The Government is eager to roll-out the Goods and Services Tax (GST) – the biggest indirect tax reform in the history of our Constitution with effect from 01 April 2017. The journey to roll out GST has commenced with the enactment of the 101st Constitution Amendment Act, 2016 on 8th September, 2016 and subsequent notification of GST Council on 15th September, 2016. The introduction of GST will not only include comprehensively more indirect Central taxes and integrate goods and services taxes for set-off relief, but also capture certain value addition in the distributive trade. One of the biggest challenges is to get acquainted with the concepts, processes and procedures of GST. This FAQ will provide an insight analysis to public to get acquainted with the Model GST law and its nuances.

1. What is Goods and Service Tax (GST)?

→ GST is a single indirect tax for the whole country, which will make India one united common market. GST is a single tax on the supply of goods and services, right from the manufacturer to the consumer. The Input Tax credit paid at each stage will be available in the subsequent stage of value addition, which makes GST essentially a tax only on value addition at each stage. It is the end consumer who will bear only the GST charged by the last dealer in the supply chain, with set-off benefits at all the previous stages. However with the streamlining of the multiple taxes, the final cost to the consumer will turn out to be low because of elimination of double charging system.

2. Which of the existing taxes are proposed to be engrossed under GST?

→ Central Taxes – Following Central taxes will be subsumed under GST:

- Central Excise Duty

- Additional Duties of Excise (Goods of Special Importance)

- Excise duty levied under Medicinal & Toilet Preparations (Excise Duties) Act, 1955

- Duties of Excise (Medicinal and Toilet Preparations)

- Additional Duties of Customs (commonly known as CVD)Special Additional Duty of Customs (SAD)

- Service Tax

- Surcharge and Cess levied by Centre so far as they relate to supply of goods and services

→ State Taxes – Following State taxes will be subsumed under GST:

- Central Sales Tax

- State VAT

- Luxury Tax

- Entry Tax and Octroi (all forms)

- Entertainment and Amusement Tax (except when levied by the local bodies)

- Taxes on lotteries, betting and gambling

- Purchase Tax

- State Surcharges and Cesses so far as they relate to supply of goods and services

Note:

- Alcoholic beverages for human consumption are proposed to be kept out of the purview of GST

- GST on petroleum products would be levied from a notified date recommended by the GST Council

→ Taxes not to be subsumed:

