This content would basically cover the following topics:

This content would basically cover the following topics:

- Relevance of place of supply

- Rules for determining place of supply of goods

- Rules for determining place of supply of services

Legal Overview

122nd Constitutional Amendment Bill (“Amendment Bill”) gave power for introduction of GST.

As per Article 286 (of Amendment Bill), no law of a state shall impose a tax on supply of goods or of services or both where such supply takes place:

–outside the state, or

–in the course of import of the goods or services or both into, or export of the goods or services or both out of, the territory of India.

- It has also been specified in Article 246A (of Amendment Bill) that Parliament has exclusive power to make laws with respect to GST where the supply of goods, or of services, or both takes place in the course of interstate trade or commerce.

122nd Constitutional Amendment Bill (“Amendment Bill”) gave power for introduction of GST.

As per Article 286 (of Amendment Bill), no law of a state shall impose a tax on supply of goods or of services or both where such supply takes place:

–outside the state, or

–in the course of import of the goods or services or both into, or export of the goods or services or both out of, the territory of India.

- It has also been specified in Article 246A (of Amendment Bill) that Parliament has exclusive power to make laws with respect to GST where the supply of goods, or of services, or both takes place in the course of interstate trade or commerce.

- Accordingly, tax under the GST laws would be imposed in the following manner :

- Intra-state supplies: Centre shall impose CGST and the respective state shall impose SGST; and

- Inter-state supplies: Centre shall impose IGST.

- It thus becomes imperative to define “intra-state supply”; and “inter-state supply”.

- Article 269A(2) and Article 286 (of Amendment Bill) provides that Parliament may, by law, formulate the principles for determining when a supply of goods, or of services, or both takes place:

oin the course of interstate trade or commerce; or

(i)outside the state; or

(ii) in the course of import of the goods or services or both into, or export of the goods or services or both out of, the territory of India

- Accordingly, the Integrated Goods and Services Tax Act, 2016 (“IGST Act”)

defines the principles for determining supply of goods and/or services in the course of inter-state trade or commerce, and also in the course of intra-state trade or commerce. The said provisions are contained in Section 3 and 3A of the IGST Act.

- Supply of goods and services in the course of inter-State trade or commerce means any supply where the

(i)location of the supplier and the place of supply

(ii)are in different States

- Supply of goods and services in the course of intra-State trade or commerce means any supply where the

