Blogs

Income Tax Benefits from Home Loan

Direct Taxes (including International Taxation) | By Editor | Last updated on Oct 5, 2017

Meaning of House Property : House property consists of any building or land appurtenant thereto of which the assessee is the owner...

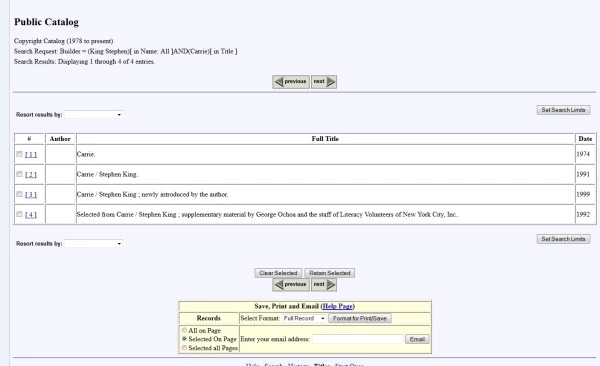

Key Challenges for Content Writers while running Copyright Searches

News & FAQs | By Editor | Last updated on Apr 2, 2016

By Ashrujit Basu Quora is a very powerful medium for exchanging knowledge and getting connected with right people while seeking answer fr...

ITR notified for AY 2016-17 with extra burden on ultra-rich

News & FAQs | By Editor | Last updated on Oct 5, 2017

If you have a high profile income which exceeds Rs. 50 lakh per annum then you got to hold all your valuable assets tightly. As the Finan...

Taxability of Gifts received by an Individual / HUF

Direct Taxes (including International Taxation) | By Editor | Last updated on Oct 5, 2017

The term “Gift” implies – any sum of money or property received by an individual or a HUF without consideration or a property acquired fo...

What 100-pc FDI in marketplace model spells for e-commerce companies as well as their customers

News & FAQs | By Editor | Last updated on Apr 6, 2016

The government recently permitted 100 percent foreign direct investment (FDI) in the marketplace format of e-commerce retailing, with a v...

Foreign payments are now easy with changes in Form 15CA/CB

News & FAQs | By Editor | Last updated on Apr 6, 2016

Form 15CA is submitted online if there is a foreign remittance to non residents and Form 15CB is a certificate issued by a CA after exami...

ITR Forms for AY 2016-17 notified but not yet released

News & FAQs | By Editor | Last updated on Oct 5, 2017

CBDT vide its Notification No. 24/2016 dated 30-03-2016 (F.No.370142/2/2016-TPL) as notified new forms for Filing Income Tax Return for A...

Dividend income is now an expense

News & FAQs | By Editor | Last updated on Apr 6, 2016

A dividend is a payment made by a corporation to its shareholders, usually as a distribution of profits. When a corporation earns a profi...

Start and Exit easy for startups with Insolvency Act

Corporate Law & Intellectual Property Rights | By Editor | Last updated on Oct 5, 2017

The current structure of Bankruptcy law in India is outdated and not efficient for a fast track exit for ailing companies. The government...

Toll Free:

Toll Free:  Contact Us

Contact Us