- Basic Customs Duty

- Export Duty

- Toll Tax

- Road and Passenger Tax

- Electricity Duty

- Stamp Duty

- Property Tax

3. How GST will operate simultaneously under Central GST (CGST) and State GST (SGST)?

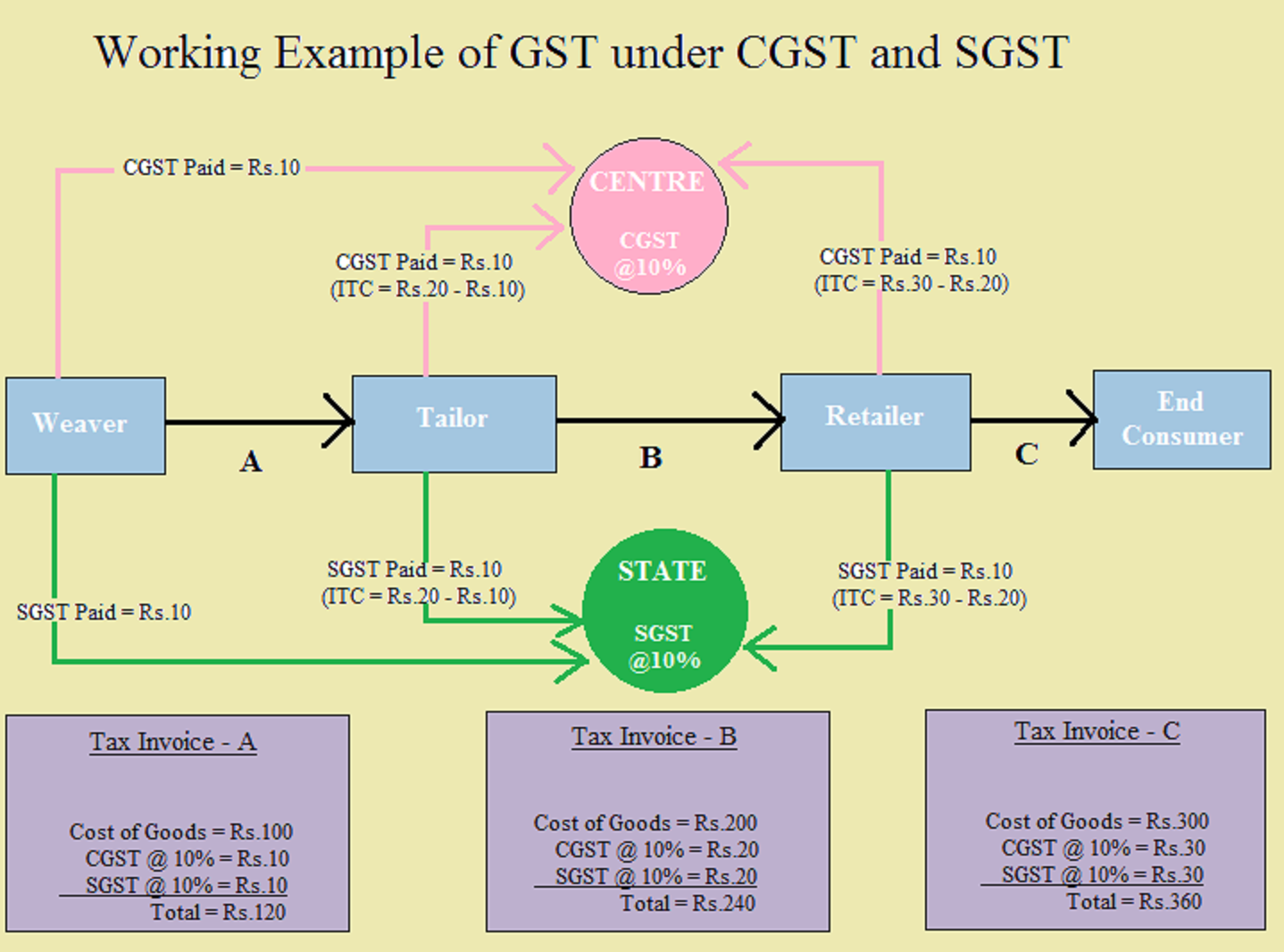

→ The Central GST and the State GST would be levied simultaneously on every transaction of supply of goods and services except on exempted goods and services, goods which are outside the purview of GST and the transactions which are below the prescribed threshold limits. Further, both would be levied on the same price or value unlike State VAT which is levied on the value of the goods inclusive of Central Excise.

The following diagram will explain the working of the dual GST model:

