GST & Other Indirect Taxes

GST Portal Goes Live: Things To Be Aware of Before Getting Enrolled

GST & Other Indirect Taxes | By Dipanjali Chakraborty | Dec 21, 2016

With the new GST portal going live, the enrollment drive for existing taxpayers registered under Central Excise Duty, Service Tax and Sta...

Now Pay Service Tax on Websites and Servers Hosted Abroad

GST & Other Indirect Taxes | By Rahul Agarwalla | Dec 16, 2016

Now Pay Service Tax on Websites and Servers hosted abroad as service tax has been levied on import of online information and database acc...

All You Need To Know About GST – FAQs

GST & Other Indirect Taxes | By Dipanjali Chakraborty | Dec 8, 2016

The Government is eager to roll-out the Goods and Services Tax (GST) – the biggest indirect tax reform in the history of our...

Would GST mark an end of Black Money era?

GST & Other Indirect Taxes | By Editor | Aug 17, 2016

The Goods and Services Tax (GST) regime will weed out black money and usher in an effective taxation system in India. GST is the biggest ...

10 things which you can’t miss about Goods and Service Tax (GST)

GST & Other Indirect Taxes | By Editor | Aug 12, 2016

Goods and Service Tax (GST) is by far one of the most awaited tax reform brought in our country. The Government is likely to push the i...

How will GST impact your E-commerce Business?

GST & Other Indirect Taxes | By Editor | Aug 11, 2016

The implementation of GST is excepted to usher in a uniform tax regime and bring some clarity to indirect taxation in the E-commerce se...

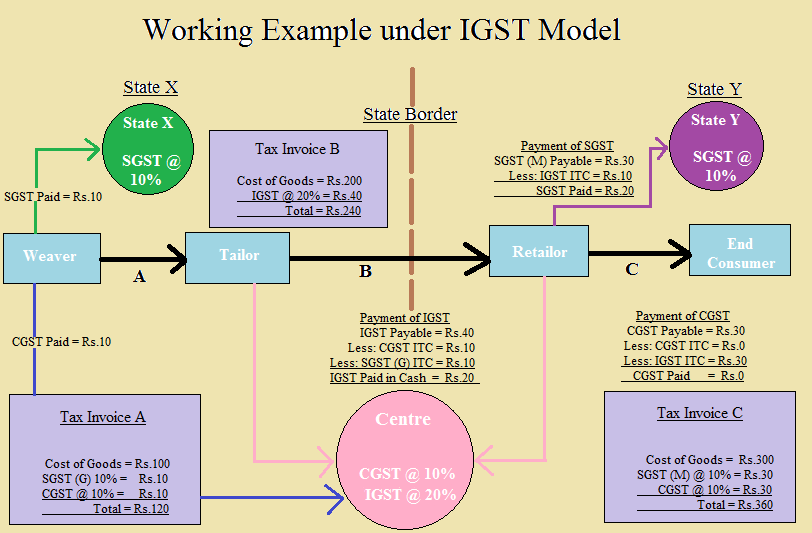

GST reduces the tax burden for the Manufacturers, Wholesalers and Retailers

GST & Other Indirect Taxes | By Editor | Aug 10, 2016

Indirect tax in India has driven businesses in restructuring and modelling their supply chain systems owing to multiplicity of taxes and ...

FAQs on Goods & Service Tax

GST & Other Indirect Taxes | By ALOK PATNIA | Aug 5, 2016

On June 14, 2016, the Central Government had put the Draft Model GST Law on public domain after getting in-principle nod from the Empower...

Are you aware of the 5 mandatory compliances for your business

Direct Taxes (including International Taxation) | By Dipanjali Chakraborty | Jul 11, 2016

Do you know that every 2nd Startup gets Income Tax Notice for tax demands or for non-compliance, 3 out of 7 Startups finds place on t...

Did you know what the MVAT Amnesty scheme holds for you?

GST & Other Indirect Taxes | By ALOK PATNIA | Jun 22, 2016

VAT Amnesty Scheme – a benefit for traders & merchants: Many traders & merchants got affected by riots in India & prope...

How reforms in existing VAT system can boost the growth of businesses

GST & Other Indirect Taxes | By ALOK PATNIA | Jun 20, 2016

Value-added taxation in India was introduced on 1st April, 2005 at State level. It is said that VAT is a better system that sales tax on ...

How Service Tax became the major source of Govt Revenue

GST & Other Indirect Taxes | By Editor | Jun 2, 2016

Service Tax is the most talked about thing in the ecosystem right now. Just after the Swachh Bharat Cess, tax payers were further burdene...

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us