Blogs

CBDT further extends due date for filing of ITRs and Tax Audit Reports to November 7, 2017

News & FAQs | By ALOK PATNIA | Last updated on Nov 1, 2017

The Central Board of Direct taxes has further extended the ‘due date’ for filing Income-tax Returns and various reports of audit prescrib...

Nearly 17 lakh companies registered till September end

News & FAQs | By ALOK PATNIA | Last updated on Nov 1, 2017

Nearly 17 lakh companies had been registered in India as of last month, out of which a little over 5.32 lakh entities had closed down, ...

Next big GST move could reduce prices of many items

News & FAQs | By ALOK PATNIA | Last updated on Nov 1, 2017

India could review the application of the highest 28% slab under the goods and services tax (GST) and consider imposing a lower rate on i...

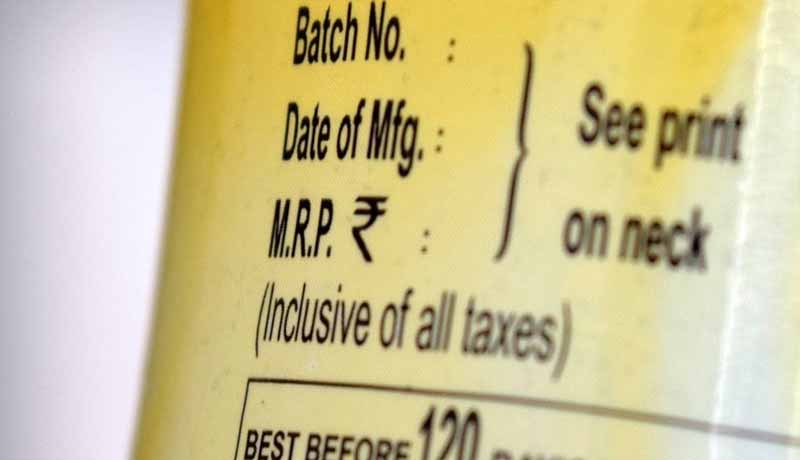

Panel suggests making GST inclusion in MRP mandatory

News & FAQs | By ALOK PATNIA | Last updated on Nov 1, 2017

GoM has recommended that the government make it amply clear in the present GST law that MRP is the maximum price of a product to be sold ...

How to file GSTR 2 – Beginner’s guide

GST & Other Indirect Taxes | By Editor | Last updated on Oct 31, 2017

What is Form GSTR-2? GSTR-2 is the details of inward supplies of goods or services to be furnished by registered taxpayer on a monthly ba...

Due date for GSTR-2 & GSTR-3 for July 2017 extended

News & FAQs | By ALOK PATNIA | Last updated on Oct 30, 2017

To facilitate trade, last date for filing GSTR-2 & GSTR-3 for July 2017 extended to 30th Nov & 11th Dec 2017 respectively. Every ...

Is GST to be levied on ocean freight for imported goods?

GST & Other Indirect Taxes | By Dipanjali Chakraborty | Last updated on Oct 30, 2017

Ocean freight on imported goods has always been a controversial topic in Indirect taxation regime. Even under Service Tax, the issue was ...

Businesses under composition scheme to soon start filing GST returns

News & FAQs | By ALOK PATNIA | Last updated on Oct 30, 2017

Businesses which opted for composition scheme in the July-September quarter will get to file their maiden GST returns soon. Around 15 la...

GoM for 12% GST on AC eateries, composition scheme tax cut

News & FAQs | By ALOK PATNIA | Last updated on Oct 30, 2017

The Group of Ministers set up to make GST composition scheme more attractive today suggested lowering tax rates for manufacturers and res...

Toll Free:

Toll Free:  Contact Us

Contact Us