Blogs

ONLINE INCOME TAX RETURN FILING-FY 2015-16 ( AY 2016-17)

Direct Taxes (including International Taxation) | By Editor | Last updated on Oct 5, 2017

What is Income Tax Return? Ans. The particulars of Income earned by a person in a Financial Year is ascertained and declared and taxes t...

Directors’ time to be Vigilant

Corporate Law & Intellectual Property Rights | By Editor | Last updated on Oct 5, 2017

Section 2 (34) of the Companies Act, 2013 defines “Director”. In simple word director is any person occupying the position by whatever na...

Facebook friends will be treated as Related Party: SEBI

Corporate Law & Intellectual Property Rights | By Editor | Last updated on Oct 5, 2017

SEBI in a landmark judgement considered facebook friends as related party. The result of such judgement led to a penalty of more than Rs....

Notices from Income Tax Department and How To Deal With It

Direct Taxes (including International Taxation) | By Editor | Last updated on Oct 5, 2017

With the change in the know-your-customer norms, online filing of returns and strict watch on the source of income of the assesses by the...

Why it is not so good idea to file your tax returns that early

Direct Taxes (including International Taxation) | By Editor | Last updated on Oct 5, 2017

This article has been inspired from a piece written by Mohit Bansal’s article Income tax return for AY 2016-17 have already been r...

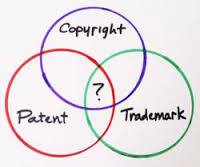

Difference between Trademark, Copyright and Patent: IP Eco System

Corporate Law & Intellectual Property Rights | By Editor | Last updated on Oct 5, 2017

By Ashrujit Basu ‘Rembrandts In Attic’ written by two fellow Intellectual Property Strategist named Kevin G Rivette and Dav...

Penalties and Interest under the Service Tax Provisions

GST & Other Indirect Taxes | By Editor | Last updated on Nov 22, 2019

Service tax refers to tax collected by the government of India from certain service providers for providing certain services. The person ...

New ITR 4S – Even Firms Can Also File

Direct Taxes (including International Taxation) | By Editor | Last updated on Oct 5, 2017

With the onset of new Financial Year i.e., 1st April, 2016, it’s now high time to get the returns filed for FY 15-16 (AY 16-17) as the Fi...

Relaxation from Additional Fees to cover up Ministry fault

News & FAQs | By Editor | Last updated on Apr 14, 2016

For all the stakeholders who were fed-up and gave up their efforts to the Ministry can relax and rejoice with the issue of the Circular ...

Toll Free:

Toll Free:  Contact Us

Contact Us