4. How GST will operate under Integrated GST (IGST) ?

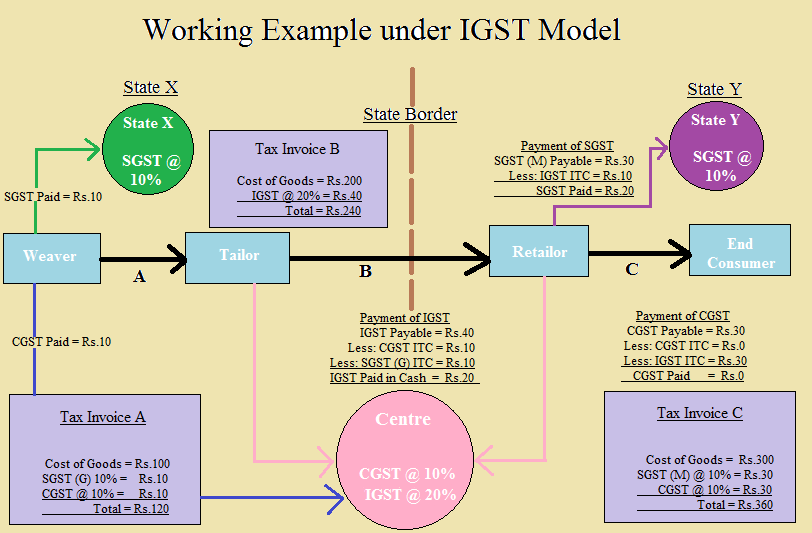

→ In case of inter-State transactions, the Centre would levy and collect the Integrated Goods and Services Tax (IGST) on all inter-State supplies of goods and services. The IGST would roughly be equal to CGST plus SGST. The IGST mechanism has been designed to ensure seamless flow of input tax credit from one State to another. The inter-State seller would pay IGST on the sale of his goods to the Central Government after adjusting credit of IGST, CGST and SGST on his purchases (in this particular order). The exporting State will transfer to the Centre the credit of SGST used in payment of IGST. The importing dealer will claim credit of IGST while discharging his output tax liability (both CGST and SGST) in his own State. The Centre will transfer to the importing State the credit of IGST used in payment of SGST. Since GST is a destination-based tax, all SGST on the final product will ordinarily accrue to the consuming State..

The following diagram will explain the working IGST model for inter- State transactions:

5. Will cross utilization of credits between goods and services be allowed under GST regime?

→ Cross utilization of credit of CGST between goods and services would be allowed. Similarly, the facility of cross utilization of credit will be available in case of SGST. However, the cross utilization of CGST and SGST would not be allowed except in the case of inter-State supply of goods and services under the IGST model.

6. What are the benefits of GST?

→ Following are the benefits of GST to different sectors :

For business and industry :

- Uniformity of tax rates and structures : GST ensure that indirect tax rates and structures are common across the country, thereby increasing certainty and ease of doing business. In other words, GST would make doing business in the country tax neutral, irrespective of the choice of place of doing business.

- Compliance Friendly : A robust and comprehensive IT system would be the foundation of the GST regime in India. Therefore, all tax payer services such as registrations, returns, payments, etc. would be available to the taxpayers online, which would make compliance easy and transparent.

- Removal of cascading system : A system of seamless tax-credits throughout the value-chain, and across boundaries of States, would ensure that there is minimal cascading effect of taxation. This would reduce hidden costs of doing business.

- Gain to manufacturers and exporters : The subsuming of major Central and State taxes in GST, complete and comprehensive set-off of input goods and services and phasing out of Central Sales Tax (CST) would reduce the cost of locally manufactured goods and services. This will increase the competitiveness of Indian goods and services in the international market and give boost to Indian export industry. The uniformity in tax rates and procedures across the country will also go a long way in reducing the compliance cost.

For Central and State Governments :

- Simple and easy administration : Multiple indirect taxes at the Central and State levels are being replaced by GST. Backed with a robust end-to-end IT system, GST would be simpler and easier to administer than all other indirect taxes of the Centre and State levied so far.

- Higher revenue efficiency : GST is expected to decrease the cost of collection of tax revenues of the Government, and will therefore, lead to higher revenue efficiency.

- Better controls on leakage : GST will result in better tax compliance due to a robust IT infrastructure. Due to the seamless transfer of input tax credit from one stage to another in the chain of value addition, there is an in-built mechanism in the design of GST that would incentivize tax compliance by traders.

For the consumer :

- Relief in overall tax burden : Because of efficiency gains and prevention of leakages, the overall tax burden on most commodities will come down, which will benefit consumers.

- Single and transparent tax proportionate to the value of goods and services : Due to multiple indirect taxes being levied by the Centre and States, with incomplete or no input tax credits available at progressive stages of value addition, the cost of most goods and services in the country today are laden with many hidden taxes. Under GST, there would be only one tax from the manufacturer to the consumer, leading to transparency of taxes paid to the final consumer.

