REVERSE CHARGE UNDER GOODS & SERVICE TAX (GST)

GST & Other Indirect Taxes | By ALOK PATNIA | Jun 13, 2017

Reverse Charge Meaning- Section 2(98) of CGST Act, 2017 “Reverse Charge” means the liability to pay tax by the recipient of the supply of...

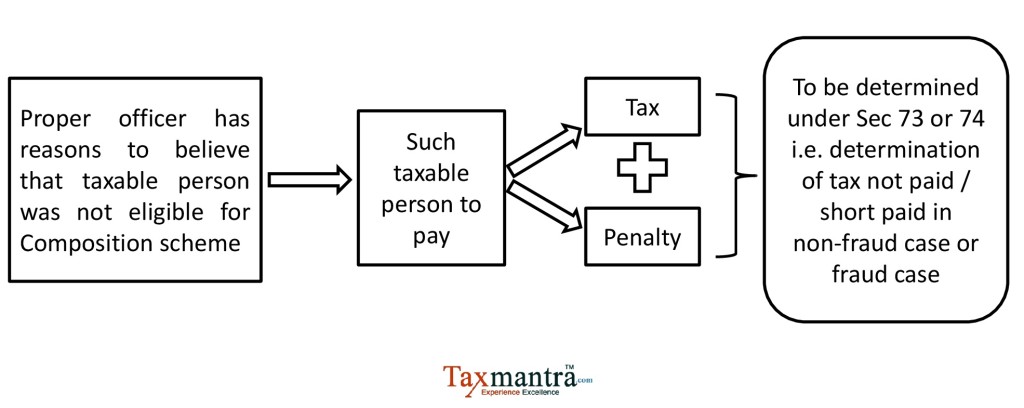

COMPOSITION LEVY SCHEME UNDER GST

GST & Other Indirect Taxes | By ALOK PATNIA | Jun 12, 2017

Section 10 (1) – Composition Levy Notwithstanding anything to the contrary contained in this Act but subject to the provisions of sub-sec...

GST: GST Council revises rates for 66 items

News & FAQs | By Dipanjali Chakraborty | Jun 11, 2017

After the 16th GST Council meet concluded today, the rates of 66 items under the upcoming GST regime have been revised. Add...

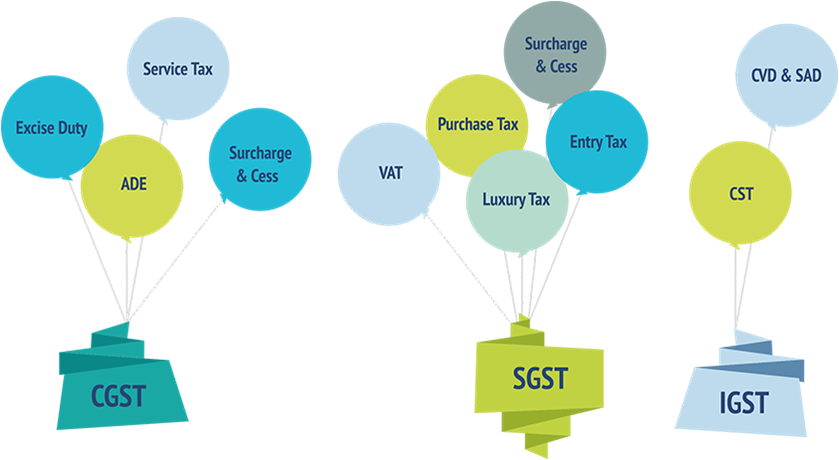

करों को जीएसटी में जमा करना

GST & Other Indirect Taxes | By ALOK PATNIA | Jun 9, 2017

जीएसटी को आमतौर पर अप्रत्यक्ष, व्यापक, व्यापक-आधारित उपभोग के रूप में वर्णित किया गया है। भारत में कार्यान्वित किया जाएगा जो दोहरी जीएसटी...

