News & FAQs

Durga Puja Idol Makers finds GST a New ‘Demon’

GST & Other Indirect Taxes | By Nikita Agarwal | Sep 22, 2017

“Puja organisers are facing a serious challenge in the regime of the new demon — GST. Most of the big Pujas depend on sponsor...

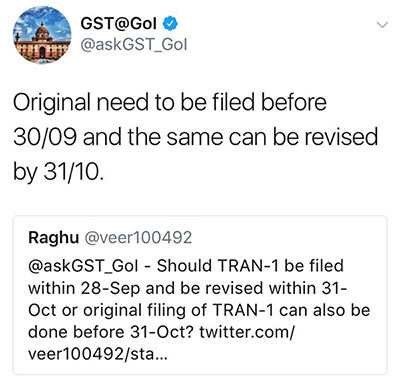

September 28 or October 31? When to file TRAN 01?

News & FAQs | By ALOK PATNIA | Sep 21, 2017

There seems to be complete confusion regarding the dates for filing of TRAN 1 as the decision taken by the GST Council during its 21st me...

No Further Extension in GSTR Filings

GST & Other Indirect Taxes | By Nikita Agarwal | Sep 18, 2017

The Government had advised the taxpayers to file the GST returns in advance and not to wait for any further extensions as no further exte...

Uttar Pradesh registers highest post-GST revenue growth in country

GST & Other Indirect Taxes | By Nikita Agarwal | Sep 18, 2017

Where most of the states have suffered a severe setback in the first month of the GST launch, Uttar Pradesh experienced a great start by ...

50,000 co-op housing societies in Mumbai and suburbs in GST regime

GST & Other Indirect Taxes | By Nikita Agarwal | Sep 18, 2017

As the annual collections (turnover) of the 70,000 co-operative housing societies (CHS) in the state, including 50,000 in the Mumbai Metr...

Good News for Petrol and Diesel under GST

GST & Other Indirect Taxes | By Nikita Agarwal | Sep 18, 2017

Finally petrol and diesel are out of the ambit of GST. Also, petrol and diesel prices are set to become cheaper under GST regime. Reporte...

Casual taxable persons making taxable supplies of handicraft goods exempted from registration und...

GST & Other Indirect Taxes | By Nikita Agarwal | Sep 16, 2017

In exercise of the powers conferred by sub-section (2) of section 23 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Ce...

CBEC Eyes on 162 Businesses who claimed Transitional Credit over 1 Crore

GST & Other Indirect Taxes | By Nikita Agarwal | Sep 16, 2017

The companies who claimed GST transitional credit of over Rs 1 crore, as more as 162 companies, are under the eyes of tax authorities for...

GST Panel set by Govt to examine profiteering complaints

GST & Other Indirect Taxes | By Nikita Agarwal | Sep 15, 2017

The Government has allowed consumers to file complaints against any irrational profit made by businesses by not passing on cost reduction...

Non – Resident Taxable Person In GST

GST & Other Indirect Taxes | By Nikita Agarwal | Sep 15, 2017

Introduction “Non-resident taxable person” means any person who occasionally undertakes transactions involving supply of goods or service...

Goods Transport Agency In GST

GST & Other Indirect Taxes | By Nikita Agarwal | Sep 15, 2017

Background of levying tax on the services of Goods Transport Agency The levy of Service Tax on Road Transportation Service has alw...

GST Official booked for taking Bribe

GST & Other Indirect Taxes | By Nikita Agarwal | Sep 13, 2017

An official of the GST Department got booked by the CBI for allegedly demanding the bribe from a businessman for processing his applicati...

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us