(i)location of the supplier and the place of supply

(ii)are in same State

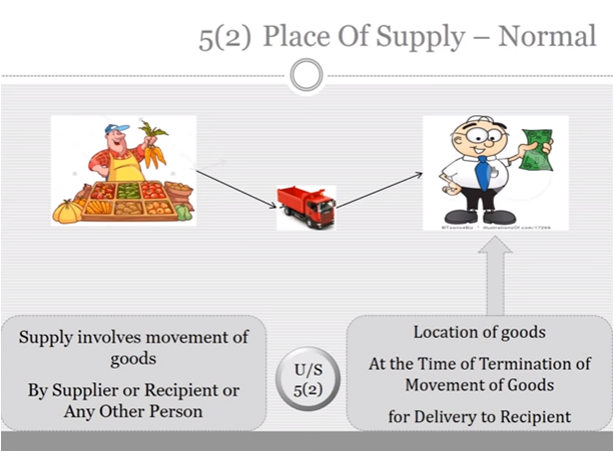

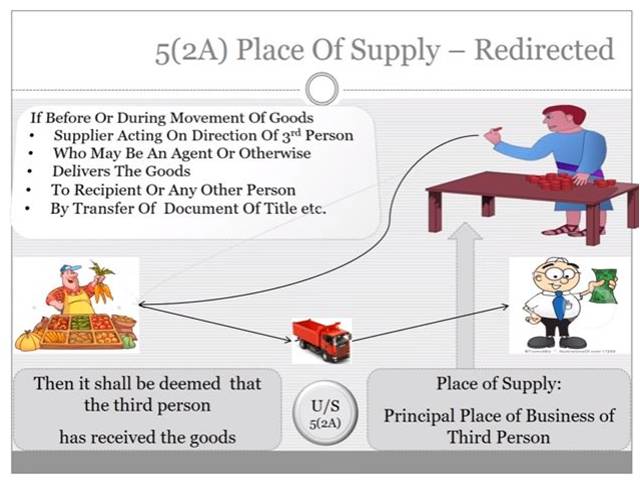

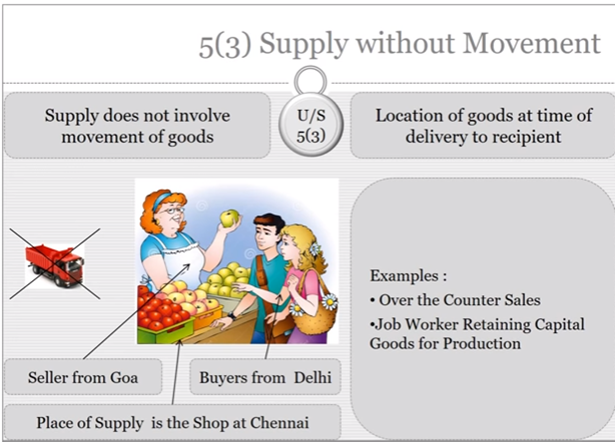

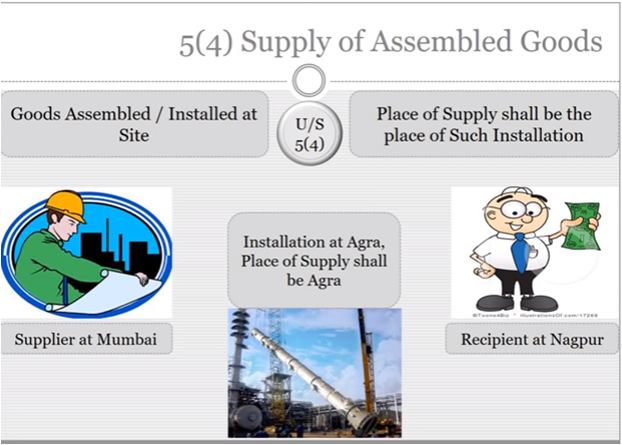

- Thus, for determining whether a supply is inter-state or intra-state, it is important to determine its “place of supply”.

- “Place of supply” is also required for determining whether any supply is “export of service” or not.

- Article 269A provides that Parliament may, by law, formulate the principles for determining the place of supply of any goods or services.

- Article 269A (2) provides that Parliament may, by law, formulate the principles for determining the place of supply of any goods or services.

Article 269A

(1)….

(2) Parliament may, by law, formulate the principles for determining the place of supply, and when a supply of goods, or of services, or both takes place in the course of inter-State trade or commerce.’’

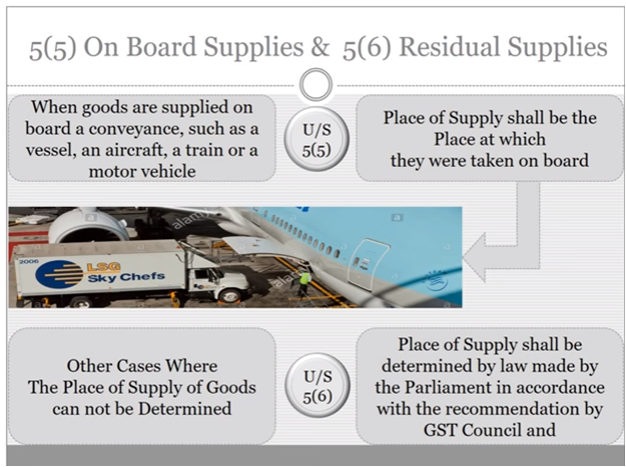

- accordingly Section 5 and Section 6 are formulated in IGST Act

Basic Principles of ‘Place of supply”

- The basic principle behind ‘place of supply’ provisions is that GST is consumption based tax. The tax is payable in the state in which goods or services or both are consumed

- If location of supplier of services and place of supply are in the same state or union territory, CGST and SGST / UTGST payable

- If location of supplier of service and place of supply are in different states or union territory, IGST is payable

- Supply of services to or by a SEZ developer or an SEZ unit, shall be deemed to be supply of services in the course of Inter-State Trade or Commerce

- Supply of services where the location of the supplier and the place of supply are in the same state or union territory shall be treated as intra-state supply. However, this is subject to the provisions of section 12 of IGST Act. Further, the intra state supply of services shall not include supply of services to or by a SEZ developer or to or by a SEZ unit

