IMPACT OF GST ON CONTRACTORS

WHAT IS WORKS CONTRACT?

Works Contract has been defined in Section 2 (119) of the CGST Act, 2017 as under:

“works contract” means a contract for building, construction, fabrication, completion, erection, installation, fitting out, improvement, modification, repair, maintenance, renovation, alteration or commissioning of any immovable property wherein transfer of property in goods (whether as goods or in some other form) is involved in the execution of such contract.

Thus, the definition as adopted in GST is more influenced from VAT Laws than Service Tax. Accordingly, the definition does not provide for any generic definition but only includes 14 types of contracts as works contract, which are as follows:

- building

- construction

- fabrication

- completion

- Erection

- Installation

- Fitting out

- Improvement

- Modification

- Repair

- Maintenance

- Renovation

- Alteration

- Commissioning

Thus as per the present definition, there is no requirement of any transfer of property, nor any contract can be classified as works contract.

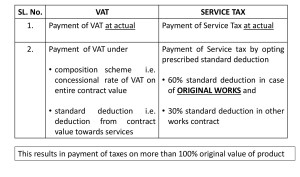

VALUATION METHODS UNDER CURRENT REGIME

PLACE OF SUPPLY IN CASE OF WORKS CONTRACT?

Place of Supply of Goods –

As per Section 10 (1) (d) of IGST ACT – where the goods are assembled or installed at the site, the place of supply shall be the place of such installation or assembly.

Place of Supply of Services –

As per Section 12 (3) (d) of IGST ACT – any services ancillary to the services referred to in clauses (a), (b) and (c) (i.e in relation to an immovable property), shall be the location at which the immovable property or boat or vessel, as the case may be, is located or intended to be located.

Provided that if the location of the immovable property or boat or vessel is located or intended to be located outside India, the place of supply shall be the location of the recipient.

POINT OF TAXATION OF WORKS CONTRACT – GOODS

Section 12 of CGST Act provides for time of supply in case of goods to be originated out of a works contract as earlier of the following –

- The date on which goods are made available to the recipient

- The date on which the supplier issues the invoice with respect to the supply

- The date on which the supplier receives the payment with respect to the supply

- The date on which the recipient shows the receipt of the goods in his books of accounts

POINT OF TAXATION OF WORKS CONTRACT – SERVICES

Section 13 of CGST Act provides that the time of supply shall be as under for the purpose of determining most of the works contract (qualifying as continuous supply of services*)

- Where the due date of payment is ascertainable from the contract, the date on which the payment is liable be made by the recipient of service, whether or not any invoice has been issued or any payment has been received by the supplier of service

- Where the due date of payment is ascertainable from the contract, each such time when the supplier of service receives the payment, or issues an invoice, whichever is earlier

- Where the payment is linked to the completion of an event, the time of completion of that event

*Section 2(33) defines – “continuous supply of services” means a supply of services which is provided, or agreed to be provided, continuously or on recurrent basis, under a contract, for a period exceeding three months with periodic payment obligations and includes supply of such services as the Government may, subject to such conditions, as it may, by notification, specify.

