With less than 7 days remaining for GST Implementation, it is easy to get a truckload of information around. Here is a last minute guide which would come handy for your business.

1)Migration to GST

Migration to GST will be starting again from 25.06.2017. If you still have not migrated from your current Indirect Tax regime, first and foremost make sure that you complete the migration.

2)Accounting Structure and Process Preparedness

From 01st July, how to do the Invoicing and maintain books of accounts should be widespread among the team.

Read our guide on Invoicing under GST here: Invoicing Process under GST

3) Things to Do for smooth transition to GST

TRADER/MANUFACTURER –

i)Proper Stock taking to be completed

ii) Calculate the amount of taxes already paid on such materials and inputs available on them

iii)Ensure that proper Invoicing has been done

iv)Ensure that all returns have been filed with all the existing tax departments applicable to the business

v)Understand the new rates that would be applicable to your business and basic impact

SERVICE PROVIDER–

1)Ensure that proper Invoicing has been done

2)Calculate the amount of taxes already paid and inputs available on them

3)Ensure that all returns have been filed with all the existing tax departments applicable to the business

4)Understand the new rates that would be applicable to your business and basic impact

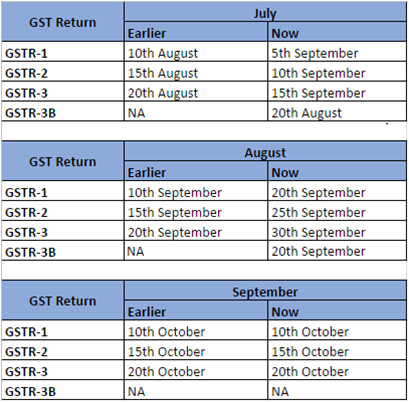

4)Compliances to be done immediately post transition period (July- September,2017 )

1)Last Service Tax Return for the period of April- June 2017 has to be filed by 15th of August, 2017

2) Every registered person has to file a Form GST TRAN-1 within 90 days of appointed date.

3) Input tax credit claimed in the return filed under previous laws for the period prior to the appointed day (1 July 2017) would be transferred to the electronic credit ledger. Existing manufacturers/dealers can claim the CENVAT credit in respect of input held in stock, semi-finished or finished goods held in stock certain conditions are satisfied.

5)Team Training

Your internal team should be well equipped with the nuances of the return filing, accounting, Invoicing aspects. It might be a good alternative to outsource GST compliances as a whole to experts, if suitable for your business.

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance.

Toll Free:

Toll Free:  Contact Us

Contact Us