Blogs

माल और सेवा कर (जीएसटी) शासन में धन वापसी कैसे करें?

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

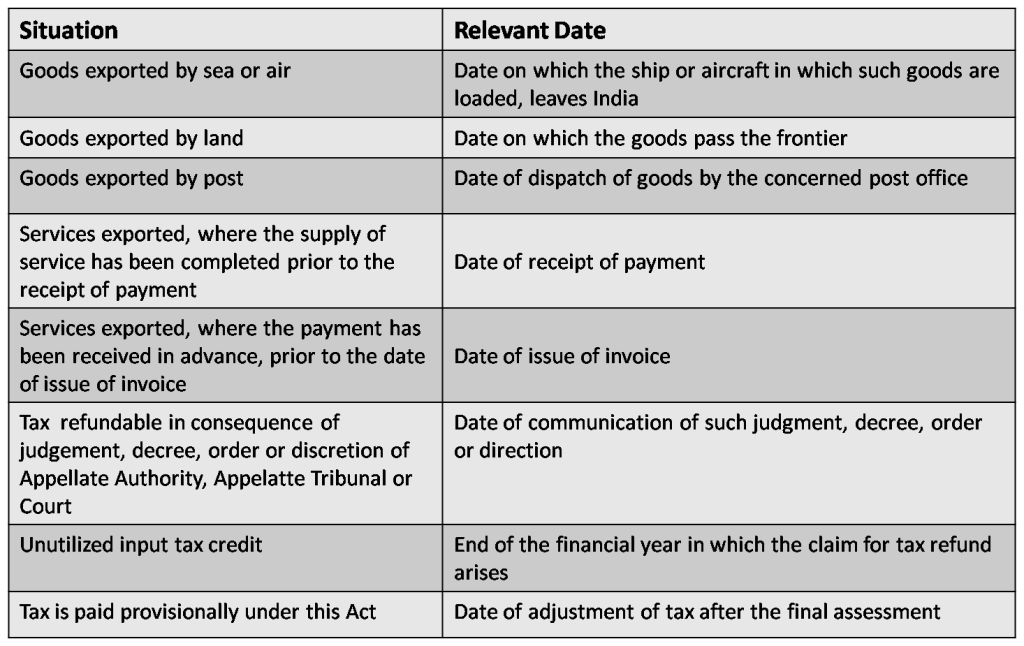

जीएसटी के तहत रिफंड क्या है? सीजीएसटी / एसजीएसटी अधिनियम की धारा 54 में वापसी की चर्चा की गई है। “वापसी” में शामिल हैं: (ए) इ...

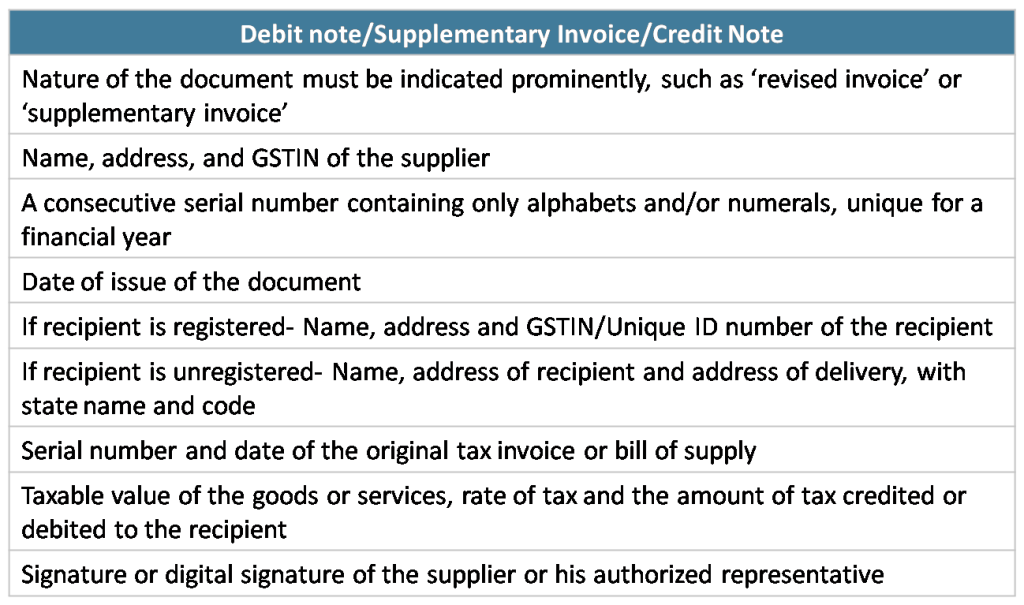

जीएसटी के तहत चालान प्रक्रिया

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

चालान की स्थापना जीएसटी शासन का सबसे महत्वपूर्ण हिस्सा होगा। यह आधार होगा कि किस प्रकार सही आदानों का लाभ उठाया जा सकता है। आवश्यक जानक...

