Direct Taxes (including International Taxation)

Budget 2019 – All about tax sops to individual tax payers

Direct Taxes (including International Taxation) | By ALOK PATNIA | Feb 1, 2019

Finance Union Minister Piyush Goyal on Friday presented the much awaited Interim Budget in Lok Sabha. It is the last budget of the NDA Go...

Key Highlights of the Interim Budget 2019 – What is in store for the middle class, farmers and St...

Direct Taxes (including International Taxation) | By ALOK PATNIA | Feb 1, 2019

The Interim Budget 2019 was presented today by the Union Minister Piyush Goyal. The major game-changers of this Budget revolved around in...

Non-Filers Asked To Submit Income Tax Returns Within 21 Days

Direct Taxes (including International Taxation) | By ALOK PATNIA | Jan 23, 2019

If you haven’t filed your income tax return yet, you have few days left to do so to avoid legal proceedings. Individuals who have n...

Angel tax: the latest DIPP notification demystified for startups, investors

Direct Taxes (including International Taxation) | By ALOK PATNIA | Jan 18, 2019

Credit: YourStory Amid several calls from startups for abolishing angel tax and media reports that the government may water down angel ta...

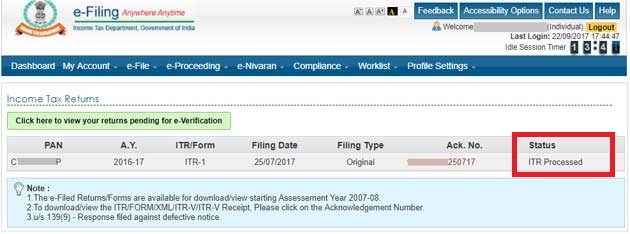

Income Tax return processing time to reduce from 63 days to just 1 day

Direct Taxes (including International Taxation) | By ALOK PATNIA | Jan 18, 2019

Credit: Economic Times The Union Cabinet on Wednesday approved an integrated income-tax e-filing and centralised processing centre (CPC) ...

Brokerages set up shop in Daman to avail tax exemption

Direct Taxes (including International Taxation) | By ALOK PATNIA | Jan 18, 2019

The Union Territory of Daman and Diu is emerging as a hub for Indian brokerages thanks to a favorable tax law. The region with less than ...

Income Tax Exemption Threshold May Go Up In Interim Budget

Direct Taxes (including International Taxation) | By ALOK PATNIA | Jan 15, 2019

Finance Minister Arun Jaitley may double the income tax exemption threshold for the salaried from the present Rs. 2.5 lakh to Rs. 5 lakh ...

An India Singapore Corporate Tax comparison – What to expect when you start your business i...

Corporate Law & Intellectual Property Rights | By ALOK PATNIA | Jan 14, 2019

Credit: Business Setup Worldwide As one of the fastest-growing economies in the world with its recent economic reforms, India present...

No TDS for long-term property lease premium, rules Mumbai’s Income-tax Appellate Tribunal

Direct Taxes (including International Taxation) | By ALOK PATNIA | Jan 11, 2019

BoI paid MMRDA the lease premium and additional premium for FSI (floor space index) along with interest and fee for delay in the construc...

After quota for general category, govt likely to announce tax, housing loan exemption for middle ...

Direct Taxes (including International Taxation) | By ALOK PATNIA | Jan 9, 2019

A day after the Narendra Modi government played a masterstroke to woo the upper castes by announcing 10 per cent reservation in jobs, the...

Income Tax department withdraws circular on transfer of shares for ‘no or inadequate consideration

Direct Taxes (including International Taxation) | By ALOK PATNIA | Jan 7, 2019

Photo Credit: Financial Express The Income Tax Department has withdrawn a four-day old circular relating to transfer of shares for “n...

Finance and Accounting – Change of Role Needed in Growth Story of Business Entities

Corporate Law & Intellectual Property Rights | By ALOK PATNIA | Jan 2, 2019

Finance and Accounting have traditionally been identified as leaders in providing information for the management of performance of variou...

Toll Free:

Toll Free:  Contact Us

Contact Us