GST & Other Indirect Taxes

Business with nil tax liability may get to file GST returns bi-annually

GST & Other Indirect Taxes | By ALOK PATNIA | Mar 26, 2018

Businesses having zero tax liability for six consecutive months under GST may soon get relief once the proposal to allow such entities to...

CBEC to verify GST transitional credit claims of 50,000 taxpayers

GST & Other Indirect Taxes | By ALOK PATNIA | Mar 20, 2018

In order to check “frivolous and fraudulent” tax credit claims by businesses, the CBEC has decided to verify demands of top 5...

Advisory to the Exporters filing for Refund

GST & Other Indirect Taxes | By ALOK PATNIA | Feb 20, 2018

a) Advisory to the Exporters for Refund of IGST Paid on Export of Goods: 1. File FORM GSTR 1 for the corresponding tax period. 2. Fill co...

CII urges government to bring oil, natural gas under GST

GST & Other Indirect Taxes | By ALOK PATNIA | Jan 17, 2018

Industry association CII has asked the government for inclusion of oil and natural gas in the new Goods and Services Tax (GST) regime at ...

GST on hotels and restaurants

GST & Other Indirect Taxes | By ALOK PATNIA | Jan 15, 2018

Fooding is one of those business segments which will never go “out of fashion”. According to the National Restaurant Association of Indi...

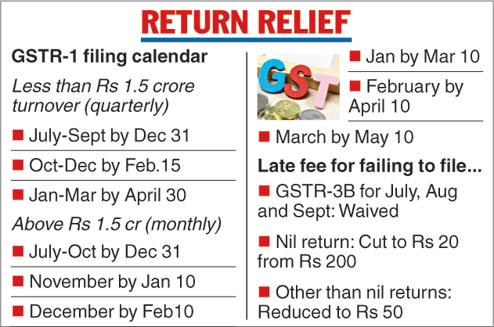

GST Compliances eased for taxpayers having upto Rs. 1.5 crore

GST & Other Indirect Taxes | By Dipanjali Chakraborty | Nov 11, 2017

The GST Council on Friday provided the much-needed relief to businesses by easing return filing requirements as well as lowering the pena...

Composition scheme receives huge boost after GST Council Meeting

GST & Other Indirect Taxes | By Dipanjali Chakraborty | Nov 11, 2017

The 23rd GST Council Meeting was held yesterday, on 10th November 2017. The meeting had some huge perks to offer – much needed ones...

How to file GSTR 2 – Beginner’s guide

GST & Other Indirect Taxes | By Editor | Oct 31, 2017

What is Form GSTR-2? GSTR-2 is the details of inward supplies of goods or services to be furnished by registered taxpayer on a monthly ba...

Is GST to be levied on ocean freight for imported goods?

GST & Other Indirect Taxes | By Dipanjali Chakraborty | Oct 30, 2017

Ocean freight on imported goods has always been a controversial topic in Indirect taxation regime. Even under Service Tax, the issue was ...

Exporters to get GST refunds in bank accounts filed with customs

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 15, 2017

The government has decided to give goods and services tax (GST) refunds to exporters in the bank accounts they have filed with the custom...

Appeal to reduce GST by Builders Association of India (BAI)

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 11, 2017

The Builders Association of India (BAI) on Sunday urged the Central and State governments to reduce Goods and Service Tax (GST) from 12 t...

This is how fireworks makers are avoiding payment of higher GST

GST & Other Indirect Taxes | By ALOK PATNIA | Oct 11, 2017

In Sivakasi, it is easy to buy crackers without a bill or with an unsigned invoice A section of fireworks industry spread over Virudhun...

Toll Free:

Toll Free:  Contact Us

Contact Us