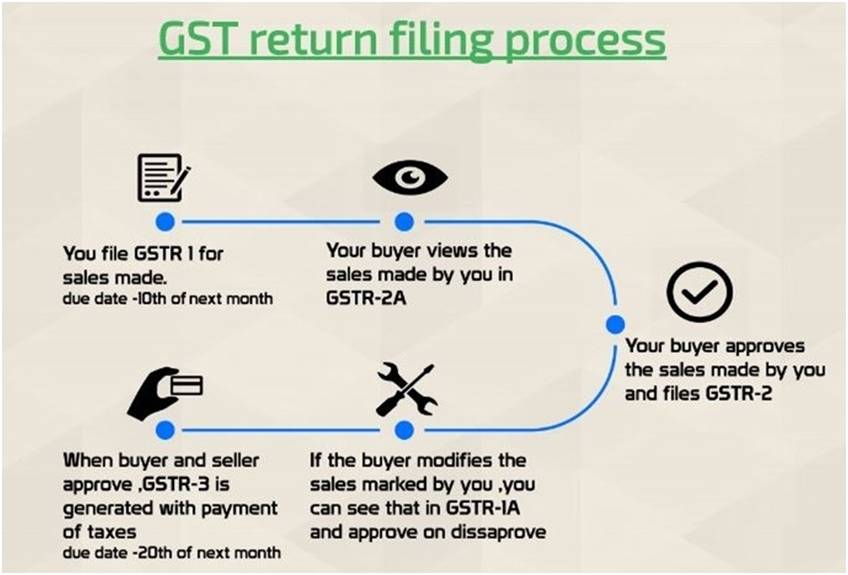

माल और सेवा कर (जीएसटी) के तहत रिटर्न की फाइलिंग

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

जावक आपूर्ति का विवरण प्रस्तुत करना- (जीएसटी 1) यह रिटर्न इनपुट सेवा वितरक, कर विभाग (धारा 37) और करपात्र व्यक्तियों के लिए संरचना लेवी (...

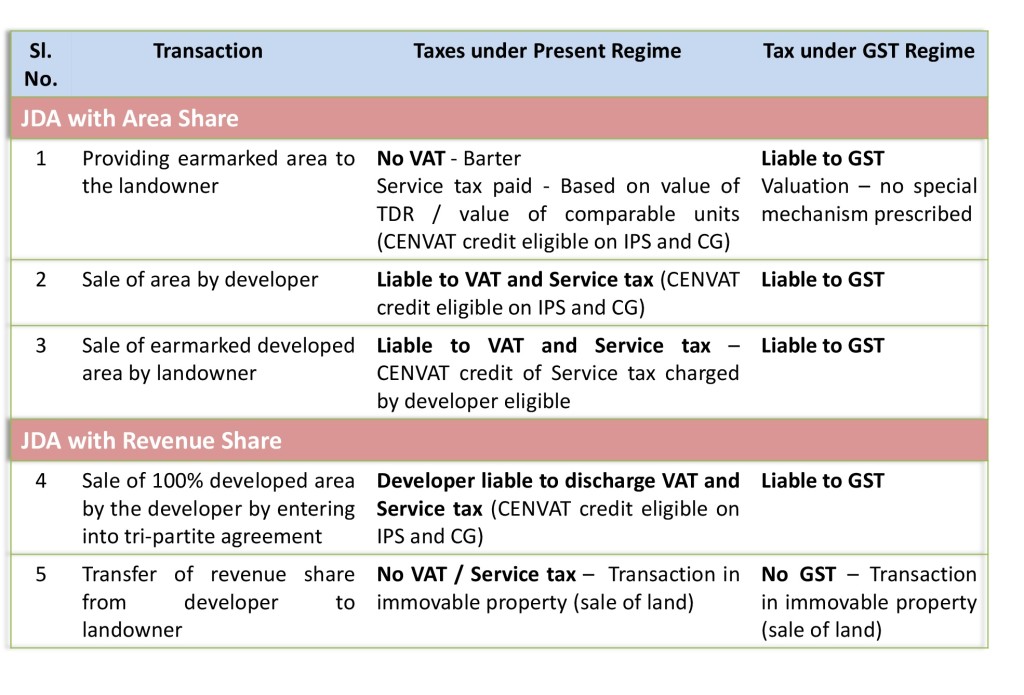

IMPACT OF GST ON CONTRACTORS AND REAL STATE

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

IMPACT OF GST ON CONTRACTORS WHAT IS WORKS CONTRACT? Works Contract has been defined in Section 2 (119) of the CGST Act, 2017 as under: ...