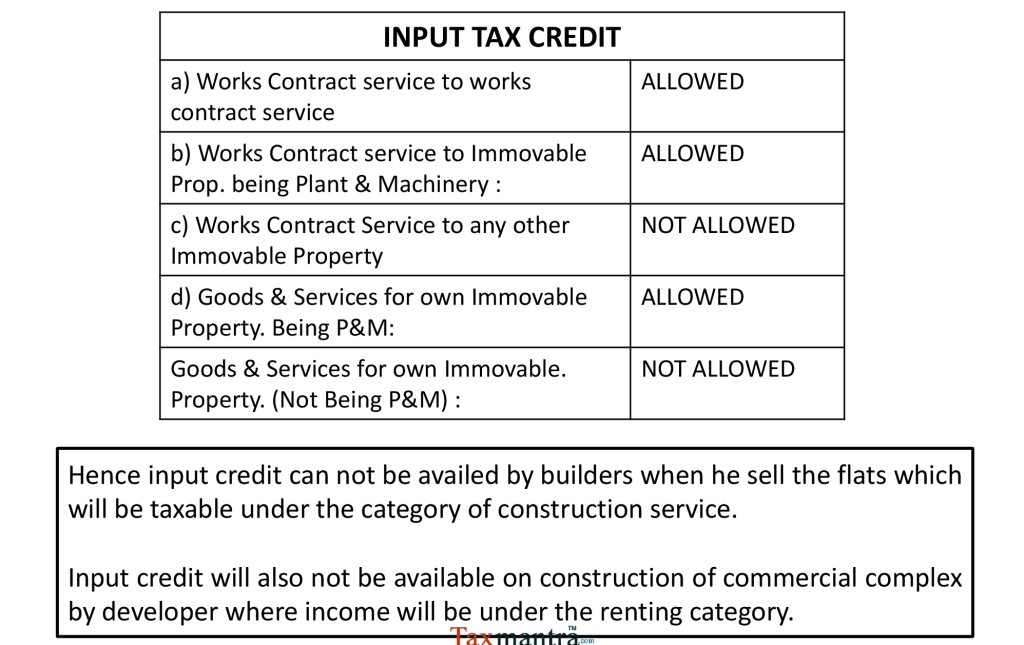

CONCEPT OF INPUT TAX CREDIT UNDER WORKS CONTRACT

AVAILABILITY OF INPUT TAX CREDIT

As per Section 17(5)(c) & 17(5)(d)of CGST ACT input tax credit shall not be available where:

- works contract services when supplied for construction of an immovable property (other than plant and machinery) except where it is an input service for further supply of works contract service;

- goods or services or both received by a taxable person for construction of an immovable property (other than plant or machinery) on his own account including when such goods or services or both are used in the course or furtherance of business.

Section 16(2) of CGST Act provides conditions for availing credit:

- Possession of invoice;

- Receipt of services;

- Tax should have been paid to government;

- Return should have been furnished(monthly return due date 20th

SIGNIFICANT IMPACT ON WORKS CONTRACT IN GST REGIME

1)Lesser Litigation

Works contract is always an area for litigation on different matters such as valuation, classification etc. GST since subsuming multiple taxes in to it would probably reduce litigation in this area.

2)Dual Taxation Would be History

Article 366 (29A) (b) enable to state government(s) to tax goods portion involved in the execution of works contract. Further, service portion of works contract is declared service under section 66E of Finance Act 1994.

Under GST, in terms of Schedule II of GST ACT, works contract including transfer of property in goods (whether as goods or in some other form) involved in the execution of a works contract; is a service.

TREATMENT OF STOCK TRANSFERS

Stock Transfers:

Since, transfer of inputs/ capital equipments from one site to another is quite common in this sector. Therefore, construction companies operating from multiple locations in different states, then it would require to pay GST on stock/ Assets transfers from its premises in one state to its premises in another state.

Further, in case construction companies are having multiple business verticals within the state and if a construction companies opts to take separate registration for each such business vertical, then GST needs to be paid for stock transfers even when made within the same state.

