TIME OF SUPPLY OF GOODS

(1) The liability to pay GST on the goods shall arise at the time of supply as determined in terms of the provisions of this section

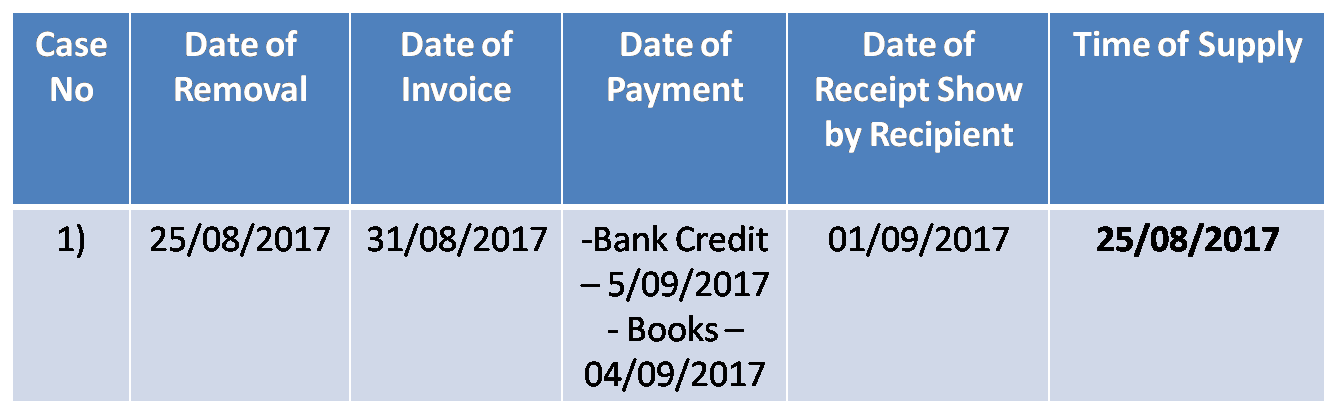

(2) The time of supply of goods shall be the earliest of the following dates, namely,-

(a)(i) the date on which the goods are removed by the supplier for supply to the recipient, in a case where the goods are required to be removed or

(ii) the date on which the goods are made available to the recipient, in a case where the goods are not required to be removed; or

(b) the date on which the supplier issues the invoice with respect to the supply; or

(c) the date on which the supplier receives the payment with respect to the supply; or

(d) the date on which the recipient shows the receipt of the goods in his books of account.

Note-1 Provision of sub clause (ii) of clause (a) Subsection(2) of section 12 will apply in the following instances : –

-Immovable Supply

–Supplied in assembled or installed form

–Supplied by supplier to his agent or his principal

Note -2 Made available to the recipient means –

Goods are placed at the disposal of recipient

Note :1 Supply of Goods shall deemed to have been made to the extent it is covered by the Invoice & Payment made for the purpose of subsection 2 clause (b) & (c ).

Note : 2 Date of credit by bank or date of entry in the books of account w.e.f will be deemed to be the date of receipt of payment for the purpose of subsection 2 clause (c)

Example 1 – Supply of FMCG Goods ( Movable Goods)

