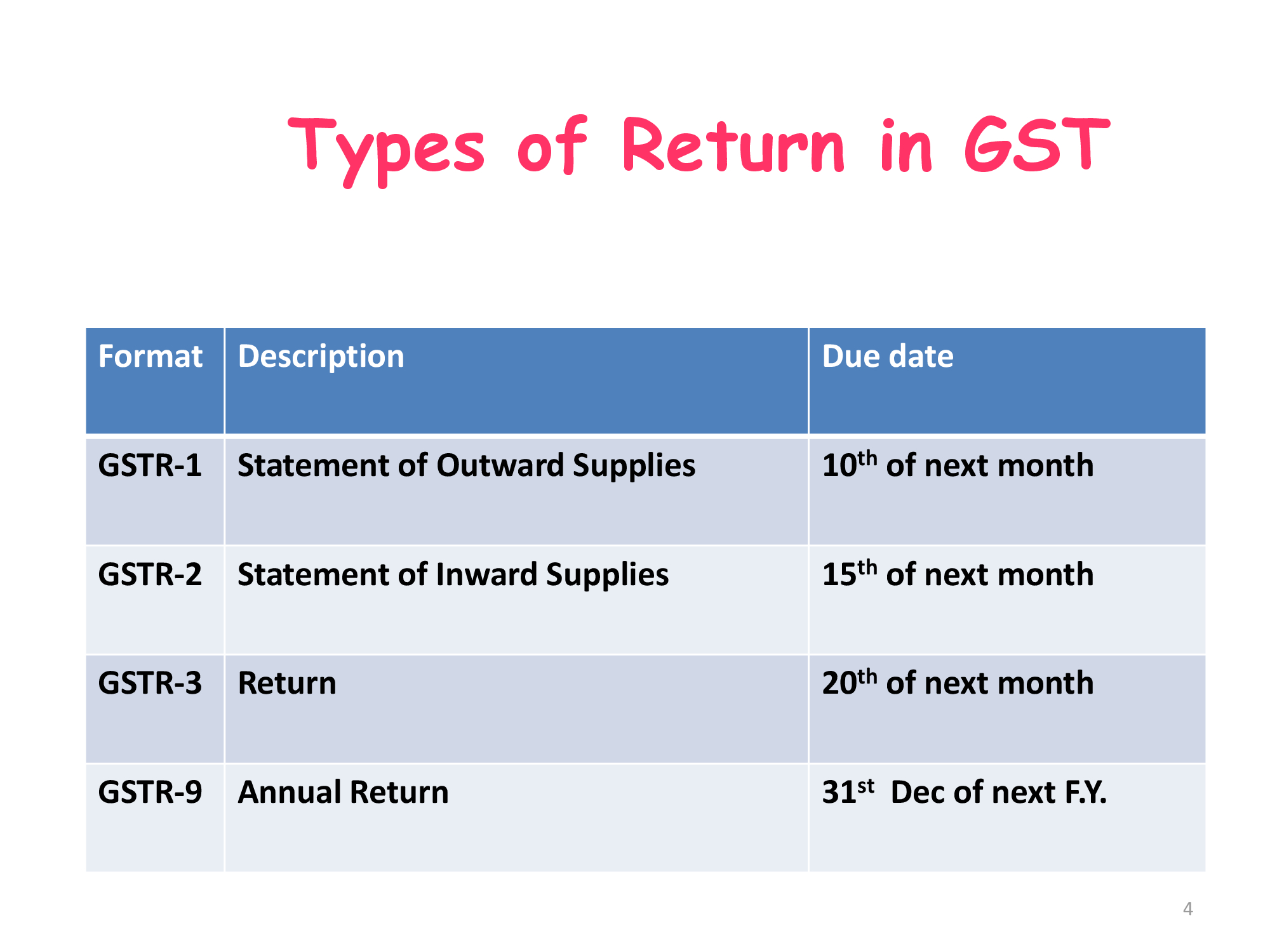

Furnishing details of outward supplies- (GSTR 1)

- This Return is not applicable to Input Service Distributor, Deductor of Tax (Section 37) and Taxable persons opting for Composition Levy (Section 8).

- This e-return shall be filed within 10 days from the end of the tax period.

- Details of outward supplies” which shall include details relating to zero-rated supplies, inter-state supplies, return of goods received in relation to/ in pursuance o an inward supply, exports, debit notes, credit notes and supplementary invoices issued during the said tax period.

Revision / Rectification of Original Return :

- In case any outward supplies are not matched with the respective recipients’ return of inward supplies, the return for outward supplies requires rectification which is allowed.