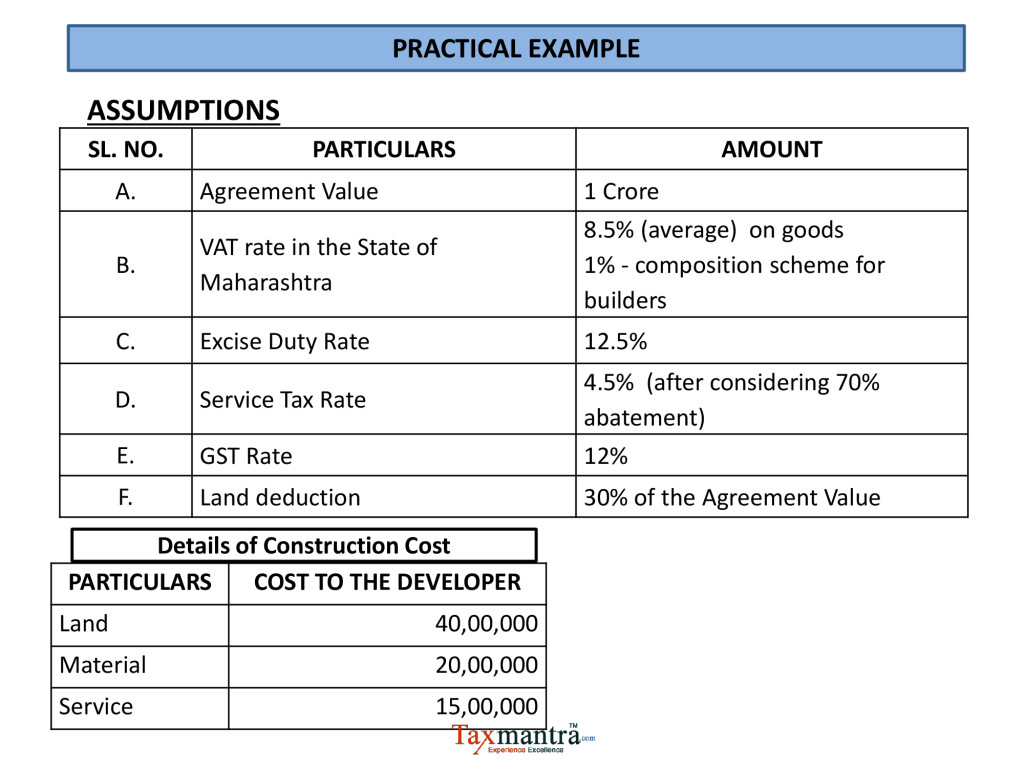

IMPACT OF GST ON REAL ESTATE

PRESENT SCENARIO OF REAL ESTATE INDUSTRY

- One of the most complex areas of the tax levied by the Centre and the States is works contract and sale of property. Currently, such transactions are broken into three parts – the value of goods and materials, value of services and value of land.

- This area has seen extensive litigation and many borderline, illogical reasoning has been accepted by the tax authorities on the logic that some tax is being collected. Construction and Real Estate sector constitutes approximately 9% of the country’s total GDP. Growth of this sector has a direct nexus with the nations growth.

- GST could be a blessing in disguise for this sector which has been surviving the adversities of the current indirect tax complexities for a substantially long period of time the last big hit being demonetization.

