Blogs

Inspection, Search, Demand, Penalties and Compounding under GST

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

Power of Inspection, Search and Seizure These powers lie with officers now below the rank of Joint Commissioner (JC) There should be a ...

ASSESSMENTS AND AUDIT UNDER GST

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

Section 59 – Self Assessment “Every registered person shall self-assess the taxes payable under this Act and furnish a return for e...

JOB WORK UNDER GST

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

WHAT IS JOB WORK? Section 2 (68) – Definition of Job Work “job work” means any treatment or process undertaken by a person on goods...

REVERSE CHARGE UNDER GOODS & SERVICE TAX (GST)

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

Reverse Charge Meaning- Section 2(98) of CGST Act, 2017 “Reverse Charge” means the liability to pay tax by the recipient of the supply of...

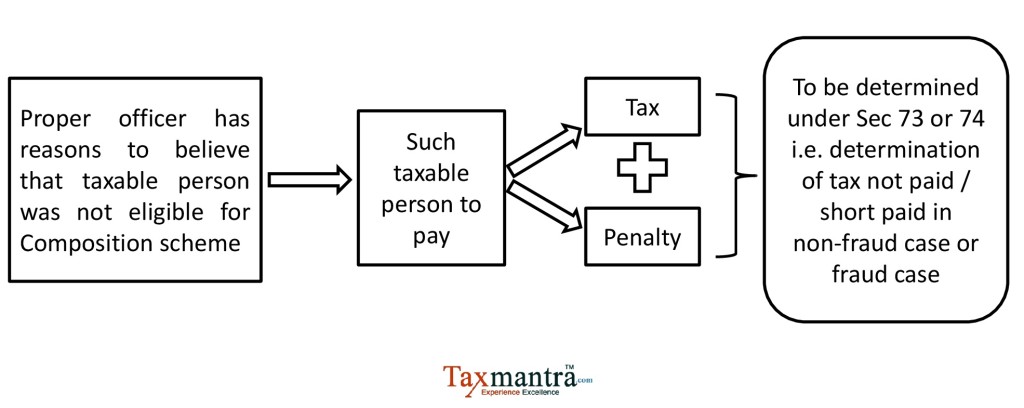

COMPOSITION LEVY SCHEME UNDER GST

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

Section 10 (1) – Composition Levy Notwithstanding anything to the contrary contained in this Act but subject to the provisions of sub-sec...

GST: GST Council revises rates for 66 items

News & FAQs | By Dipanjali Chakraborty | Last updated on Oct 4, 2017

After the 16th GST Council meet concluded today, the rates of 66 items under the upcoming GST regime have been revised. Add...

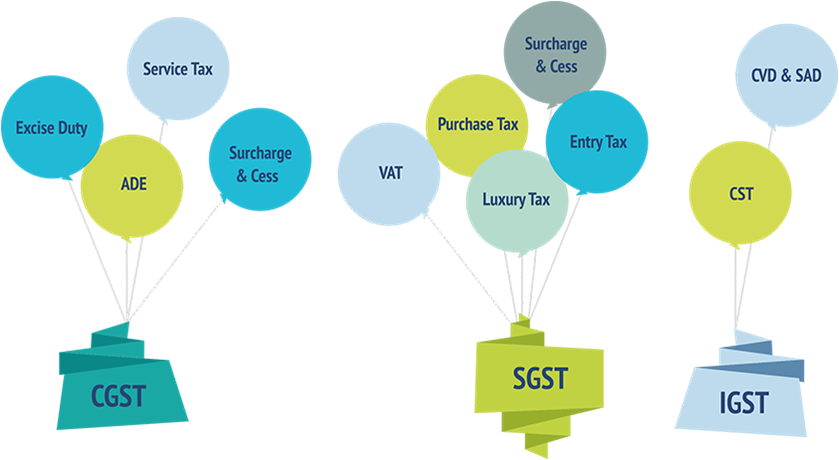

करों को जीएसटी में जमा करना

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

जीएसटी को आमतौर पर अप्रत्यक्ष, व्यापक, व्यापक-आधारित उपभोग के रूप में वर्णित किया गया है। भारत में कार्यान्वित किया जाएगा जो दोहरी जीएसटी...

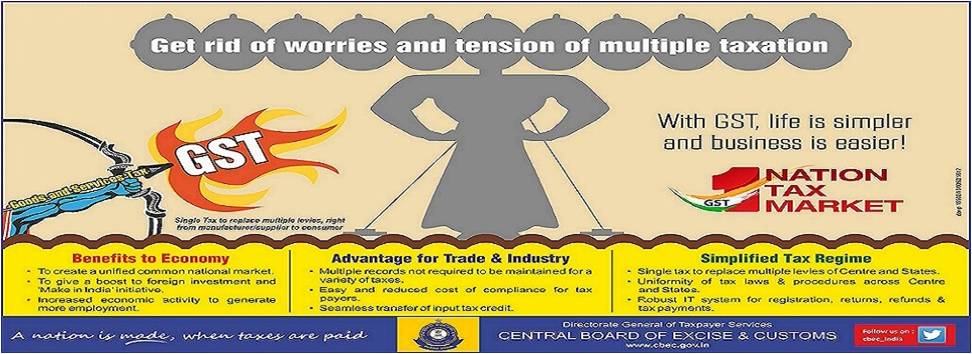

भारत में गुड्स एंड सर्विस टैक्स (जीएसटी) की आवश्यकता क्यों है?

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

माल और सेवा कर क्या है? जैसा कि नाम से पता चलता है, यह तब होता है जब उपभोक्ता एक अच्छा या सेवा खरीदता है। इसका मतलब एकल, व्यापक कर है जो ...

INPUT TAX CREDIT (ITC) UNDER GST

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Oct 5, 2017

INPUT TAX CREDIT (ITC) UNDER GST Meaning and definition of Input Tax Credit (ITC) Section – 2(56) – “input tax credit” means ...

Toll Free:

Toll Free:  Contact Us

Contact Us