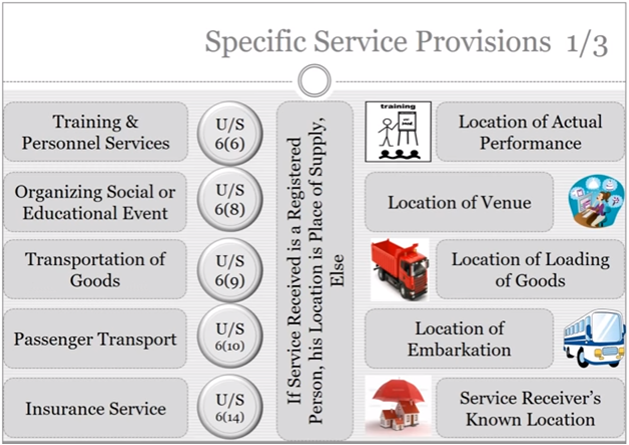

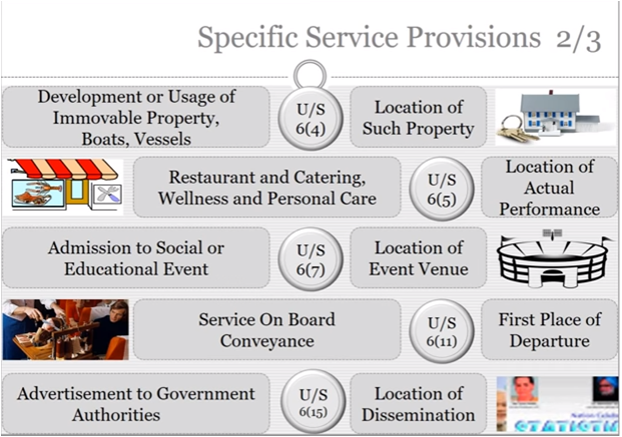

- Specific provisions have been made for place of supply in case of services:

a)Directly relating to immovable property,

b)Restaurant,

c)Training and Appraisal,

d)Admission to events,

e)Transportation of goods and passengers,

f)Services on board a conveyance,

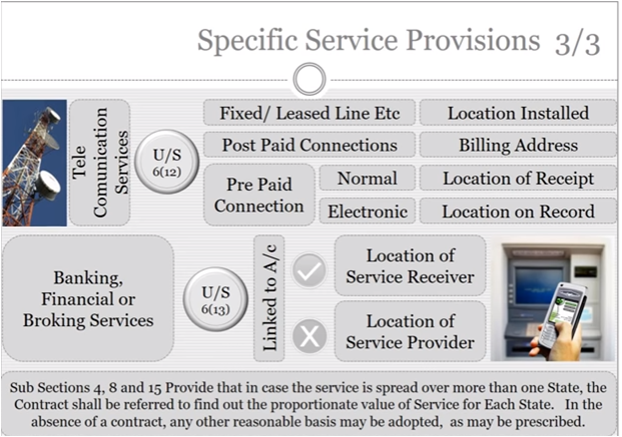

g)Telecom services,

h)Banking and Financial services;

i)Insurance services, and advertisement services to Govt within India

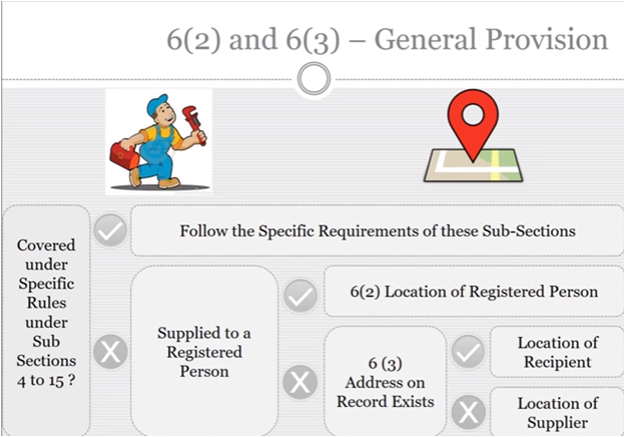

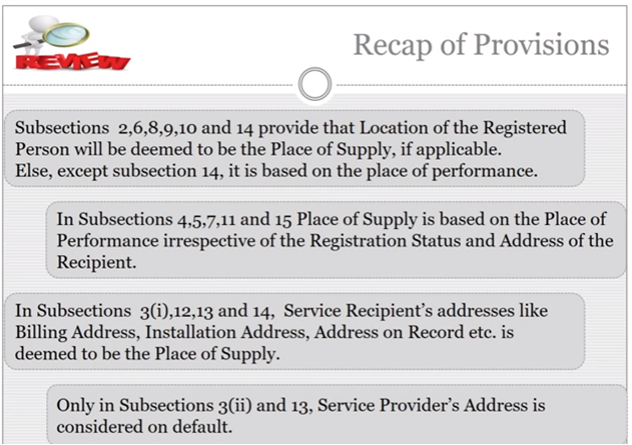

- In case of services other than those specified in the last slide, the place of supply of services –

a)Made to a registered person shall be location of service recipient – Section 12(2)(a) of IGST Act,

a)Made to any person other than a registered person shall be

(i) the location of the recipient where the address on record exists,

and (ii) the location of the supplier of services in other cases

PLACE OF SUPPLY OF GOODS:

Place of Supply of Services

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance.

Toll Free:

Toll Free:  Contact Us

Contact Us