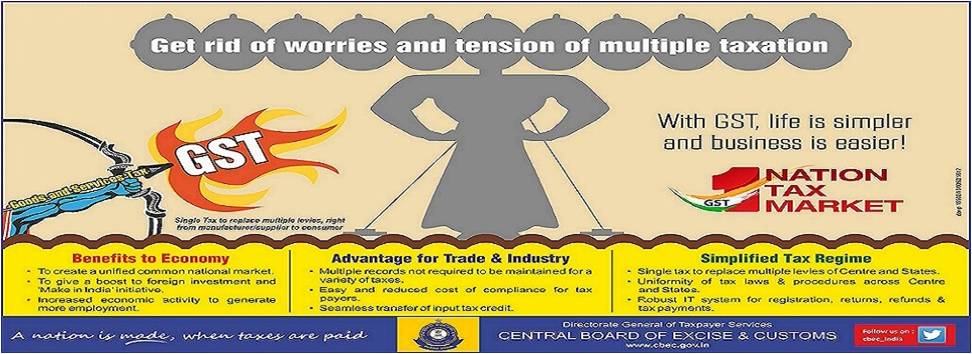

भारत में गुड्स एंड सर्विस टैक्स (जीएसटी) की आवश्यकता क्यों है?

GST & Other Indirect Taxes | By ALOK PATNIA | Jun 9, 2017

माल और सेवा कर क्या है? जैसा कि नाम से पता चलता है, यह तब होता है जब उपभोक्ता एक अच्छा या सेवा खरीदता है। इसका मतलब एकल, व्यापक कर है जो ...

INPUT TAX CREDIT (ITC) UNDER GST

GST & Other Indirect Taxes | By ALOK PATNIA | Jun 9, 2017

INPUT TAX CREDIT (ITC) UNDER GST Meaning and definition of Input Tax Credit (ITC) Section – 2(56) – “input tax credit” means ...

VALUATION UNDER GST

GST & Other Indirect Taxes | By ALOK PATNIA | Jun 9, 2017

Valuations under the GST law refers to ‘value of taxable supply’ Determination of Value of taxable supply is of utmost...

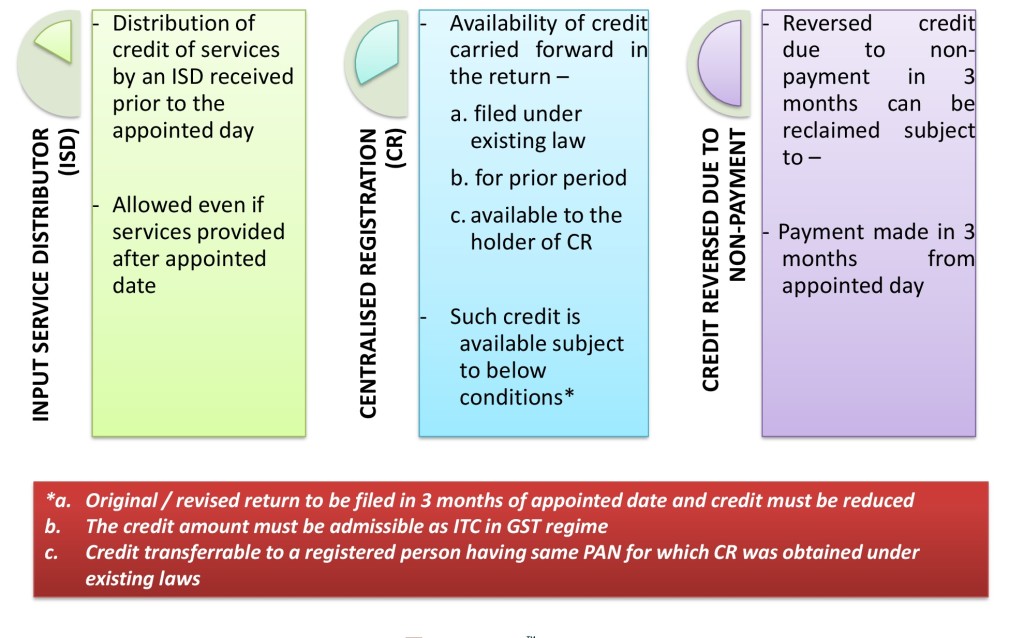

TRANSITIONAL PROVISIONS UNDER GST

GST & Other Indirect Taxes | By ALOK PATNIA | Jun 8, 2017

MIGRATION OF EXISTING TAXPAYERS IN GST A certificate of registration on a provisional basis is first issued to every person registered un...

