WHAT IS REFUND UNDER GST?

WHAT IS REFUND UNDER GST?

Refund has been discussed in Section 54 of the CGST/SGST Act.

“Refund” includes :

(a)any balance amount in the electronic cash ledger so claimed in the returns,

(b)any unutilized input tax credit in respect of (i) zero rated supplies made without payment of tax or, (ii) where the credit has accumulated on account of rate of tax on inputs being higher than the rate of tax on output supplies (other than nil rated or fully exempt supplies),

(c)tax paid by specialized agency of United Nations or any Multilateral Financial Institution and Organization notified under the United Nations (Privileges and Immunities) Act, 1947, Consulate or Embassy of foreign countries on any inward supply.

SITUATIONS FOR REFUND UNDER GST

- Export of Goods or Services (Including Deemed Export)

- Refund of Unutilized Input Tax Credit

- Refund from Manufacturing / Generation / Production – Tax Free Supplies

- Excess payment due to mistake and inadvertence

- Finalization of Provisional Assessment

- Refund for Tax payment on transactions by UN bodies, CSD Canteens, Para-military forces canteens, etc

- Refund of pre deposit in case of Appeal.

REFUNDS

Section 54 (1) – Refund of Tax

Any person claiming refund of any tax and interest, if any, paid on such tax or any other amount paid by him, may make an application before the expiry of two years from the relevant date in such form and manner as may be prescribed

Provided that a registered person, claiming refund of any balance in the electronic cash ledger in accordance with the provisions of sub-section (6) of section 49, may claim such refund in the return furnished under section 39 in such manner as may be prescribed.

Section 49 (6) – The balance in the electronic cash ledger or electronic credit ledger after payment of tax, interest, penalty, fee or any other amount payable under this Act or the rules made thereunder may be refunded in accordance with the provisions of section 54.

EXPORT OF GOODS OR SERVICES (INCLUDING DEEMED EXPORT)

- Tax paid on inward supply of goods and/or services which have been exported or on inputs or input services used in goods and/or services exported can be claimed as refund.

Proviso to Sec 54(3) – Provided further that no refund of unutilised input tax credit shall be allowed in cases where the goods exported out of India are subjected to export duty

- Unutilized input tax credit due to output supplies being exports or zero rated supplies can be claimed as refund

- In case of exports of goods and/ or services out of India on which export duty is payable then availing the input tax credit of duty paid inputs and exporting finished goods after payment of duty (after utilizing such input tax credit) and thereafter claiming the rebate of the duty paid on export. Refund of the unutilized input tax credit can’t be claimed.

ORDER FOR REFUND ON ACCOUNT OF EXPORT

If the refund is on account of export of goods and/or services, the authorised officer will refund 90% of the total amount claimed as refund on a provisional basis in Form GST RFD-4. Thereafter, after due verification of the documents furnished, the officer will issue an order for final settlement of the refund claim.

Provisional refund will be granted subject to the following conditions:

- The person claiming refund has not been prosecuted for tax evasion of an amount exceeding Rs. 250 Lakhs during the preceding 5 years.

- The person’s GST compliance rating is not less than 5 on a scale of 10.

- No pending appeal, review or revision exists on the amount of refund.

REFUND OF UNUTILIZED INPUT TAX CREDIT

Section 54 (3)

Subject to the provisions of sub-section (10), a registered person may claim refund of any unutilised input tax credit at the end of any tax period:

Provided that no refund of unutilised input tax credit shall be allowed in cases other than––

(i) zero rated supplies made without payment of tax;

(ii) where the credit has accumulated on account of rate of tax on inputs being higher than the rate of tax on output supplies (other than nil rated or fully exempt supplies), except supplies of goods or services or both as may be notified by the Government on the recommendations of the Council.

REFUND FROM MANUFACTURING / GENERATION / PRODUCTION / CREATION OF TAX FREE SUPPLIES

GST paid on inputs used for the Manufacturing / Generation / Production / Creation of tax free supplies can be claimed as refund.

EXCESS PAYMENT DUE TO MISTAKE OR INADVERTENCE

Refund of excess payment of tax either by mistake or by inadvertence resulting in more payment of tax than due to the Government can be claimed.

REFUND FOR TAX PAYMENT ON TRANSACTIONS BY UN BODIES, CSD CANTEENS, PARA-MILITARY FORCES CANTEENS ETC

Section 55

The Government may, on the recommendations of the Council, by notification, specify any specialised agency of the United Nations Organisation or any Multilateral Financial Institution and Organisation notified under the United Nations (Privileges and Immunities) Act, 1947, Consulate or Embassy of foreign countries and any other person or class of persons as may be specified in this behalf, who shall, subject to such conditions and restrictions as may be prescribed, be entitled to claim a refund of taxes paid on the notified supplies of goods or services or both received by them.

Conclusion:

- Supply to UN Bodies, Embassies, CSD Canteens and Para-military forces canteen will be taxed, which later on can be claimed as refund by them.