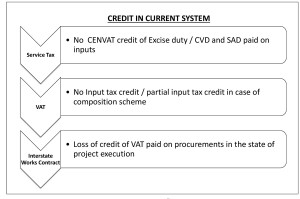

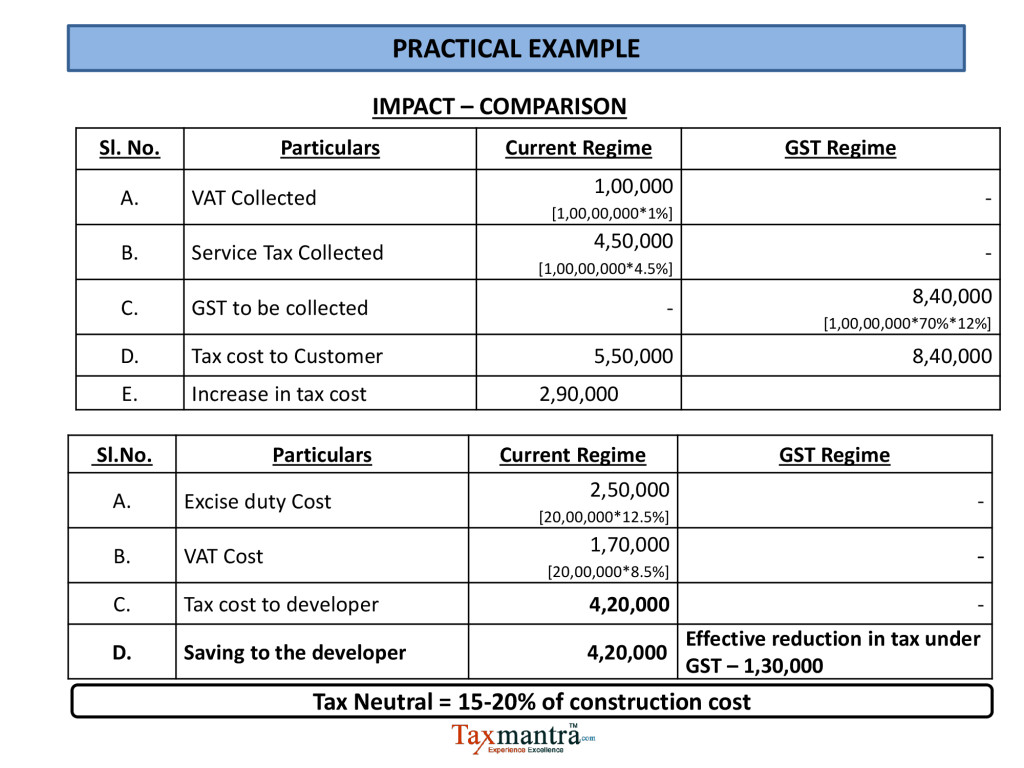

CONCEPT OF INPUT TAX CREDIT IN REAL ESTATE INDUSTRY

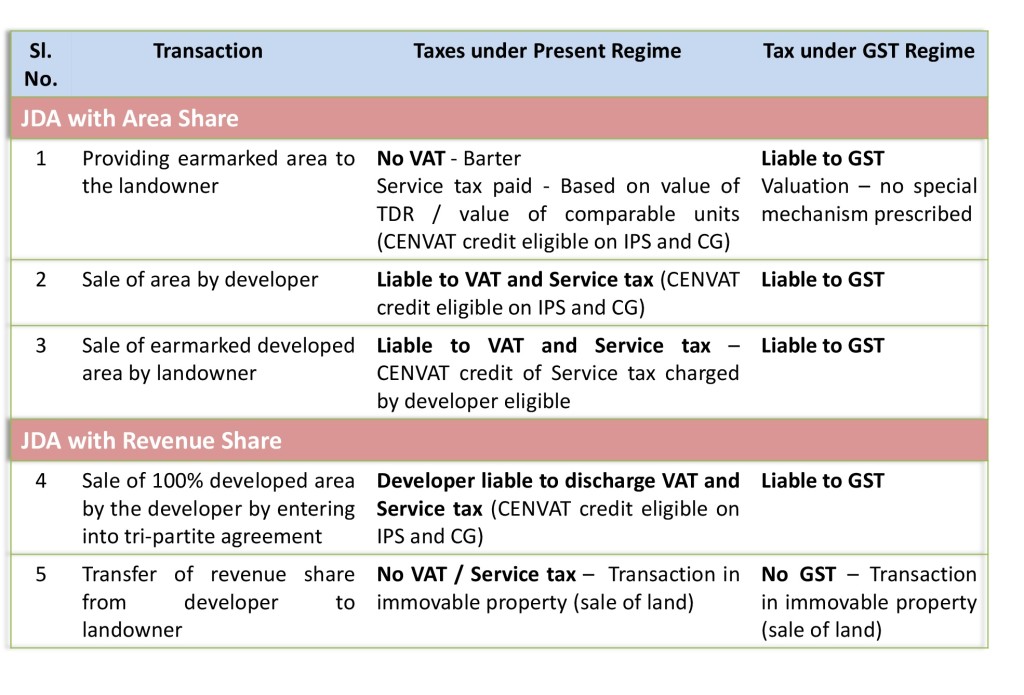

IMPACT ON JDA

IMPACT ON RESIDENTIAL REAL ESTATE

IMPACT ON RESIDENTIAL REAL ESTATE

- If we look at the residential property sector, sales are not just impacted by tax rates but also by sentiment, and also on account of the trust deficit which the Real Estate Regulation & Development Act – or RERA – now seeks to address. That said, if costs do go higher under GST, the lower prevailing current home loan rates could assuage the impact to some extent.

- Buyers and investors as well as developers are understandably worried that the final ticket size of homes will increase even if the Government levies GST at 12%, when compared to the existing service tax rates. Developers are still awaiting further clarity on this, but they know that it is in the interest of their business to keep ticket sizes range-bound.

- Evolving market dynamics have already brought about a change in the manner in which developers work. Staying customer-centric and delivery-focused to create a differentiated identity will be the most logical and likely method for them to adopt.

IMPACT ON RENTAL HOUSING

- The rental housing segment may see a huge slump over the medium-term, since residential leases are currently not taxed at all.

- Here, it is pertinent to note that residential leasing is an inherent demand which will not evaporate merely by higher taxes. Certainly, we may be looking at a rental stagnation or marginal decline as the market readjusts to the new dynamics which GST will infuse. However, rental housing demand is sticky and end-user-driven in nature, so we are definitely not looking at a major slump in this segment because of GST even if it does tax residential leases.

- That said, rental yields in major cities could certainly moderate if GST is levied on rental housing. In India, rental yields in housing are quite modest at around 2-4% on an average. Rents may either hold steady or decline marginally due to increase in housing stock. However, it is also true that most investors in the residential sector do not invest for rental yields but rather for the capital value appreciation, so reduced rental yields would not independently impact sentiment.

IMPACT ON COMMERCIAL REAL ESTATE

When it comes to GST’s impact on the commercial office real estate market – with the existing service tax for commercial leases at 15%, GST would be likely neutral overall (at 12% slight savings, and at 18% slight increase).

IMPACT ON AFFORDABLE HOUSING

Affordable housing is currently exempt from service tax. It is likely that the government may come out with a clarification regarding the applicability or continuing exemption under the GST .

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance.

Toll Free:

Toll Free:  Contact Us

Contact Us