Blogs

Common legal phrases which are used in Agreements

Corporate Law & Intellectual Property Rights | By Soumik Kumar Sen | Last updated on Oct 5, 2017

As a corporate law consultant, I have vetted and drafted various legal Agreements. Whether it’s a simple five-page Rent Agreement or a co...

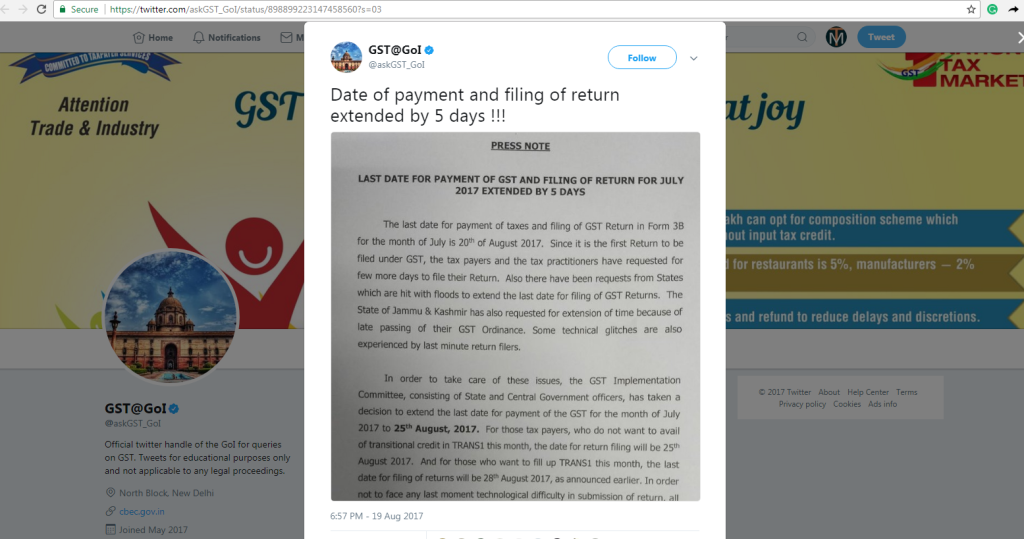

GSTR 3B filing due date extended by 5 days, due date now being 25th August, 2017

News & FAQs | By Editor | Last updated on Oct 4, 2017

The GSTR 3B filing due date has finally been extended by 5 days. Since this is the first return and also the site has not been working si...

Employee Reimbursement under GST And RCM

GST & Other Indirect Taxes | By Nikita Agarwal | Last updated on Oct 5, 2017

Reverse charge means the liability to pay tax is on the recipient of supply of goods or services instead of the supplier of such goods or...

GST portal stops functioning, fails to resume after ‘scheduled downtime’

General | By Editor | Last updated on Oct 5, 2017

The GST website for filing returns is facing “issues” and services to the website has not been restored, throwing into disarray the retur...

Concept of Imports Under GST

GST & Other Indirect Taxes | By Nikita Agarwal | Last updated on Oct 5, 2017

The import of goods has been defined in the IGST Act, 2017 as bringing goods into India from a place outside India. All imports shall be ...

Step by Step Guide To File LUT Or Bond Under GST

GST & Other Indirect Taxes | By Nikita Agarwal | Last updated on Oct 5, 2017

Export and Import under GST are mainly governed by IGST Act as they are treated as inter-state supply. In case where, goods are exported ...

Common use items exempt from e-way bill provision under GST

GST & Other Indirect Taxes | By Editor | Last updated on Oct 5, 2017

LPG, kerosene, jewellery and currency are among the common use items that have been exempted from the requirement of obtaining electronic...

GSTR 3B filing due date extended to August 28

News & FAQs | By Editor | Last updated on Oct 4, 2017

The deadline for first GST Return, GSTR- 3B, has been extended (states are still coming up with Notifications) to August 28 from its orig...

GST glitches may hit pricing, new orders: Exporters

GST & Other Indirect Taxes | By Editor | Last updated on Oct 5, 2017

The slowdown in exports may mark the beginning of trouble ahead, said exporters a month and half after the goods and services tax (GST) r...

Toll Free:

Toll Free:  Contact Us

Contact Us