Import and Export under GST

GST & Other Indirect Taxes | By ALOK PATNIA | Jun 8, 2017

The current Indirect tax regime in India is complex as there are multiplicity of taxes, elaborate compliance obligations and tax cascadin...

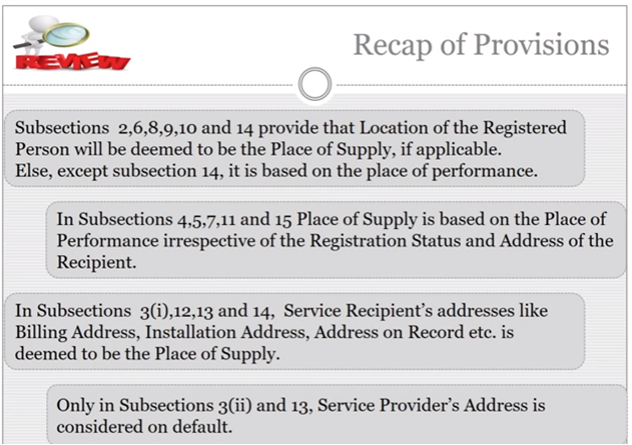

Place of supply of goods & services under GST

GST & Other Indirect Taxes | By ALOK PATNIA | Jun 6, 2017

This content would basically cover the following topics: Relevance of place of supply Rules for determining place of supply of goods Rul...

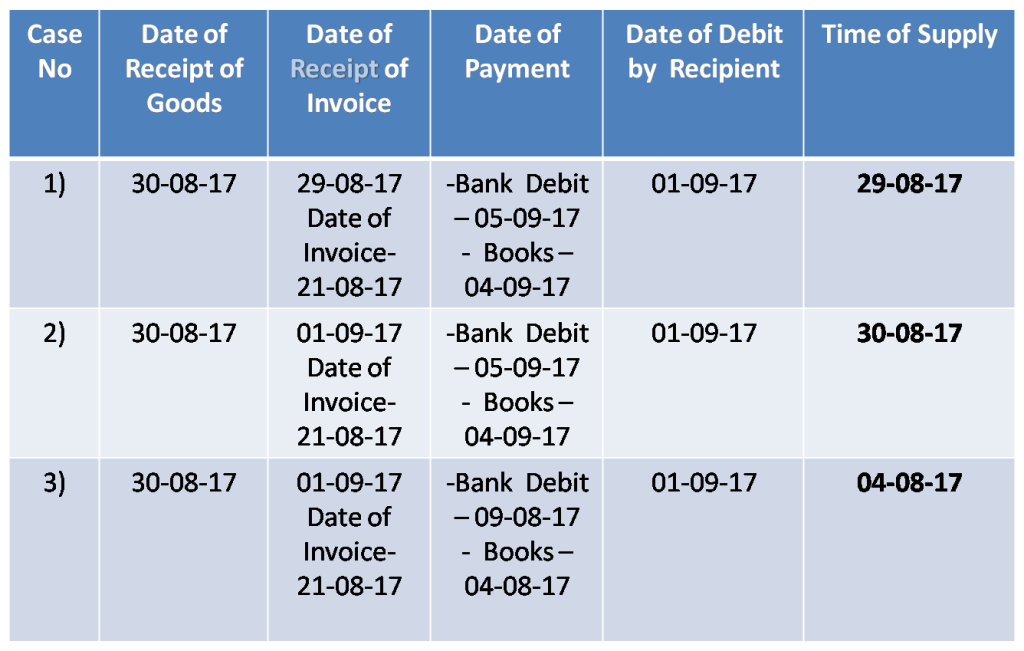

Time of supply of goods & services under GST

GST & Other Indirect Taxes | By ALOK PATNIA | Jun 6, 2017

TIME OF SUPPLY OF GOODS (1) The liability to pay GST on the goods shall arise at the time of supply as determined in terms of the provis...

Meaning of Supply of goods and Supply of Services under GST

GST & Other Indirect Taxes | By ALOK PATNIA | Jun 6, 2017

Definition of Supply under GST Definition of ‘supply’ Under section 2(92) read with section 3 ‘supply’ includes all forms of supply o...

Toll Free:

Toll Free:  Contact Us

Contact Us