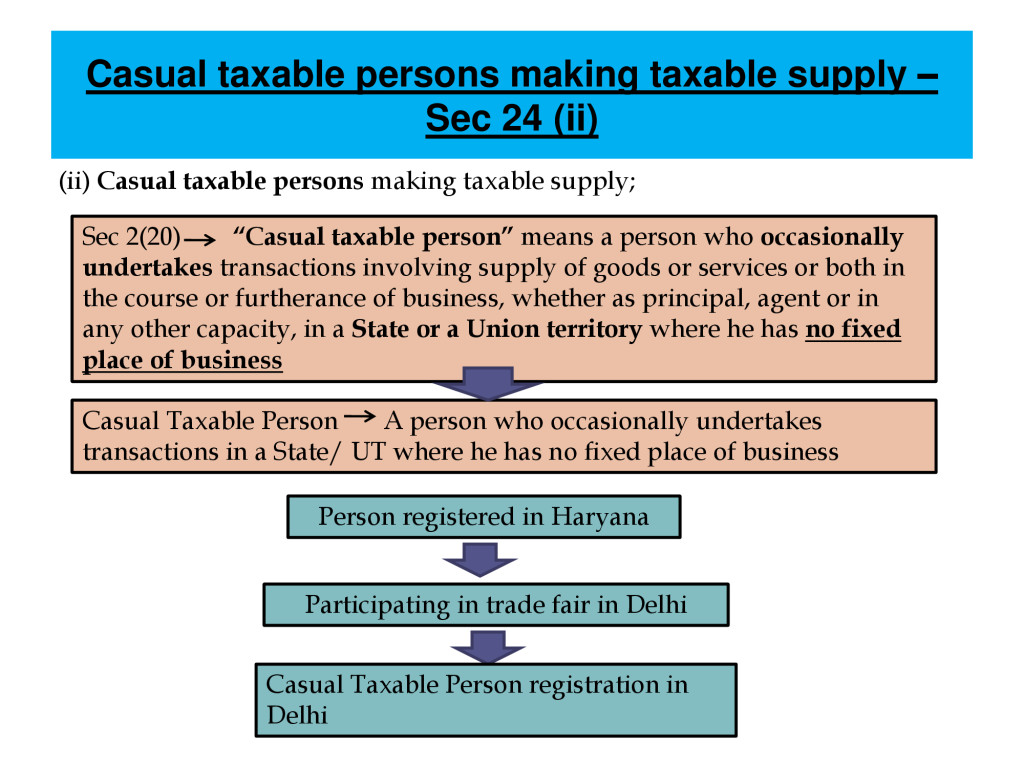

कर योग्य व्यक्ति, सीमा सीमा, जीएसटी के तहत अनिवार्य पंजीकरण

General | By ALOK PATNIA | Last updated on Oct 5, 2017

एक नजर में कर योग्य व्यक्ति प्रावधान जीएसटी पंजीकरण के लिए थ्रेसहोल्ड सीमा “सकल टर्नओवर” के आधार पर गणना की जाने वाली सीमा सी...

Impact of GST on traders and manufacturers

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

India has been grappling with multiple indirect taxes for a long time; the introduction of GST is, therefore, a landmark in the country’s...

जीएसटी की मूल बातें – पता करने के लिए चीजें

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

जीएसटी माल और सेवाओं की आपूर्ति पर एकमात्र कर है, जो निर्माता से लेकर उपभोक्ता तक है। प्रत्येक चरण में दिए गए इनपुट टैक्स क्रेडिट वैल्यू ...

E-Commerce under the GST Regime

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

Traditional Online vis-à-vis New E-Commerce Model Sale of Goods – Online Traditional model The traditional model known as stock-and-sell ...

Tax Recoveries, Appeals and Revision under GST

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

Tax Collected and not Paid to the Government Every person who has collected from any other person any amount as representing the tax unde...

Toll Free:

Toll Free:  Contact Us

Contact Us