E-way bill is a document required to be carried by a person in charge of the conveyance carrying any consignment of goods of value exceeding fifty thousand rupees as mandated by the Government in terms of section 68 of the Goods and Services Tax Act read with rule 138 of the rules framed thereunder. It is generated by the registered persons or transporters who causes movement of goods on consignment before the commencement of such movement.

When should an e-way bill be issued?

E-way bill will be generated when there is a movement of goods of value more than Rs. 50,000 –

- In relation to a ‘supply’

- For reasons other than a ‘supply’ ( say a return)

- Due to inward ‘supply’ from an unregistered person

Who should generate an e-way bill?

- Registered Person – E-way bill must be generated when there is a movement of goods of more than Rs 50,000 in value to or from a Registered Person.

- Unregistered Persons – Unregistered persons are also required to generate e-Way Bill. However, where a supply is made by an unregistered person to a registered person, the receiver will have to ensure all the compliances are met as if they were the supplier.

- Transporter – Transporters carrying goods by road, air, rail, etc. also need to generate e-Way Bill if the supplier has not generated an e-Way Bill.

What is a pre-requisite to generate the e-way bill?

To generate the e-way bill, it is essential that the person shall be registered person and if the transporter is not registered person it is mandatory to get enrolled on the common portal of e-way bill before generation of the e-way bill.

The documents required for generation of the e-way bill are:-

- Invoice/ Bill of Supply/ Challan related to the consignment of goods.

- Transport by road – Transporter ID or Vehicle number.

- Transport by rail, air, or ship – Transporter ID, Transport document number, and date on the document.

Why do the transporters need to enroll in the e-way bill system?

There may be some transporters, who are not registered under the Goods and Services Tax Act and if such transporters cause the movement of goods for their clients, they are required to generate the e-way bill on behalf of their clients or update the vehicle number for e-way bill.

Hence, they need to enroll on the e-way bill portal and generate the 15 digits Unique Transporter Id.

Optional Compliances of E-Way Bill

- A registered person or the transporter may generate at his option and carry e-way bill even if the value of consignment is less than Rs. 50,000/-

- Where the movement is caused by an unregistered person either in his own conveyance or a hired one or through a transporter, he or the transporter may, at their option, generate e way bill in FORM GST EWB-01. However, where a supply is made by an unregistered person to a registered person, then the movement is deemed to have caused by a registered recipient and liability to generate e-way bill lies on to recipient, i.e, the receiver will have to ensure all the compliances are met as if they were the supplier.

- Where the goods are transported for a distance of less than 10 km within the State or Union territory from the place of business of consignor to the place of business of transporter for further transportation, the supplier or transporter may not furnish the details of conveyance in Part B of FORM GST EWB-01. However, Part A has to be filled.

Items exempted from listing under GST E-Way Bill

- According to goods and services tax, it is mandatory to have a permit, i.e., E-way bill for transportation of consignment with value more than Rs 50,000 in order to check tax evasion practices. But in a GST Council meeting on August 5, they announced a list of 153 products which are totally exempted from having any sort of e-way bill while transportation.

2.The list which is exempted from the e-waybill includes some of the items like: LPG, Kerosene, Currency, Live Bovine Animals, Fruits and Vegetables, Fresh milk, Honey, Seeds, Cereals, Flour, Betel Leaves, Raw Silk, Khadi, Earthen Pot, Clay Lamps, Pooja Samagri.

Validity of e-way bill

An e-way bill is valid for periods as listed below, which is based on the distance traveled by the goods. Validity is calculated from the date and time of generation of e-way bill

| Distance | Validity of E-Way Bill |

| Less than 100 Kms | 1 Day |

| For every additional 100 Kms or part thereof | Additional 1 Day |

Consolidated E-Way Bill

Consolidated e-way bill is a document containing the multiple e-way bills for multiple consignments being carried in one conveyance (goods vehicle).

That is, the transporter, carrying the multiple consignments of various consignors and consignees in one vehicle is required to carry one consolidated e-way bill instead of carrying multiple e-way bills for those consignments.