- Such rectification, however, is not permitted after filing of the annual return or the return for the month of September of the following year whichever is earlier.

Furnishing details of inward supplies-(GSTR 2)

- With respect to the return for outward supplies filed by the supplier of goods/services (under section 25) the receiver is required to match his receipts with the details of supplies filed by the supplier.

- In fact, the receiver is required to –verify, validate, modify or even delete – the details furnished by the suppliers. Now, these details as accepted by the recipient will be filed in the return for inward supplies by the recipient.

- Details of inward supplies include debit notes, credit notes and inward supplies liable for tax payment on reverse charge basis.

- This Return is not applicable to Input Service Distributor, Deductor of Tax (Section 37) and Taxable persons opting for Composition Levy (Section 8).

Revision / Rectification of Original Return :

- In case the return for inward supplies requires rectification, it is allowed.

- Such rectification, however, is not permitted after filing of annual return or the return for the month of September of the following year, whichever is earlier.

- The information submitted in GSTR-1 by the Counterparty Supplier of the taxpayer will be auto-populated in the concerned tables of GSTR-2. The same may be modified i.e. added or deleted by the Taxpayer while filing the GSTR-2. The recipient would be permitted to add invoices (not uploaded by the counterparty supplier) if he is in possession of invoices and has received the goods or services.

- This e-return shall be filed within 15 days from the end of the tax period.

GSTR 3 – Return

- Every Registered Taxable Person for every calendar month Shall furnish the following:

(a) of inward and outward supplies of goods and/or services,

(b) input tax credit availed,

(c) tax payable,

(d) tax paid and

(e) other particulars as may be prescribed

(f) within 20 days after the end of such month:

- Paying tax under composition scheme shall furnish a return for each quarterly basis, electronically, in prescribed form manner, within 18 days after the end of such quarter

- If any taxable person after furnishing a return discovers any omission or incorrect particulars therein, shall rectify in the return to be filed for the month or quarter, during which such omission or incorrect particulars are noticed, subject to payment of specified interest as applicable.

What gets matched?

- Tax Invoices

- Debit and Credit Notes

Valid Return

- Unless tax is paid, the return does not go for matching – ITC for invoices that have been uploaded but tax not paid will get reversed.

-

No tax payer can file a monthly return unless he has filed a valid return for previous month’s return.

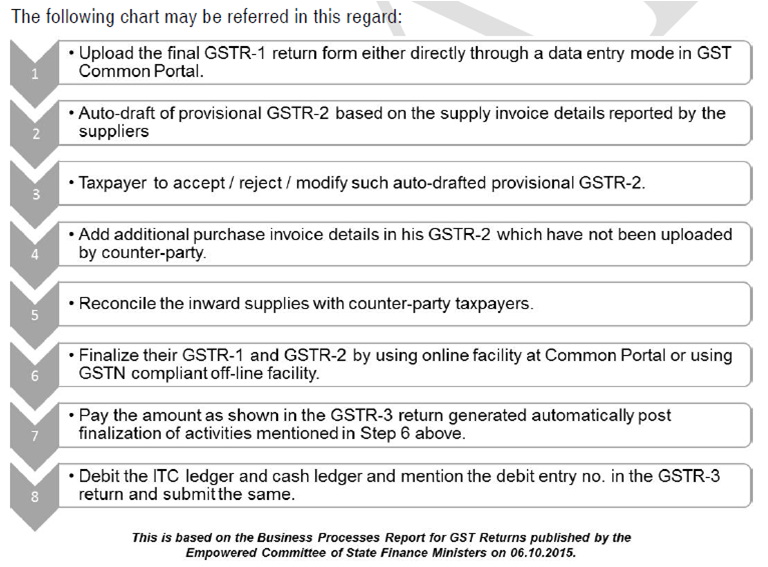

Steps for Return Filing

GSTR 9 – Annual Return

- Form GSTR-9 is required to be furnished by every registered taxable person, other than ISD, TDS deductor, Casual taxable person and Non-resident taxable person on or before 31st December following the end of the FY. Persons required to get their accounts audited must also furnish annual return along with audited copy of annual accounts and reconciliation statement, reconciling the value of supplies declared in annual return with annual financial statement.

- The Model GST law contemplates that a taxable person cannot take the credit of tax paid on goods and/or services after filing GSTR-3 for the month of September following the end of financial year to which such invoice pertains or filing of the relevant Annual Return (31st December), whichever is earlier.

