What are the documents required to register for GST?

GST & Other Indirect Taxes | By Editor | Jul 17, 2017

Documents Required to Complete the Application for New Registration: Please keep the scanned copy of below mentioned documents handy to f...

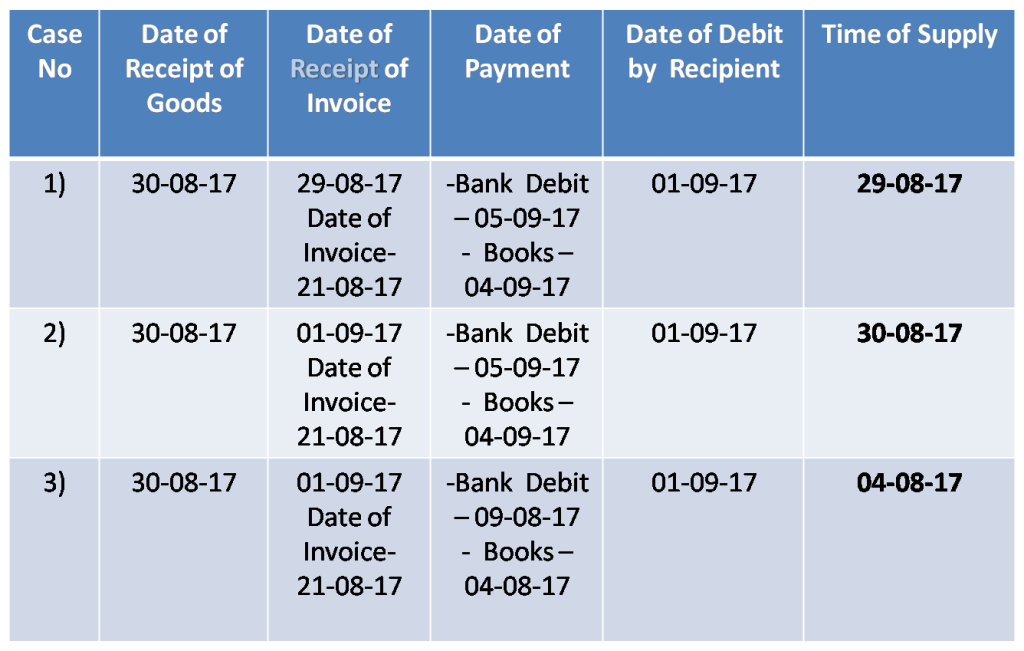

जीएसटी के तहत माल और सेवाओं की आपूर्ति का समय

GST & Other Indirect Taxes | By ALOK PATNIA | Jul 13, 2017

माल की आपूर्ति का समय (1) वस्तुओं पर जीएसटी का भुगतान करने की जिम्मेदारी इस खंड के प्रावधानों के अनुसार निर्धारित आपूर्ति के समय उत...

Income Tax Return filing – FY 2017 -18 : Key Changes in ITR Forms you should know about

Direct Taxes (including International Taxation) | By ALOK PATNIA | Jul 13, 2017

New Income Tax Forms has been notified by CBDT for the Assessment Year 2017-18. The biggest change is the number of ITR forms have reduce...

GSTIN display on sign boards must for businesses

GST & Other Indirect Taxes | By Editor | Jul 12, 2017

Traders and businesses will have to display the GST registration number on their business sign boards and the registration certificate in...

Declaration required for businesses opting for low-tax composition scheme

GST & Other Indirect Taxes | By Editor | Jul 12, 2017

Eateries and shops that opt for the low-tax composition scheme will have to prominently display a board stating this and can’t cha...

GST on sanitary napkins – Is Govt’s justification valid?

GST & Other Indirect Taxes | By Dipanjali Chakraborty | Jul 12, 2017

“There are some remarks made by various column writers on GST rate on sanitary napkins. It may be mentioned that the tax incidence on thi...

All about GST in India – FAQs Updated

GST & Other Indirect Taxes | By ALOK PATNIA | Jul 11, 2017

REGISTRATION 1)Does aggregate turnover include value of inward supplies received on which RCM is payable? Aggregate turnover does not ...

Composition Scheme under GST-What is new

GST & Other Indirect Taxes | By ALOK PATNIA | Jul 7, 2017

What is Composition Scheme? The basic principle underlying the composition scheme is to minimize the burden of compliance for smal...

How will Reverse Charge under GST impact exempted sectors like Healthcare

GST & Other Indirect Taxes | By ALOK PATNIA | Jul 6, 2017

Picture Credit: Yourstory Reverse Charge Meaning- Section 2(98) of CGST Act, 2017 “Reverse Charge” means the liability to pay tax by the ...

FAQs on Exports under GST

GST & Other Indirect Taxes | By Dipanjali Chakraborty | Jul 6, 2017

1) What is the meaning of “Exports” under GST? “Export of Goods”, with its grammatical variations and cognate expressions, means taking o...

GST Rates 2017 – Ready Reckoner

GST & Other Indirect Taxes | By Editor | Jun 30, 2017

With GST now staring at us up close, the air is pumped all around in the ecosystem. Here is something to help you with the rates of GST o...

An Overview on Inputs available under GST Regime

GST & Other Indirect Taxes | By ALOK PATNIA | Jun 28, 2017

Eligibility and Conditions for Taking Input Tax Credit What does the law say – “(1) Every registered person shall, subject to such cond...

Toll Free:

Toll Free:  Contact Us

Contact Us