General

Registration requirement under GST

General | By CA Priyanka Agarwal | May 3, 2017

Goods and service tax is taking India by the storm. GST will bring uniformity in taxes to unite indirect taxes under one umbrella and ass...

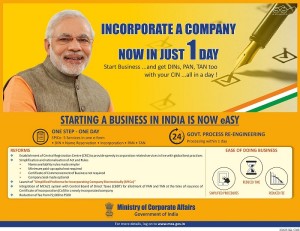

SPICe form- Register your Start-up in one day!

General | By Soumik Kumar Sen | Apr 27, 2017

In the endeavor to improve its global ranking in the ease of doing business Ministry of Corporate Affairs (MCA) has established Central R...

Possible Impact of GST on Real Estate Sector

General | By ALOK PATNIA | Apr 26, 2017

The biggest reform in the indirect tax regime is set to get implemented very soon. Instead of different types of taxes—central, state, ...

Filing of returns under the GST law

General | By ALOK PATNIA | Apr 13, 2017

Every taxable person registered under the GST Act has to furnish the details of sales/services provided, purchases/input services ...

How do you know if you are ready to startup – 8 things to consider

General | By ALOK PATNIA | Mar 24, 2017

Starting up your business is not a one-day hustle. It is not as glamorous as it often seems to be.7 out of 10 startups fail. Though there...

Why is it the right time to Startup

General | By CS Niladree Chakraborty | Feb 27, 2017

When should I startup? What should I startup? Where should I startup? These are the common questions which hovers a person’s mind ...

How to simplify bookkeeping for your business?

General | By Dipanjali Chakraborty | Feb 4, 2017

Startups and small business owners spend 12-14 hours a week on an average on book-keeping functions. Bookkeeping includes recording, orga...

The Startup India initiative – a very long way to go

General | By Editor | Jan 30, 2017

It has been a year now since Prime Minister Narendra Modi launched the Startup India scheme on the 16th of January, 2016. However, the re...

How to avoid 5 operational issues faced by an E-Commerce Business

General | By Editor | Jun 11, 2016

Internet revolution has given birth to different industries. Internet can be used for a number of operational purposes. E-Commerce is one...

Save taxes on payment made for medical treatment- 80DD

Direct Taxes (including International Taxation) | By ALOK PATNIA | Jan 19, 2011

The Income Tax Act provides the facility to an assessee being a resident individual or Hindu Undivided Family, of claiming deduction unde...

Reduce your taxes towards payment made for medical treatment – 80DDB

Direct Taxes (including International Taxation) | By ALOK PATNIA | Jan 18, 2011

Under the provision of Income Tax Act, a resident individual can claim deduction under section 80DDB for actual payment towards the medic...

Tax benefits on interest on education loan- 80E

Direct Taxes (including International Taxation) | By ALOK PATNIA | Jan 17, 2011

Under the provisions of section 80E of the Income Tax Act, 1961, an individual can claim deduction from total income, arrived at for comp...

Toll Free:

Toll Free:  Contact Us

Contact Us