News & FAQs

GST cess raised to 25 per cent – SUVs, luxury cars to cost more

News & FAQs | By Editor | Aug 9, 2017

Under the new tax regime, cars attract the top tax rate of 28 per cent, besides attracting a cess of 1-15 per cent in order to create ...

Timeline for filing of GST returns notified by the Government

News & FAQs | By Editor | Aug 9, 2017

The government has notified the timeline for furnishing final tax returns for July and August under the Goods and Services Tax (GST) regi...

50 probable questions that Investors ask Start-ups

Corporate Law & Intellectual Property Rights | By CS Niladree Chakraborty | Aug 7, 2017

Overview Almost every startup today intends to get investment from Angel Investors, Venture Capitalists, etc., however, less than ...

E-way rules may be finalized tomorrow by the GST Council

News & FAQs | By Editor | Aug 5, 2017

The GST Council is likely to lower tax rate tomorrow on job works making fabric to garments to 5 per cent and put in place a mechanism fo...

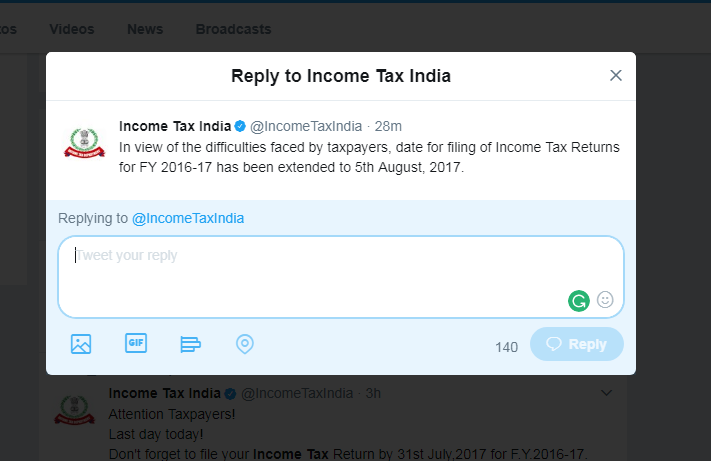

Income Tax Return filing due date extended to 5th August, 2017

News & FAQs | By Editor | Jul 31, 2017

The last date for filing of income tax returns (ITRs) for the financial year 2016-17 has been extended to August 5. The original deadline...

E-way bill floor may be raised from Rs. 50000 to prevent harassment to business

News & FAQs | By Editor | Jul 31, 2017

The Rs 50,000 threshold for e-way bills under the goods and services tax (GST) regime may be raised in order to reduce the scope for hara...

Billing cycle of telecom delayed due to GST

News & FAQs | By Editor | Jul 31, 2017

A section of postpaid users and corporate customers are getting their monthly mobile bills late as big phone companies are struggling to ...

Subdued demand may force relook at GST composition scheme

News & FAQs | By Editor | Jul 31, 2017

With just about one lakh of 70 lakh businesses opting for GST Composition Scheme, tax authorities are reviewing why the scheme that allow...

Small grocers signing up with wholesale majors abandoning unorganized trade

News & FAQs | By Editor | Jul 27, 2017

While last November’s demonetisation choked the cash-based unorganised retail trade in the country, the game-changing Goods and Services ...

Confusion for sweet makers – GST Impact

GST & Other Indirect Taxes | By Editor | Jul 27, 2017

Sweet makers are finding it difficult to decipher the taxation rates under GST. For example: Plain sandesh, which is a ‘sweet’...

Invoice uploading for businesses started in GST Portal

News & FAQs | By Editor | Jul 26, 2017

The GSTN portal has started accepting uploading of sale and purchase invoices of businesses generated post Goods and Services Tax rollout...

Refund of CGST on goods made in excise-free zones proposed

News & FAQs | By Editor | Jul 26, 2017

A proposal to refund central goods and services tax (GST) on items made in formerly excise-free zones in Himachal Pradesh, Uttarakhand an...

Toll Free:

Toll Free:  Contact Us

Contact Us