- UN Bodies, Embassies, CSD Canteens and Para-military forces canteen will be required to take a Unique Identity Number and purchases made by them will be reflected in the return of outward supplies of the supplier and refunds of taxes can be granted.

REFUND PROCESS UNDER GST

The procedure for processing of refund claim is as follows :

1.Application form for claiming refund can be filed through the GSTN portal.

2.An acknowledgement number would be shared with applicant via sms or email, once the application is filed electronically.

3.Adjustment would be made to return and cash ledger and reduce the “carry-forward input tax credit” automatically.

4.Refund application and documents submitted shall be scrutinized within a period of 30 days of filing the refund application.

5.Concept of “unjust enrichment” would be examined for reach refund application. If it does not qualify, then the refund would be transferred to CWF (Consumer Welfare Fund).

6.If refund claimed exceeds the predetermined amount of refund then it will go through pre-audit process for sanctioning the refund.

7.Refund will be credited electronically to the account of applicant via ECS, RTGS or NEFT.

8.Application for refund can be made at end of each quarter.

9.No refund shall be provided for an amount of less than Rs 1,000.

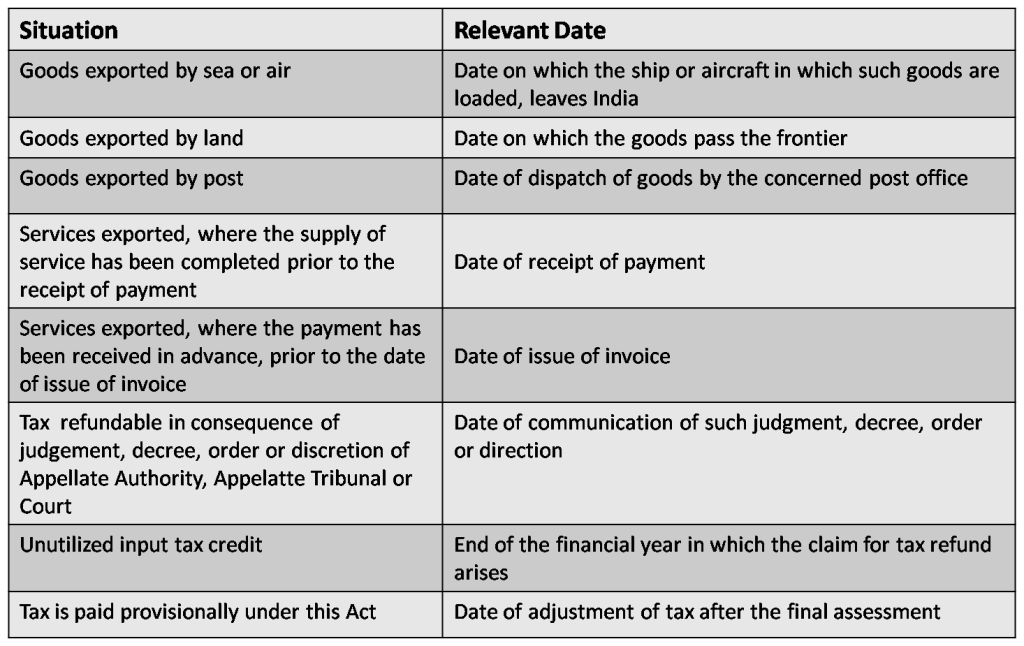

RELEVANT DATE FOR CLAIMING REFUND

As per Explanation to Sec 54, “Relevant Date” means –

(a)in the case of goods exported out of India where a refund of tax paid is available in respect of goods themselves or, as the case may be, the inputs or input services used in such goods,

(i) if the goods are exported by sea or air, the date on which the ship or the aircraft in which such goods are loaded, leaves India; or

(ii) if the goods are exported by land, the date on which such goods pass the frontier; or

(iii) if the goods are exported by post, the date of despatch of goods by the Post Office concerned to a place outside India;

(b) in the case of supply of goods regarded as deemed exports where a refund of tax paid is available in respect of the goods, the date on which the return relating to such deemed exports is furnished.

(c)in the case of services exported out of India where a refund of tax paid is available in respect of services themselves or, as the case may be, the inputs or input services used in such services, the date of––

(i) receipt of payment in convertible foreign exchange, where the supply of services had been completed prior to the receipt of such payment; or

(ii) issue of invoice, where payment for the services had been received in advance prior to the date of issue of the invoice;

(d)in case where the tax becomes refundable as a consequence of judgment, decree, order or direction of the Appellate Authority, Appellate Tribunal or any court, the date of communication of such judgment, decree, order or direction;

(e)in the case of refund of unutilised input tax credit under sub-section (3), the end of the financial year in which such claim for refund arises;

(f)in the case where tax is paid provisionally under this Act or the rules made thereunder, the date of adjustment of tax after the final assessment thereof;

(g)in the case of a person, other than the supplier, the date of receipt of goods or services or both by such person; and

(h) in any other case, the date of payment of tax

SNAPSHOT OF “RELEVANT DATE”

For claiming refund, application shall be made within 2 years from the relevant date. If refund of tax and interest has been paid under protest then the limitation of 2 years shall not be apply.

