Traditional Online vis-à-vis New E-Commerce Model

Sale of Goods – Online Traditional model

The traditional model known as stock-and-sell model of online sale of goods involved an inventory of goods / services which was displayed to the customer, wherein the customer can choose desired goods/ services in his virtual cart and makes payment for such purchases. The purchased goods/ services is then delivered to the customer by various modes like courier, hand delivery, option to pick from stores of the supplier etc.

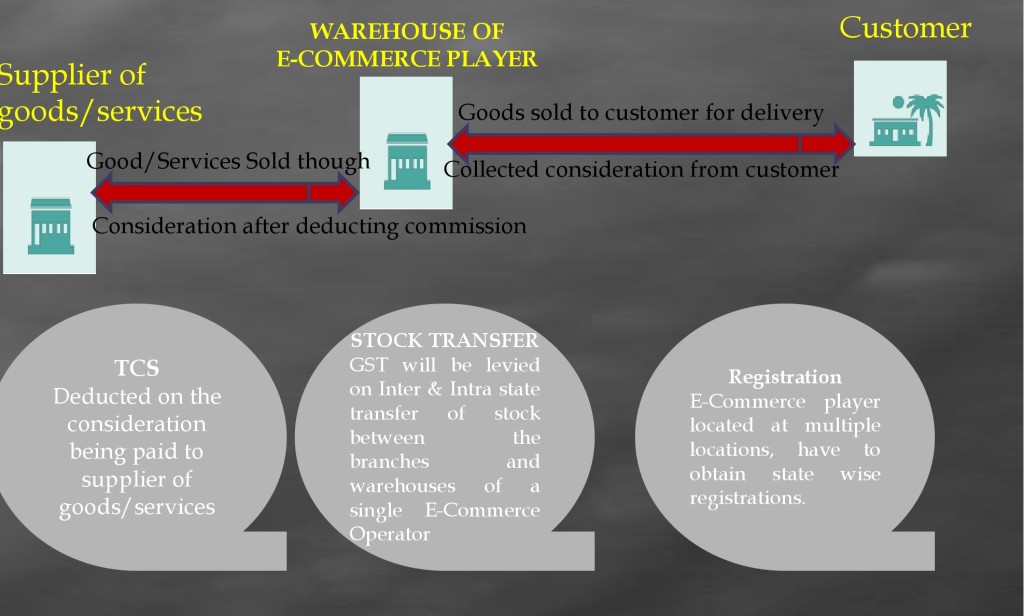

Sale of Goods – Marketplace – The aggregator

In this model, the online platform is owned by one person, but the goods are sold on such platform by other sellers, it becomes the marketplace model. The person owning the site or platform displays the products of other persons. The payment is made to the site owner while the delivery of goods is directly provided by the seller to the buyer. The site owner makes the payment of the goods to the seller after deducting his margin or commission.

E-Commerce & Present Tax Regime

The present indirect tax structure in India is complicated and contains many taxes levied by both Central as well respective State governments. Indian commerce has been fragmented owing to differences in state VAT laws, and one of the industries that has been worst hit by the same is electronic commerce.

Both the electronic commerce and its taxation was in evolving stage even under the current regime, and its structures were in invention and transformation stage and thus, as of date no concrete model can be attributed. The status of present levies has been summarised in brief as under:

Excise:

Generally it is understood that there is no levy of excise in the field of electronic commerce as no one can engage in virtual production of goods. Even the activities of packing and re-packing undertaken by the electronic commerce platforms for the purpose of logistics were ruled as not amounting to manufacture by the Authority for Advance Rulings in Ruling AAR/CE/04/2012. However, tagging could amount to manufacture in certain cases as per the Advance Ruling in case of same assesse in Ruling No. AAR/CE/06/2016. Further repacking, relabelling to enable to make it for retail sales may also amounts to manufacture with regard certain products like healthcare, consumer goods, if it is mentioned so in the notes to central excise tariff or in Schedule.

Service Tax:

Sale of goods is not subject to service tax. However, the commission or any other charges for permitting use of electronic platform, operator’s trade name etc. retained by electronic commerce platforms is chargeable to service tax. Further, the services of aggregators have been specifically included in the ambit of service tax and they have been made liable under reverse charge.

VAT/Sales Tax:

It is applicable on sale. In case of inter-state sale, CST is charged. Form C is not required in most of the cases as the customers are unregistered dealers and therefore, the highest rate of tax is applicable. In case of intra-state sale, VAT is applicable.

E-Commerce Businesses under GST Regime

GST Law recognizes the need for rules specific to the e-commerce industry, with specific provisions with respect to e- commerce broadly under two categories :

- The e-commerce operator ; and

- Suppliers on e-commerce platforms

An e-commerce operator is a person who owns, operates or manages digital or electronic facility or platform for electronic commerce. The requirements from an e-commerce operator under GST are –

- All e-commerce operators are mandatorily required to register under GST irrespective of their turnover.

- Certain service categories may be notified, on supply of which, tax shall be paid by the e-commerce operator, and If the e-commerce operator does not have an establishment in a state, any person representing the e-commerce operator will be liable to pay the tax

- E-commerce operator should collect tax @ 2% on the net value of taxable supplies made through their platform, where the consideration, with respect to such supplies, has to be collected by the operator & need to file GSTR 8 by 10th of the month

Suppliers on e-commerce platforms are persons who supply goods or services on an e-commerce platform. The requirements from suppliers on e-commerce platforms are-

- All suppliers on e- commerce platforms are mandatorily required to register under GST. Hence, even e-commerce suppliers whose aggregate turnover does not exceed the threshold limit for registration will have to compulsorily register

- A person who supplies goods or services through an e-commerce operator will not be eligible for registration under composition Scheme. Hence, even if the person’s aggregate turnover does not cross Rs. 50 Lakhs, he/she does not have the option to become a composition tax payer

- Suppliers on e-commerce platforms are required to file periodical returns under GST ( GSTR 1, GSTR 2A, GSTR 2, GS ITC 1)

Under GST law, the term ‘electronic commerce operator’ has been defined to mean any person who owns, operates or manages digital or electronic facility or platform for electronic commerce. The definition of electronic commerce is widely worded to provide that ‘electronic commerce’ means supply of goods and/or services including digital products over digital or electronic network.