They can use the form GST EWB-02 to produce a consolidated e-way bill, by providing the e-way bill numbers of each consignment.

Acceptance of GST e-way bill

The consignment of the available e-way bill is accepted by the recipient who is registered on the common portal. In case the recipient doesn’t respond to the available E-way bill details within 72 hours, then it is considered that the e-way bill is accepted by the recipient.

Whether the e-way bill can be CANCELLED? if yes, under what CIRCUMSTANCES?

Yes, the e-way bill can be canceled if either good is not transported or are not transported as per the details furnished in the e-way bill. E-way bill can be canceled within 24 hours from the time of generation.

If the vehicle in which goods are being transported having e-way bill is changed, then what has to be done?

The e-way bill for transportation of goods always should have the vehicle number that is actually carrying the goods. There may be a requirement to change the vehicle number after generating the e-way bill or after the commencement of movement of goods due to transshipment or due to the breakdown of the vehicle. In such cases, the transporter or generator of the e-way bill can update the changed vehicle number.

FORM GST EWB – 01

| PART – A | |

| A.1. | GSTIN of Recipient |

| A.2. | Place of Delivery |

| A.3. | Invoice or Challan Number |

| A.4. | Invoice or Challan Date |

| A.5. | Value of Goods |

| A.6. | HSN Code |

| A.7. | Reason for Transportation |

| A.8. | Transport Document Number |

| PART – B | |

| B. | Vehicle Number |

STATES THAT HAVE NOTIFIED E-WAY BILL

|

KARNATAKA |

RAJASTHAN |

|

UTTARAKHNAD |

KERALA |

|

HARYANA |

BIHAR |

|

MAHARASHTRA |

GUJARAT |

|

SIKKIM |

JHARKHAND |

HOW TO GENERATE E-WAY BILL?

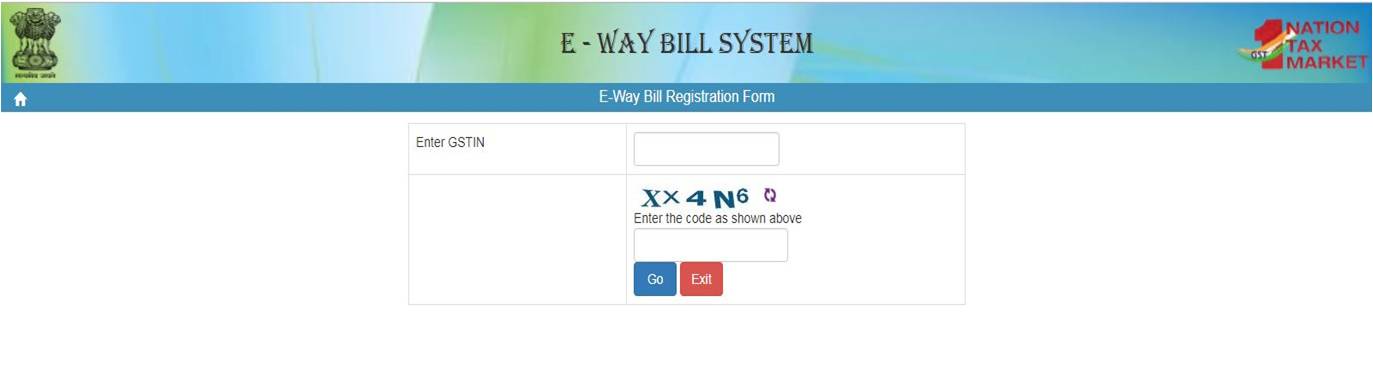

2.We will create login credentials with the help of GST Number of the assessee after click on the “ E-way Bill Registration ” option at the home page or any transporter who does not hold GST number they can get enroll for themselves to generate E-way bill choosing of “ Enrollment for Transporter “ option.

3.Every registered person shall create login credential first before issuing e-way bill.

