What is Composition Scheme?

The basic principle underlying the composition scheme is to minimize the burden of compliance for small taxpayers.

There are around 8 million taxpayers to be migrated from the current laws into the GST regime. However, many of these taxpayers will have limited turnover and may not have requisite resources and expertise to comply with all the procedures mentioned under the GST.

Accordingly, the government has come up with composition scheme wherein any taxpayer whose turnover is below Rs 75 lakhs can choose not to register as a normal taxpayer.

Instead, he may choose to get registered as a taxpayer under composition scheme and pay taxes on his supplies at a nominal rate.

However, he shall not be eligible to issue a tax invoice and cannot utilize the credit of input tax paid as a result thereof.

Watch our Video here:

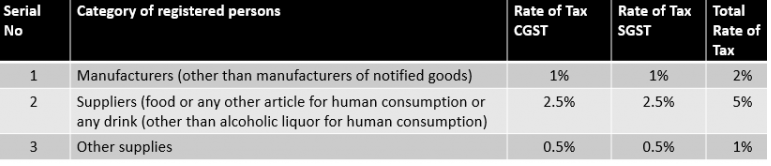

Rates of taxes under Composition Scheme

Format of Invoice under Composition Scheme

Benefits of registration under Composition Scheme

1) Limited Compliance:

Quarterly returns are required to be furnished under this scheme. Hence, it provides some ease on the record keeping and monthly compliance due date front.

2) Limited Tax Liability :

The basic principle underlying this scheme is levy of tax at nominal rates. Check rates in the next slide.

3) High Liquidity:

A normal taxpayer will be required to pay output tax on his supplies at a standard rate and any credit of input is available only when his own supplier files a return online which shall reconcile with his own return. Thus a large chunk of his working capital will always remain blocked in the form of input credit.

4) Level Playing Field:

Since the profit margin of a supplier in composition scheme is more than a large taxpayer, such supplier can outplay the economies of scale of large enterprises by offering competitive prices and have a better hold on the local market of supply.

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance.

Demerits of registration under Composition Scheme

1) Limited Territory for Business:

Inter-state sale cannot be done by the dealer, including exports. Hence, business territory gets restricted.

2)No Credit of Input Tax:

There has been no provision of input credit on B2B transactions. Thus, if any taxable person is carrying out business on B2B model, such person will not be allowed the credit of input tax paid from the output liability. Also, the buyer of such goods will not get any credit on tax paid, resulting in price distortion and cascading. This will further result in a loss of business as a buyer registered as a normal taxpayer will not get any credit when buying from a person registered under composition scheme. Eventually, such buyers might avoid purchases from a taxpayer under composition scheme.

3) No Collection of Tax:

Though the rate of tax for a scheme holder is lower the burden of such tax is kept on the taxpayer himself, leading to higher cost of sales.

4) Penal Provision:

As per the Model GST Law, if the taxpayer who has previously been given registration under composition scheme is found to be not eligible to the composition scheme or if the permission granted earlier was incorrectly granted, then such taxpayer will be liable to pay the differential tax along with a penalty.

5) Electronic Commerce out of scope:

One of the major industries which has flourished in recent times, is the e-commerce in India. There have been numerous companies who are into e-commerce, some of them have turnover into crores, however many of them are still at nascent stage and have not achieved breakeven as well. Such units carry out their business online through internet and supply across states. Since they are into inter-state supplies they are not eligible for composition scheme and thus the benefit of this section has been kept away from them.

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance.

COMPOSITION LEVY : OTHER IMPORTANT POINTS

Which returns are required to be filed by a taxable person registered under Composite Scheme ?

The taxable person is required to furnish only one return i.e. GSTR-4 on a quarterly basis and an annual return in FORM GSTR-9A.

Is liability to pay taxes under Reverse Charge Mechanism covered under the Composite Scheme?

Any tax payable under Reverse Charge Mechanism will not be covered under the scheme. These taxes will be liable to be paid as a normal tax payer.

What are the transition provisions if a business transits from Composition Scheme under current regime to Regular Taxation under GST?

Taxpayers registered under composition scheme under the current regime will be allowed to take credit of input held in stock, or in semi-finished goods or in finished goods on the day immediately preceding the date from which they opt to be taxed as a regular tax payer.

What are the conditions for availing input credit on stock lying at the time of transition?

Following are the conditions which must be addressed by the taxpayer to avail credit on input at the time of transition from composition scheme to the normal scheme:

- Such inputs or goods are intended to be used for making taxable supplies under GST law.

- Taxpayer was eligible for CENVAT Credit on such goods under the previous regime, however, couldn’t claim it being under composition scheme.

- Such goods are eligible for input tax credit under GST regime.

- The taxpayer has legal evidence of input tax paid on such goods.

- Such invoices were issued within a period of 12 months from GST applicable date.

What is the treatment for input credit availed when transitioning from normal scheme to Composition Scheme?

When switching from normal scheme to composition scheme, the taxpayer shall be liable to pay an amount equal to the credit of input tax in respect of inputs held in stock on the day immediately preceding the date of such switchover. The balance of input tax credit after payment of such amount, if any lying in the credit ledger shall lapse.

Who can opt for composition scheme?

- Manufacturers

- Restaurants

- Other suppliers of goods

- The turnover must be within Rs 75 lakh. This limit has been reduced to Rs 50 lakh for Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, and Himachal Pradesh.

Can a Composition Dealer collect composition tax separately?

No, a Composition Dealer is not allowed to collect composition tax from the buyer.

Who cannot opt for composition scheme?

- Service providers other than restaurants

- Any business that makes inter-state supplies

- Any business registered on an e-commerce platform

- Manufacturers of ice cream, edible ice, pan masala, tobacco, and tobacco substitutes.

- A person registering as a non-resident taxable person. This is someone who wants to do business for a short period and is based out of India with no office in India.Registration is valid for 90 days.

- A person registering as a casual taxable person. This is someone who seeks a temporary registration in a state where he has no office. Registration is valid for 90 days.

The information in this article stands updated as on 11th November, 2017 to the extent of updates received after 23rd GST Council Meeting held on 10th November, 2017. Access the updates here: Composition scheme receives huge boost after GST Council Meeting

We have launched Single Platform on GST Compliances In India, assisting in 4 areas – 1) Migration, 2) GST Compliance, 3) Training and 4) Transition & Implementation. Click this link for any assistance.

customersuccess@taxmantra.com

customersuccess@taxmantra.com Toll Free:

Toll Free:  Contact Us

Contact Us