News & FAQs

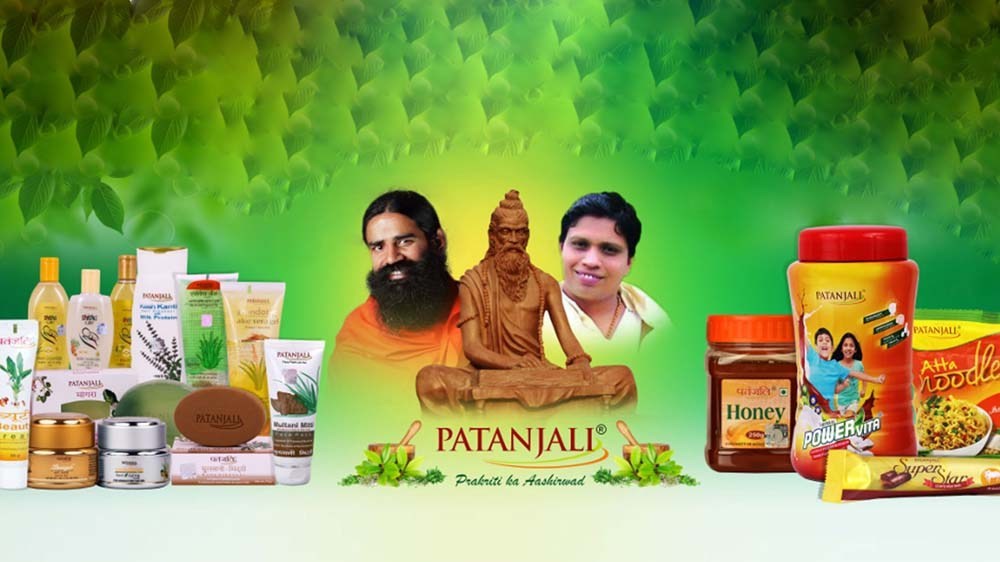

Patanjali distributors under anti-profiteering lens for not passing GST benefits

GST & Other Indirect Taxes | By ALOK PATNIA | Mar 1, 2019

Patanjali Ayurved distributors have come under the lens of National Anti-profiteering Authority (NAA) for not passing on lower GST rate b...

Realtors seek clarity on GST exemption on development rights

GST & Other Indirect Taxes | By ALOK PATNIA | Mar 1, 2019

Realty developers are seeking clarity on recent exemption offered from the goods & services tax (GST) levied on development rights, i...

10,000 penalty for non filing of E-Form Active

Corporate Law & Intellectual Property Rights | By Soumik Kumar Sen | Feb 22, 2019

MCA has recently modified the Incorporation Rules. Now any company which was incorporated before 31st December, 2017 has to file E-Form A...

GST Council Likely To Meet Next Week To Discuss Cement Rate Cut

GST & Other Indirect Taxes | By ALOK PATNIA | Feb 14, 2019

The GST Council is likely to meet on February 20 to discuss a proposal to slash tax on cement to 18 per cent from 28 per cent and also co...

Qatar seeks inclusion of natural gas in GST

GST & Other Indirect Taxes | By ALOK PATNIA | Feb 11, 2019

India’s largest LNG supplier Qatar on February 10 urged the central government to include natural gas in GST to help create demand ...

Government favours cut in GST to 5% from effective rate of 12% for residential properties

GST & Other Indirect Taxes | By ALOK PATNIA | Feb 11, 2019

A Group of Ministers (GoM) formed to analyse tax rates and issues being faced by the real estate sector under the goods and services tax ...

CBDT chairman assures quick solution to startups’ tax issues

Direct Taxes (including International Taxation) | By ALOK PATNIA | Feb 8, 2019

The government may soon find a solution to address the tax concerns of startups, Central Board of Direct Taxes (CBDT) chairman Sushil Cha...

Filmmaking firm evades Rs 7.4 crore GST

GST & Other Indirect Taxes | By ALOK PATNIA | Feb 8, 2019

Sleuths of the anti-evasion wing of the Ranga Reddy GST Commissionerate have detected a major case of tax evasion by a filmmaking firm to...

Tax authorities to levy interest on cash, ITC component of GST paid after due date

GST & Other Indirect Taxes | By ALOK PATNIA | Feb 8, 2019

Tax authorities have made it clear that interest will be levied on both cash and input tax credit (ITC) component of GST paid after the p...

Gujarat HC strikes down restrictive provision for export sops under GST

GST & Other Indirect Taxes | By ALOK PATNIA | Feb 6, 2019

In a major relief for exporters, the Gujarat high court has struck down the constitutional validity of a provision under the goods and ...

Taxmen send notices to Wakf boards for non-payment of service tax and GST

GST & Other Indirect Taxes | By ALOK PATNIA | Feb 6, 2019

Tax officials have started sending out notices to various Wakf boards for not paying service tax and GST on rent received from properties...

Telcos seek GST waiver on payments to govt, Rs 35K-cr input credit adjustment

GST & Other Indirect Taxes | By ALOK PATNIA | Feb 5, 2019

Telecom firms, barring Reliance Jio, have asked the government to waive GST on spectrum payments and other levies, while adjusting accumu...

Toll Free:

Toll Free:  Contact Us

Contact Us