News & FAQs

Shops cheating in the name of GST – Decode the Bill

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 28, 2017

To collect GST from the consumers over the bill, one has to have registered under the GST with GSTIN number and the taxpayers having the ...

Teething problems persist among traders over GST

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 28, 2017

Although 25th August was the due-date for filing the GSTR 3B – for the taxpayers who does not has Form TRAN 1 applicable to them, ...

Is input tax credit available for tax paid on mobiles given to staff ?

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 28, 2017

The most common and hot topic in the present GST regime is Input Tax Credit. What are the scenarios where the ITC can be availed and how ...

Corporate Fears of Loosing ITC over GST Portal

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 28, 2017

With the August 28 (Monday) deadline looming for filing returns and ensuring GST compliance, corporate are deeply concerned about the GST...

10 lakh tax payers file GSTR-3B till 10 am today: Sources

GST & Other Indirect Taxes | By Editor | Aug 23, 2017

The government had extended the goods and services tax (GST) filing period from August 20 to August 25 and CNBC-TV18 learn from sources t...

Curious case of Kolkata’s GST registration surge

GST & Other Indirect Taxes | By Editor | Aug 23, 2017

The GST regime was widely expected to widen the tax base of the country. But it was unexpected that Kolkata and West Bengal will be front...

GST to benefit lower, lower-middle income class: Asian Development Bank

GST & Other Indirect Taxes | By Editor | Aug 22, 2017

The goods and services tax in India will benefit the lower and lower-middle income class as it is likely to reduce the tax rate on goods,...

Common legal phrases which are used in Agreements

Corporate Law & Intellectual Property Rights | By Soumik Kumar Sen | Aug 20, 2017

As a corporate law consultant, I have vetted and drafted various legal Agreements. Whether it’s a simple five-page Rent Agreement or a co...

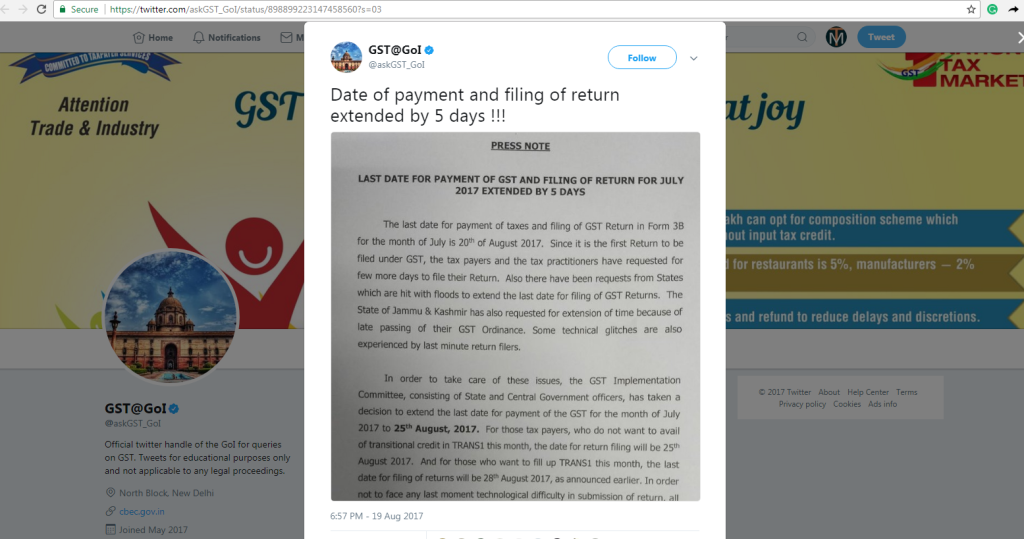

GSTR 3B filing due date extended by 5 days, due date now being 25th August, 2017

News & FAQs | By Editor | Aug 19, 2017

The GSTR 3B filing due date has finally been extended by 5 days. Since this is the first return and also the site has not been working si...

Employee Reimbursement under GST And RCM

GST & Other Indirect Taxes | By Nikita Agarwal | Aug 19, 2017

Reverse charge means the liability to pay tax is on the recipient of supply of goods or services instead of the supplier of such goods or...

GST portal stops functioning, fails to resume after ‘scheduled downtime’

General | By Editor | Aug 19, 2017

The GST website for filing returns is facing “issues” and services to the website has not been restored, throwing into disarray the retur...

Common use items exempt from e-way bill provision under GST

GST & Other Indirect Taxes | By Editor | Aug 18, 2017

LPG, kerosene, jewellery and currency are among the common use items that have been exempted from the requirement of obtaining electronic...

Toll Free:

Toll Free:  Contact Us

Contact Us