monthly basis or on the periodicity of how your employer deducts TDS and credits the tax to the IT department)

- This section also gives you details about the ‘period of employment’. (If you have worked for two or more companies in a financial year, you will have multiple form 16s)

Part ‘B’ has the details like:

- Income Chargeable under the head of ‘Salary’. (Includes salary – Allowances and deductions (like LTA /HRA / Professional tax etc)

- Gross Income is Salary income + any other income reported by you. (Other income can be negative income i.e. loss from your house property or capital gains etc.,)

- Next, deductions Under Sections 80c / 80 CCC / 80 CCD are provided. (The maximum limit is Rs 1.5 Lakh)

- Then the deductions under other sections such as 80D(health insurance premium), 80E (interest on education loan), 80G (donations), and others are provided. (You would have submitted investment proofs for claiming tax deductions to your employer, these tax deductions are listed here)

- The totals of qualifying deductions(Aggregate of deductible amounts under Chapter VI A) are reduced from your Gross Incometo arrive at the ‘Taxable Income’ . Tax is calculated on this amount based on your tax slab.

- If TDS is deducted by your employer, this amount is subtracted from your total tax liability. The net tax amount can be nil (or) some tax amount payable (or) refund. (The balance, if negative, is your refund amount)

Form 16 A is issued under Section 203 of Income Tax Act, 1961 and contains the following particulars:

- Name, PAN no and TAN no of the Deductor.

- Name and PAN no of the Deductee.

- Nature of payment, amount paid and the date of the payment.

- Receipt no of the TDS payment.

- Even if no taxes have been deducted from salary, is there any need for my employer to issue Form 16 to me?

Form is a TDS Certificate and in your case it will not apply. However your employer must issue a salary statement.

- Do I have to attach Form 16 while filing income tax return?

As per the IT department rules, it is not necessary to attach the original Form 16 to your income tax returns. However, in your interest, you could attach a photocopy of Form 16 while retaining the original with yourself.

- What if the figures in the Form 16 are wrongly mentioned?

Tally the figures in Form 16 with the tax declaration statement provided to you at the beginning of the year. It’s possible that the figures mentioned are either wrong, or not considered at all. The result would be that fewer deductions would have been shown, resulting in higher tax liability. You might not have submitted the proofs of all investments, or could have forgotten to submit the bills. If it’s an employer mistake, ask him to rectify it and issue a revised Form 16. While filing the tax return, refund, if any, can be claimed.

- What if I cannot get Form 16 from my previous employer at the time of joining?

Your best option then is to fill Form 12B (refer Rule 26A) and submit it to your new employer. The employer will take into account the previous salary you earned while deducting tax.

- I have not received TDS certificate from my employer. Can I claim TDS deducted from my salary?

Yes. The claim can be made in your return. Department, however, will raise a demand which will not be enforced on you but on your employer.

- If a deductee comes back stating that the original TDS certificate is lost, can a duplicate certificate be issued?

Yes. Deductor will have to issue the duplicate certificate.

- Can deductor download Form 16 without being registered on TRACES?

No, only registered user (deductor) on TRACES can download Form 16 / 16A.

- Can I make any changes in the certificate generated by TDS CPC?

The certificates shall be generated in PDF format, therefore they are not editable. Deductor is thereby not permitted to make changes to these certificates. If any error is identified in the certificate, deductor will have to file a correction statement for the same.

- Can Form 16 (Part A) / Form 16A be issued manually?

No. Only the Form 16 (Part A) / Form 16A downloaded from TRACES are considered as valid TDS certificates, as per CBDT circular 04/2013 dated 17th April, 2013.

- What other particulars should be checked in Form 16?

Apart from your personal particulars and details of amount of income and TDS deducted, the most important thing you need to confirm in Form 16 is the PAN number. If it is wrong, you have to ask your employer to rectify it and give you a new Form 16. Besides, the employer needs to make a correction at their end by filing revised return of TDS to credit the TDS proceeds to the correct PAN number.

- If I am receiving my pension through a bank who will issue Form 16 or pension statement to me – the bank or my former employer?

The bank will issue Form 16.

- While submitting request to download Form 16 / 16A, deductor has entered details correctly in Part 1 and Part 2 in validation details screen, yet it shows error as ‘Invalid Details’ in Part 1 and Part 2. What should deductor do?

Details to be filled in validation screen should be exactly the same as reported in the TDS statement. If you have filed any correction statement, Token Number and other details should be as per the latest correction statement.

- I am unable to download Form 16 / 16A as the number of PANs for which Form 16 / 16A were submitted was higher, however the PDFs generated were less. What should I do?

Check the status of the PANs for which Form 16 / 16A has not been generated. These PANs might be with inactive status or not present in the TDS statement filed.

- What is the password for opening Form 16 / 16A text file?

The password for opening Form 16 / 16A will be your TAN in capital letters, i.e., AAAA11111A.

- Registered user on TRACES has updated the communication and address details on TRACES. However while downloading Form 16A, it shows a different address. How can deductor edit address details in Form 16A?

Details updated in ‘Profile’ section of your TRACES account will be saved only in TRACES and will not be updated in TAN database. To change details in TAN database, submit TAN change request form (Form 49B) at www.tin-nsdl.com.

- If I have received Form 16 and Form 16A, do I have to file an income tax return?

The income tax department requires that a return of income must be submitted where your gross total income exceeds Rs 2, 50,000 in the financial year. Therefore, even though TDS may have been fully deducted from your income, Form 16 may or may not have been issued; you must file an income tax return if your income exceeds the specified limit.

- What is Form 12 BA?

Form 12BA is a statement showing particulars of perquisites, other fringe benefits or amenities and profits in lieu of salary thereof granted by your employer to you during the year. Perquisites (or perks) are additional monetary / non-monetary benefits that you may have been granted throughout the year like rent free accommodation, interest free or concessional loans, etc. Profits in lieu of salary means any payment due to or received by you from your employer in connection with or at the time of termination of employment or modification in terms and conditions relating thereto like gratuity, pension, etc. The form also confirms the amount of tax deducted from your salary and paid into the Government Treasury by your employer. The statement should also contain declaration from the employer that the figures stated in the form are correct and accurate as per their books of accounts.

- Is your tax-return replica of your Form 16?

It’s incorrect when you think that you have to only copy paste the stuff from your Form 16 into your tax return. If you have earned any income during the year which has not been reported to your employer (eg bank interest), certainly the same will not be reflected in your Form 16 but should form part of your tax return. Similarly, you may have made certain tax saving investments at the end of the year (in March) which would not be reflected in your Form 16. Benefit of the same can be availed in the tax return even if not reflected in your Form 16.

- Can you confirm the amount of TDS deposited by your employer in your name?

Yes by checking your Form 26AS available on the website www.incometaxindiaefiling.gov.in.

_____________________________________________________________________________________________________________________________________

We’re listening:

For any query, support or feedback, reach us at Taxmantra CFO Advisory Services or Call/WA us at +91-9230033070 for any support/query/feedback.

___________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________________

In these troubled times -COVID-19, we, at Taxmantra Global urge you to stay safe – social distancing, personal hygiene and health care are of utmost importance! Stay safe!

__________________________________________________________________________________________________________________________

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us