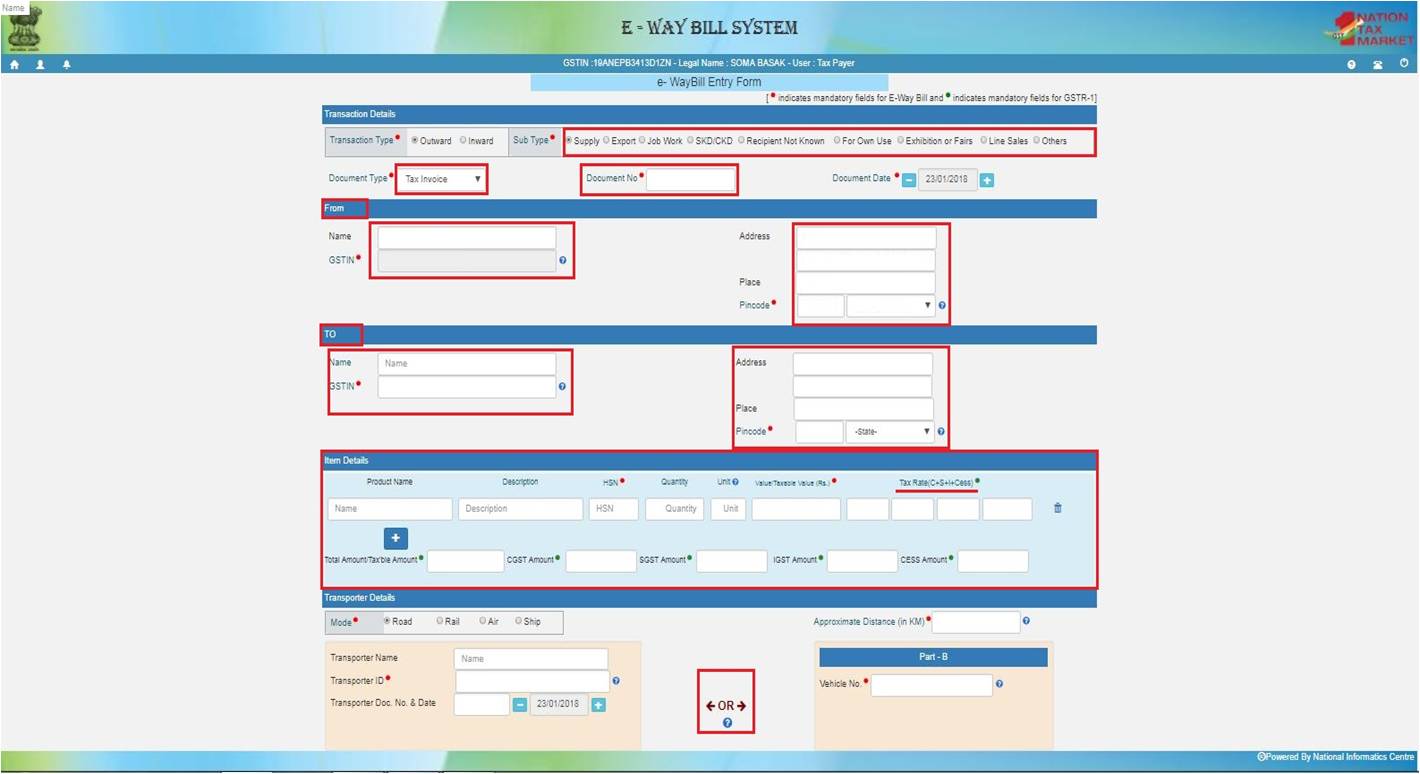

4. This is the primary Dashboard of E-way bill portal, from here we can start to create new E-way bill after click on “Generate New” option comes under e-Waybill menu.

5. Fill up the e-Way bill Entry form Part A & Part B with the required details & click on the submit button after final review.

Please note e-Way bill can not be revised or alter once submitted to the portal.

6.Generated 12 digit acknowledgment receipt number after successful submission of EWB-01 Form & this reference number would help us to track the movement of goods in further.

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance.

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us