The GST Council on Friday provided the much-needed relief to businesses by easing return filing requirements as well as lowering the penalty for late filing. Since the inception of this landmark law, it has been fraught with controversies. High rates of taxes, too many returns, too high penalties and late fine were some of the real roadblocks to the implementation of this regime. Time and again, the Govt has tried to simplify the processes, exempt the penalties and extended the due dates. This spirit of encouragement seemed to echo through the Council Meeting yesterday. Small businesses with turnover of less than or upto Rs. 1.5 crores would be largely benefitted by these measures.

Here are the key reliefs for businesses upto a turnover of Rs. 1.5 crores that were announced:

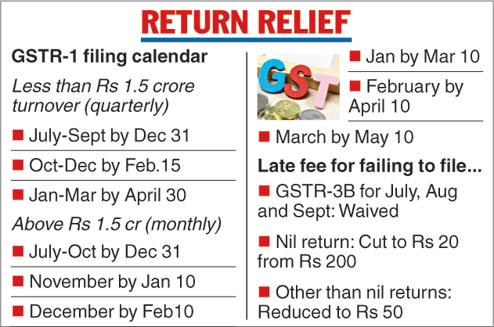

i) Tax payers with annual turnover of up to Rs 1.5 crore will have to file GSTR-1 return quarterly

ii) Late filing charges have been drastically cut down. Late fee for NIL returns will be charged at Rs 20 per day while normal late returns will be charged Rs 50. Earlier the charge was Rs 200 per day irrespective.

In cases where such late fee were paid, it has been decided that the same will be re-credited to the Electronic Cash Ledger under “Tax” head instead of “Fee” so as to enable users to use that amount to discharge their future tax liabilities. However, software changes for this decision are yet to be made. Once the same has been made, this will be implemented.

iii) The council has also waived the late fee on those who could not file GSTR-3B within due date for the months of July, August and September.

iv) GSTR 2 and 3 for the FY 17-18 have been waived. Now, such small businesses are no longer required to file the same for the FY 17-18.

v) Instead of that GSTR 3B would have to be filed alongwith payment of tax by 20th of succeeding month till March 2018.

vi) Filing of GSTR 1 will be quarterly for the above businesses:

| Period | Dates |

| July – Sep | 31.12.2017 |

| Oct – Dec | 15.02.2018 |

| Jan – Mar | 30.04.2018 |

vii)Tax payers below the turnover of Rs 1.5 crore will have to file the returns of July-Sept by December 31, 2017. Returns for the month Oct-Dec to be filled by Feb 15, 2018 and for Jan-March, returns to be filed by April 30, 2018.

viii) A 40-days period for filing of invoices has been recommended. Invoices of November 2017 to be filled by January 10, 2018 while for December and January, Feb 10 and March 10 respectively.

ix) A facility for manual filing of application of advance ruling is being introduced for the time being.

x) Another huge relief came for the e-commerce service providers. Now, even e-commerce players. Now, if their turnover does not exceed Rs. 20 lakhs, they would not be required to obtain a GST registration. Previously, ecommerce operators were an exception to the threshold limit. This is a highly anticipated move and would be of a huge help to startups and small businesses.

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance.

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us