Raising of invoices will be the most crucial part of the GST Regime. It will be the basis on which rightful inputs can be availed.

Raising of invoices will be the most crucial part of the GST Regime. It will be the basis on which rightful inputs can be availed.

The absence or wrong filing of required information could trigger denial or delay in claiming input tax credit.

In the GST regime, two types of invoices will be issued:

1.Tax invoice

2.Bill of supply

Tax Invoice

When a registered taxable person supplies taxable goods or services, a tax invoice is issued.

- There are 16 particulars that are required to be filled up in the invoice, these include:

– HSN (Harmonised System of Nomenclature) code,

– 15-digit goods and services taxpayer identification number (GSTIN) of the recipient; and

– the state code in which the delivery has been made.

- For generating the invoice, variety of transactions needs to be captured , such as:

– services on inter-company basis,

– stock transfer and receipt of advances; and

– centralised procurements for re-distribution

Time limit for issue of tax invoice

In CASE of Supply of SERVICES:

The tax invoice must be issued before or at the time of Removal of goods, where supply involves movement of goods

OR

At the time of delivery of goods to the recipient, where supply does not require movement of goods

PS – In case of reverse charge, the invoice needs to be issued on the date of receipt of goods or services.

In CASE of Supply of SERVICES:

The tax invoice must be issued within 30 days from the date of supply of the service.

Where the supplier is a bank or any financial institution, the invoice must be issued within 45 days of the supply of service.

Copies of the tax invoice under GST

In case of Supply of Goods:

3 copies of the invoice are required – Original, Duplicate, and Triplicate.

Original invoice: The original invoice is issued to the receiver, and is marked as ‘Original for recipient’.

Duplicate copy: The duplicate copy is issued to the transporter, and is marked as ‘Duplicate for transporter’. This is not required if the supplier has obtained an invoice reference number. The Invoice reference number is given to a supplier when he uploads a tax invoice issued by him in the GST portal. It is valid for 30 days from the date of upload of invoice.

Triplicate copy: This copy is retained by the supplier, and is marked as ‘Triplicate for supplier’.

In CASE of Supply of Services:

2 copies of the invoice are required:

Original Invoice: The original copy of the invoice is to be given to receiver, and is marked as ‘Original for recipient’.

Duplicate Copy: The duplicate copy is for the supplier, and is marked as ‘Duplicate for supplier’.

What does a tax invoice for export contain?

An export invoice must, in addition to the details required in a tax invoice, contain the following details:

- Must have the words ‘“Supply meant for export on payment of IGST” or “Supply meant for export under bond without payment of IGST”

- Name and address of the recipient

- Delivery address

- Number and date of ARE-1 (application for removal of goods for export)

PS – Bill of Supply is to be issued by a registered supplier in case of Supply of exempted goods or services and Supplier is paying tax under composition scheme.

Revising already raised invoices under GST

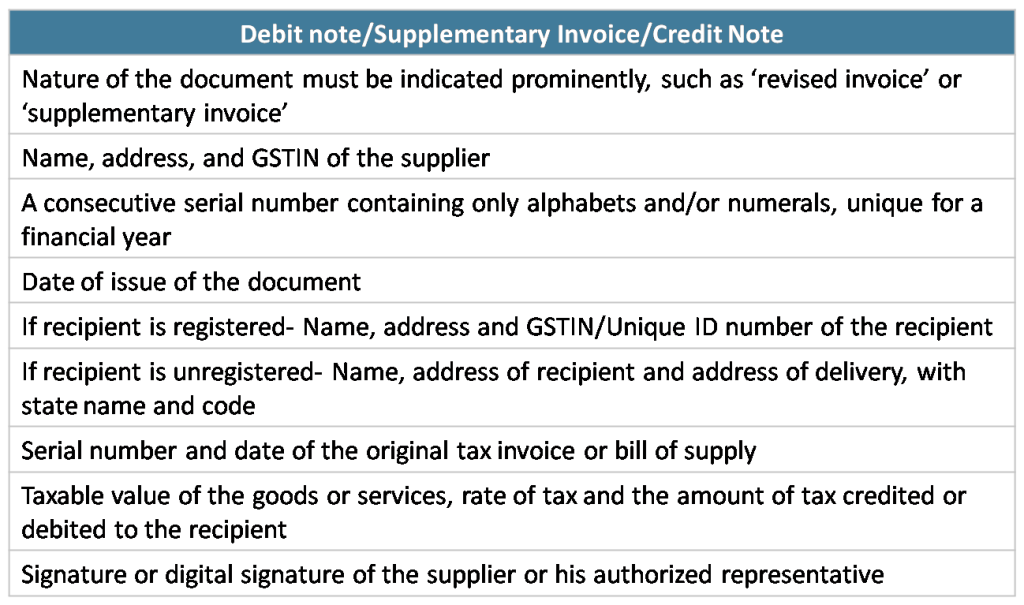

To revise the taxable value or GST charged in an invoice, a debit note or supplementary invoice or credit note must be issued by the supplier.

Debit note/supplementary invoice- These are to be issued by a supplier to record increase in taxable value &/or GST charged in the original invoice.

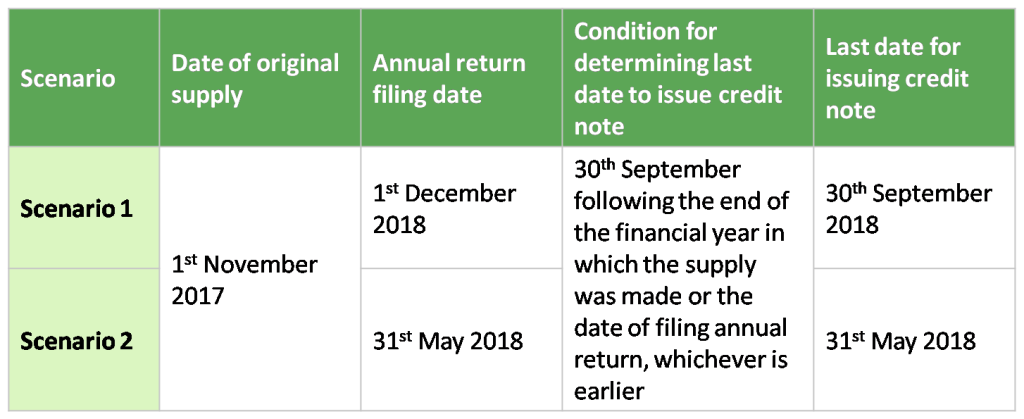

Credit note- These are to be issued by a supplier to record decrease in taxable value &/or GST charged in the original invoice. Credit note must be issued on or before 30th September following the end of the financial year in which the supply was made OR before the date of filing of the relevant annual return, whichever is earlier.

Let us ascertain the last date by when Super Cars Ltd must issue the credit note using 2 scenarios –

Scenario 1- They file annual return of the Financial Year 17-18 on 1st December ’18

Scenario 2- They file annual return of the Financial Year 17-18 on 31st May ‘18.

Details debit notes/ supplementary invoices & credit notes should include:

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance.

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us