Levy

At the outset, no threshold exemption has been provided to the electronic commerce operator. Thus, any person who is an electronic commerce operator or is supplying through an electronic commerce operator (except persons supplying notified services u/s 8(4)) shall be required to levy GST from his first rupee of supply.

In case of stock-and-sell model, GST would be levied on the entire value of goods and shall be paid by the owner of the goods and also the website. However, in case of marketplace, GST would be applicable on both transaction viz., between seller and buyer and between seller and marketplace. While the seller would discharge GST on the entire value of goods supplied by him subject to TCS u/s 56, if applicable, the site owner shall discharge GST only on the commission earned by him.

In case of service models, GST shall be applicable on the value of supplies made through such websites. In traditional model, the site owner being service providers himself, needs to comply with the levy and discharge of GST. In case of aggregators, though the levy is on the supplier of services to customers, the liability to pay such tax has been casted upon the aggregator in certain cases vide section 8(4). Only in the case of C2C transactions, a plea can be taken that no GST is leviable as such supplies are not made in the course or furtherance of business.

Liability to pay

As per the current understanding, GST would be paid under normal charge. However, a special provision for collection of tax at source has been made applicable in the case of electronic commerce operators. It has been provided that Central government shall notify categories of services on which tax shall be paid by the electronic commerce operator if such services are supplied through it, and all the provisions of this Act shall apply to such electronic commerce operator as if he is the person liable for paying the tax in relation to the supply of such services

Further, every electronic commerce operator (not being an agent) shall be liable to collect an amount calculated at the rate of 1% of the net value of taxable supplies made through it where the consideration along with appropriate GST with respect to such supplies is to be collected by the operator. The liability to pay in this respect would lie with the electronic commerce operator.

Reports/returns

Apart from the monthly and annual returns, electronic commerce operators will be required to file monthly TCS returns viz., a statement, electronically, containing the details of outward supplies of goods or services effected through it, including the supplies of goods or services returned through it, and the amount collected under during a month, in such form and manner as may be prescribed, within ten days after the end of such month.

Compliance & accounting burden

Compliance & accounting burden

- According to the draft bill, the e-commerce platform will be liable to collect TCS (tax collected at source) on the supplies of goods and services made by the supplier.

- It will be the responsibility of e-commerce firm to file monthly and annual returns.

- Also, the supplies reported by the e-commerce firm will be matched with the details given by the supplier in his return for outward supplies and in case of a mismatch; the output liability of the vendor will be re-determined.

Working Capital Issues for small sellers

- No threshold limit available to small businesses with annual turnover of less than Rs.10 lakh.

- it expects e-commerce platforms to collect tax on every transaction no matter how small the seller might be.

- This essentially means that a small seller on the platform will invariably end up paying tax and would later apply for a refund.

- This could be a grave issue for small and medium businesses that work on very tight working capital.

- A specific proposal in the draft law relating to tax collection at source will prove to be detrimental to lakhs of small and medium sellers who do business on e-commerce platforms.

Cash on Delivery, Returns and Cancelled Order

- E-commerce in India has a return or cancellation rate of about 15-18%.

- Also, more than two-third of the transactions in the country are still on cash on delivery (COD) and the cash reconciliation for e-commerce firms happens about 7-15 days later.

- Deducting tax at source would require e-commerce firms to bear the tax amount from their own capital and later seek refund from the government in case of returns and cancellations.

- Thus TCS can be a major cash flow disadvantage for e-commerce firms especially in the case of cash on delivery or orders being rejected later.

Way Ahead for E-Commerce

Compliances are expected to multiply under GST for an electronic commerce operator. Apart from Monthly returns for inward supplies, outward supplies etc., an additional liability in terms of filing statement of supplies made through it has been casted on such operators. Apart from above there is also requirement for registration in each of the states they operate. The concept of centralised registration shall no longer be a saviour and thus, such firms would be required to register themselves in each of the state where they have their presence.

Thus, Electronic commerce firms shall require a lot of change at the planning and implementation level. All in all, GST is expected to be a mixed bag for electronic commerce, with the benefits outweighing the concerns. However, the real picture shall be clear only after it is implemented.

Also, if an eCommerce platform wrongfully reports a transaction against a seller, unless reconciled, it is considered as supply by seller. Platforms will have to develop mechanisms for all cash flow from their platform to seller, such that TDS can be effected. In case of direct shipping by sellers to the end customer, the cash-on-delivery mechanism will require a major revamp.

For Service Aggregators like Uber and AirBnB, compliance and tax payment complexities are due to the dual nature of participants — drivers and passengers. This potentially complicated transaction requires aggregators to comply with TDS as well as actual sales transactions.

More clarity is required for other e-commerce verticals, such as ticketing and tourism, adventure or events, hotels or resort bookings, B2B players, and other similar industries, wherein sellers supply services to end customers, but do not necessarily involve cash flow via the platform.

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance.

Toll Free:

Toll Free:  Contact Us

Contact Us