ELIGIBILITY FOR GETTING REFUND BY APPLICANT

Refund shall be paid to the applicant, if such amount is relatable to –

1.Refund of tax and interest or any other amount paid by the applicant + he had not passed such tax and interest to any other person.

2.Tax or interest borne by such other class of applicants notified by as the Central or State Government on the recommendation of the Council.

On receipt of any application, if proper officer is satisfied that the whole or part of the amount claimed as refund is not eligible for refund then he may make an order accordingly and amount so determined shall be credited to the Consumer Welfare Fund.

TIME LIMIT FOR GRANTING REFUND & INTEREST ON DELAYED REFUNDS

As per Section 54 (7) –

The proper officer shall issue the order within sixty days from the date of receipt of application complete in all respects.

As per Section 56 –

If any tax ordered to be refunded under sub-section (5) of section 54 to any applicant is not refunded within sixty days from the date of receipt of application under subsection (1) of that section, interest at such rate not exceeding six per cent as may be specified in the notification issued by the Government on the recommendations of the Council shall be payable in respect of such refund from the date immediately after the expiry of sixty days from the date of receipt of application under the said sub-section till the date of refund of such tax:

Provided that where any claim of refund arises from an order passed by an adjudicating authority or Appellate Authority or Appellate Tribunal or court which has attained finality and the same is not refunded within sixty days from the date of receipt of application filed consequent to such order, interest at such rate not exceeding nine per cent as may be notified by the Government on the recommendations of the Council shall be payable in respect of such refund from the date immediately after the expiry of sixty days from the date of receipt of application till the date of refund.

DOCUMENTS REQUIRED FOR CLAIMING REFUND UNDER GST

As per Section 54 (4) –

The application shall be accompanied by—

(a) such documentary evidence as may be prescribed to establish that a refund is due to the applicant; and

(b) such documentary or other evidence (including the documents referred to in section 33) as the applicant may furnish to establish that the amount of tax and interest, if any, paid on such tax or any other amount paid in relation to which such refund is claimed was collected from, or paid by, him and the incidence of such tax and interest had not been passed on to any other person:

Provided that where the amount claimed as refund is less than two lakh rupees, it shall not be necessary for the applicant to furnish any documentary and other evidences but he may file a declaration, based on the documentary or other evidences available with him, certifying that the incidence of such tax and interest had not been passed on to any other person.

CRUX –

1.If the amount claimed as tax refund is less than Rs. 5 Lakhs – The person needs to file a declaration, based on the documents or other evidence available with him, certifying that the incidence of tax or interest being claimed as refund has not been passed on to another person.

2.If the amount claimed as refund is more than Rs. 5 Lakhs – The application for refund must be accompanied by:a) Documentary evidence to establish that the refund is due to the person.

a) Documentary evidence to establish that the refund is due to the person.

b) Documentary or other evidence to establish that the amount was paid by him/her, and that the incidence of the tax or interest has not been passed on to another person.

OTHER IMPORTANT PROVISIONS

Section 54 (8) –

Notwithstanding anything contained in sub-section (5), the refundable amount shall, instead of being credited to the Fund, be paid to the applicant, if such amount is relatable to—

a)refund of tax paid on zero-rated supplies of goods or services or both or on inputs or input services used in making such zero-rated supplies;

b)refund of unutilised input tax credit under sub-section (3);

c)refund of tax paid on a supply which is not provided, either wholly or partially, and for which invoice has not been issued, or where a refund voucher has been issued;

d)refund of tax in pursuance of section 77 (i.e. Tax wrongfully collected and paid to Central Government or State Government);

e)the tax and interest, if any, or any other amount paid by the applicant, if he had not passed on the incidence of such tax and interest to any other person;

f)the tax or interest borne by such other class of applicants as the Government may, on the recommendations of the Council, by notification, specify.

Section 54 (10) –

Where any refund is due under sub-section (3) to a registered person who has defaulted in furnishing any return or who is required to pay any tax, interest or penalty, which has not been stayed by any court, Tribunal or Appellate Authority by the specified date, the proper officer may—

(a)withhold payment of refund due until the said person has furnished the return or paid the tax, interest or penalty, as the case may be;

(b)deduct from the refund due, any tax, interest, penalty, fee or any other amount which the taxable person is liable to pay but which remains unpaid under this Act or under the existing law.

Section 54 (13) –

Notwithstanding anything to the contrary contained in this section, the amount of advance tax deposited by a casual taxable person or a non-resident taxable person under sub-section (2) of section 27, shall not be refunded unless such person has, in respect of the entire period for which the certificate of registration granted to him had remained in force, furnished all the returns required under section 39.

Section 54 (14) –

Notwithstanding anything contained in this section, no refund under sub-section (5) or sub-section (6) shall be paid to an applicant, if the amount is less than one thousand rupees.

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance.

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us