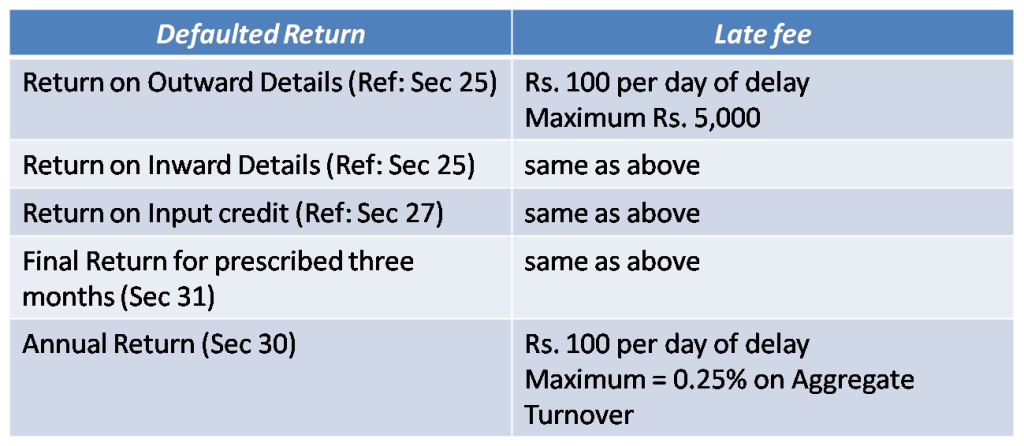

Returns: Late Filing

Points to note:

- Every assessee registered and falling under the ambit of taxability has to furnish outward supply/output service details in Form GSTR-1 (GST Returns-1) by the 10th of the subsequent month.

- Further, on the 11th of the subsequent month, the visibility of inward supplies/input services is available for the recipient for perusal in the auto-populatedGSTR-2A.

- The tenure ranging from 11thof the said a subsequent month to the 15thof the month will allow for the corrections, if any, (additions, modifications, and deletion) in Form GSTR-2A and submission in Form GSTR-2by 15th of the subsequent month.

- The aforesaid corrections (addition, modification, and deletion) by the recipient in Form GSTR-2 will be available to a supplier inForm GSTR-1A. The supplier needs to follow the either of the options i.e., to accept or reject the adjustments made by the recipient. The Form GSTR-1 will be amended according to the extent of corrections confirmed by the supplier.

- Subsequently, on 20thof the said month, the auto-populated return GSTR-3 will be available for submission along with the payment for the same.

- Post the due date of filing the monthly return i.e.,Form GSTR-3, the inward supplies will be matched with the outward supplies as furnished by the supplier, and then the final acceptance of input tax credit will be communicated in Form GST ITC-1.

- Also, the mismatch input tax credit on account of excess claims or duplication claims will be communicated inForm GST ITC-1. Discrepancies not ratified will be added as output tax liability along with interest. However, within the prescribed time, if it is ratified, the recipient will be eligible to reduce this output tax liability.

- Post the due date of filing the monthly return i.e.,Form GSTR-3, the inward supplies will be matched with the outward supplies as furnished by the supplier, and then the final acceptance of input tax credit will be communicated in Form GST ITC-1.

- Also, the mismatch input tax credit on account of excess claims or duplication claims will be communicated in Form GST ITC-1. Discrepancies not ratified will be added as output tax liability along with interest. However, within the prescribed time, if it is ratified, the recipient will be eligible to reduce this output tax liability.

- In addition to the above returns, a registered taxable person is also required to file an Annual Return in form GSTR-9. Specific provisions have been made for filing the First Return by every assessee. Further, returns have also been prescribed for a Composition taxpayer (in form GSTR-4), Non-resident foreign taxpayer (in form GSTR-5), Input Service Distributor (in form GSTR-6) and TDS deductor (in form GSTR-7).

- A registered taxable person is also required to file a Final Return in case of cancellation of registration. There is no provision for revising the returns, but rectification of errors/omissions is allowed upto a prescribed time period. It may be noted that levy for late fee for delay or non-filing of returns are prescribed

- The Model GST law contemplates that a taxable person cannot take the credit of tax paid on goods and/or services after filing GSTR-3 for the month of September following the end of financial year to which such invoice pertains or filing of the relevant Annual Return (31st December), whichever is earlier.

- A Composition taxpayer is required to furnish the First Return for the period starting from the date on which he becomes a registered taxable person till the end of the quarter in which the registration is granted. Every registered taxable person applying for cancellation of registration shall furnish a Final Return within 3 months of the date of cancellation or date of cancellation order, whichever is later.

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance.

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us