7. What are the salient features of the proposed GST model?

→ The salient features of GST are :

- The Central GST and the State GST would be applicable to all transactions of goods and services except the exempted goods and services, goods which are outside the purview of GST and the transactions which are below the prescribed threshold limits.

- The Central GST and State GST are to be paid to the accounts of the Centre and the States separately.

- Consistent with the federal structure of the country, the GST will have two components – one levied by the Centre (referred to as Central GST), and the other levied by the States (referred to as State GST). This dual GST model would be implemented through multiple statutes (one for CGST and SGST statute for every State). However, the basic features of law such as chargeability, definition of taxable event and taxable person, measure of levy including valuation provisions, basis of classification etc. would be uniform across these statutes as far as practicable.

- Cross utilization of ITC between the Central GST and the State GST would, in general, not be allowed.

- To the extent feasible, uniform procedure for collection of both Central GST and State GST would be prescribed in the respective legislation for Central GST and State GST.

- Since the Central GST and State GST are to be treated separately, in general, taxes paid against the Central GST shall be allowed to be taken as input tax credit (ITC) for the Central GST and could be utilized only against the payment of Central GST. The same principle will be applicable for the State GST.

- The taxpayer would need to submit periodical returns to both the Central GST authority and to the concerned State GST authorities.

- The administration of the Central GST would be with the Centre and for State GST with the States.

- Each taxpayer would be allotted a PAN linked taxpayer identification number with a total of 13/15 digits. This would bring the GST PAN-linked system in line with the prevailing PAN-based system for Income tax facilitating data exchange and taxpayer compliance. The exact design would be worked out in consultation with the Income-Tax Department.

8. How will the goods and services be classified under GST regime?

→ HSN (Harmonised System of Nomenclature) code shall be used for classifying the goods under the GST regime. Taxpayers having turnover above Rs. 1.5 crores but below Rs. 5 crores shall use 2 digit code and the taxpayers having turnover of Rs. 5 crores and above shall use 4 digit code. Taxpayers whose turnover is below Rs. 1.5 crores are not required to mention HSN Code in their invoices. Services will be classified as per the Services Accounting Code (SAC).

9. How will imports be taxed under GST?

→ Imports of Goods and Services will be treated as inter-state supplies and IGST will be levied on import of goods and services into the country. The incidence of tax will follow the destination principle and the tax revenue in case of SGST will accrue to the State where the imported goods and services are consumed. Full and complete set-off will be available on the GST paid on import on goods and services.

10. How will Exports be treated under GST?

→ Exports will be treated as zero rated supplies. No tax will be payable on exports of goods or services, however credit of input tax credit will be available and same will be available as refund to the exporters.

11. What is the scope of composition scheme under GST?

→ Small taxpayers with an aggregate turnover in a financial year up to Rs. 50 lakhs shall be eligible for composition levy. Under the scheme, a taxpayer shall pay tax as a percentage of his turnover during the year without the benefit of ITC. The floor rate of tax for CGST and SGST shall not be less than 1%. A tax payer opting for composition levy shall not collect any tax from his customers. Tax payers making inter-state supplies or paying tax on reverse charge basis shall not be eligible for composition scheme.

12. What are the major features of the proposed payment procedures under GST ?

→ The major features of the proposed payments procedures are as follows:

- Electronic payment process- no generation of paper at any stage

- Single point interface for challan generation- GSTN

- Ease of payment – payment can be made through online banking, Credit Card/Debit Card, NEFT/RTGS and through cheque/cash at the bank

- Common challan form with auto-population features

- Use of single challan and single payment instrument

- Common set of authorized banks

- Common Accounting Codes

GST will be a game changing reform for the Indian economy by creating a common Indian market and reducing the cascading effect of tax on the cost of goods and services. It will impact the tax structure, tax incidence, tax computation, tax payment, compliance, credit utilization and reporting, leading to a complete overhaul of the current indirect tax system.

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us