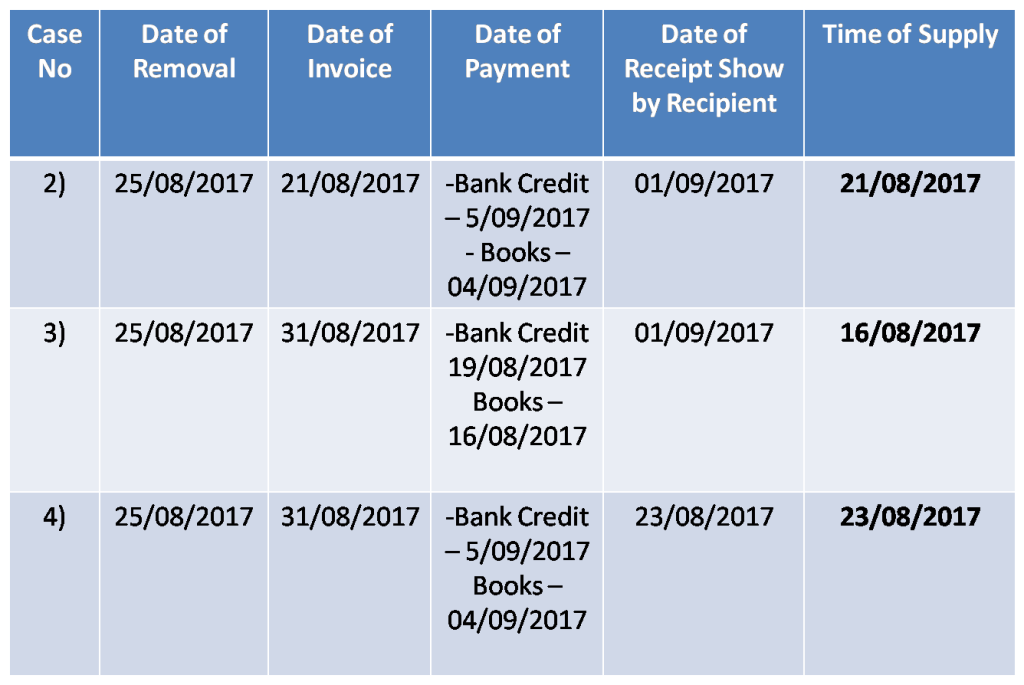

(3) In case of continuous supply of goods, where successive statements of accounts or successive payments are involved, the time of supply shall be the date of expiry of the period to which such successive statements of accounts or successive payments relate. If there are no successive statements of account, the date of issue of the invoice (or any other document) or the date of receipt of payment, whichever is earlier, shall be the time of supply.

(4) For the purposes of sub section (3) above, the Central or a State Government may, on the recommendation of the Council, specify, by notification, the supply of goods that shall be treated as continuous supply of goods;

Example 2 Goods – Assembled Goods – Contract Price is Rs.25,00,000/- Payment & Invoice details are below

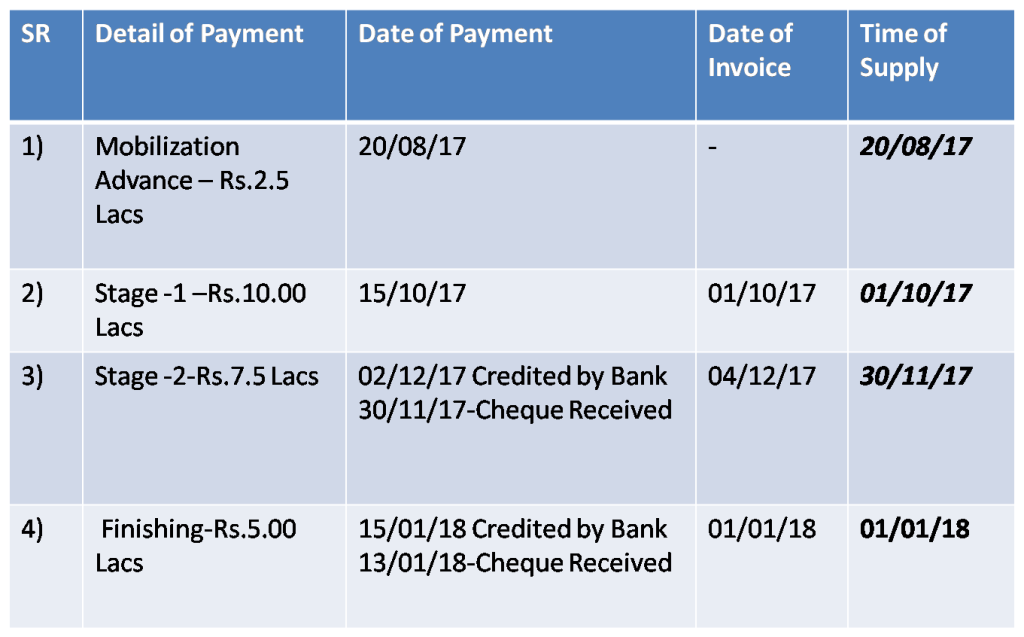

(5) In case of supplies in respect of which tax is paid or liable to be paid on reverse charge basis, the time of supply shall be the earliest of the following dates, namely—

(a)the date of the receipt of goods, or

(b) the date on which the payment is made, or

(c) the date of receipt of invoice, or

(d) the date of debit in the books of accounts.

Please note – Triggering event would be the entry to the Quantitative records, that is , when we make entry into GRN –

1)Date of Invoice v/s Date of receipt of Invoice.

2)Payment- Book entry or Bank Debit which ever is earlier.

Example 3 Supply of Goods – Reverse Charge Basis

(6) If the goods (being sent or taken on approval or sale or return or similar terms) are removed before it is known whether a supply will take place, the time of supply shall be at the time when it becomes known that the supply has taken place or six months from the date of removal, whichever is earlier.

1)This section will play key importance in case of E-Commerce trade where goods are mainly sold on approval or return basis.

2) If the period of return is less than 6 month than , expiry of such shorter period will be taken as Supply has taken place. For ex. Cell Phone sold be ecommerce website , return period is 10 days.

(7) In case it is not possible to determine the time of supply under the provisions of subsection (2), (3), (5) or (6), the time of supply shall

(a) in a case where a periodical return has to be filed, be the date on which such return is to be filed, or

(b) in any other case, be the date on which the CGST/SGST is paid.

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance.

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us