Blogs

Understanding the GST applicable on e-commerce sellers and vendors

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Jan 21, 2019

Photo Credit: Livemint E-commerce is one of the fastest growing sectors in India today as users are more inclined towards online shoppi...

Govt brings Stricter Rules for starting new business

Corporate Law & Intellectual Property Rights | By Soumik Kumar Sen | Last updated on Jan 19, 2019

Have you recently incorporated your own Private Limited Company or are you in the process of doing so? Then you must take cognizance of t...

Companies (Amendment) Ordinance, 2019- Comply or Face Consequences seems to be the order of the day

Corporate Law & Intellectual Property Rights | By Soumik Kumar Sen | Last updated on Jan 18, 2019

Companies (Amendment) Ordinance, 2019 which has just been introduced by the Government makes the intention of the Government amply clear-...

Angel tax: the latest DIPP notification demystified for startups, investors

Direct Taxes (including International Taxation) | By ALOK PATNIA | Last updated on Jan 18, 2019

Credit: YourStory Amid several calls from startups for abolishing angel tax and media reports that the government may water down angel ta...

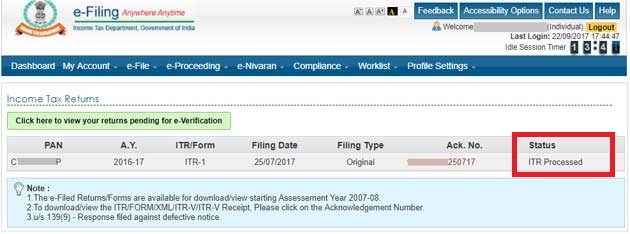

Income Tax return processing time to reduce from 63 days to just 1 day

Direct Taxes (including International Taxation) | By ALOK PATNIA | Last updated on Jan 18, 2019

Credit: Economic Times The Union Cabinet on Wednesday approved an integrated income-tax e-filing and centralised processing centre (CPC) ...

Brokerages set up shop in Daman to avail tax exemption

Direct Taxes (including International Taxation) | By ALOK PATNIA | Last updated on Nov 22, 2019

The Union Territory of Daman and Diu is emerging as a hub for Indian brokerages thanks to a favorable tax law. The region with less than ...

GST panel to study uniform tax rate on lottery

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Jan 18, 2019

Photo Credit: Bloomberg Quint A GST ministerial panel will suggest whether a uniform tax rate should be imposed on lotteries or the cur...

Delhi HC stays Rs 383-crore fine on Hindustan Unilever for GST profiteering

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Jan 17, 2019

The Delhi High Court has stayed an order given by the National Anti-profiteering Authority (NAA) against Hindustan Unilever Ltd (HUL). NA...

E-way bill to be integrated with NHAI’s FASTag to track GST evasion from April

GST & Other Indirect Taxes | By ALOK PATNIA | Last updated on Jan 16, 2019

Credit: Livemint The GST e-way bill system is likely to be integrated with NHAI’s FASTag mechanism from April to help track movemen...

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us