Blogs

New Revised PAN and TAN application fees with effect from 15th November, 2015

News & FAQs | By Editor | Last updated on Nov 23, 2015

New Revised PAN and TAN application fees with effect from 15th November, 2015 The Swachh Bharat cess (SBC) has increased the service tax ...

Funding: Easy but tricky way to track

Corporate Law & Intellectual Property Rights | By Editor | Last updated on Oct 5, 2017

Funding: Easy but tricky way to track Every decision you make in business has a financial consequence. Entrepreneurs are full of great id...

Restrictions of Tax Authorities to attach Cash Credit Account to recover tax dues

Direct Taxes (including International Taxation) | By Editor | Last updated on Oct 5, 2017

Restrictions of Tax Authorities to attach Cash Credit Account to recover tax dues Fiscally challenged, the government is frantically expl...

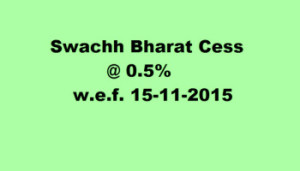

0.5% to be charged on taxable services from 15.11.2015 as Swachh Bharat Cess

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Nov 22, 2019

0.5% to be charged on taxable services from 15.11.2015 as Swachh Bharat Cess Swachh Bharat Cess has come into effect from 15th November 2...

Swachh Bharat Cess to increase Service Tax by 0.5%

News & FAQs | By ALOK PATNIA | Last updated on Nov 8, 2015

Swachh Bharat Cess to increase Service Tax by 0.5% Service tax rate goes up from 14% to 14.5% w.e.f 15th November 2015 vide notification ...

E- Sahyog introduced to highlight the Mismatch of information with any tax authorities

News & FAQs | By ALOK PATNIA | Last updated on Nov 4, 2015

E- Sahyog introduced to highlight the Mismatch of information with any tax authorities Attention assessee!! Before filing return o...

5 legal issues faced by college startups – to startup or not?

Corporate Law & Intellectual Property Rights | By ALOK PATNIA | Last updated on Oct 13, 2018

“Startups are the new Guitar. Every college student wants one” – Arunabh Kumar There was a time when starting up your own business w...

Due date of AOC-4 extended upto 30th November: Relief or Cover-up from MCA

News & FAQs | By ALOK PATNIA | Last updated on Oct 29, 2015

Due date of AOC-4 extended upto 30th November: Relief or Cover-up from MCA Much awaited extension of due date for filing Form AOC-...

Companies to comply mandatory Annual Compliance

Corporate Law & Intellectual Property Rights | By ALOK PATNIA | Last updated on Oct 5, 2017

Companies to comply mandatory Annual Compliance Companies must now set up for the Annual Compliances. Due date is close and the ne...

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us